PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750574

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750574

OTC Dry Eye Drops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

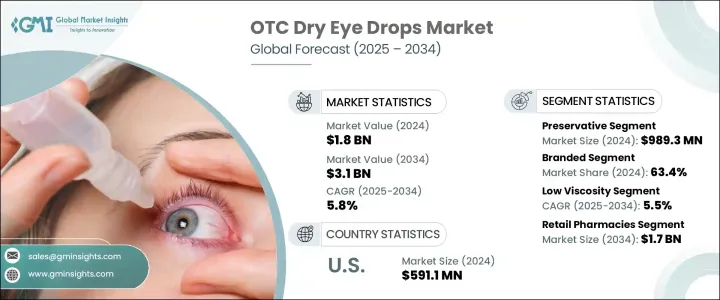

The Global OTC Dry Eye Drops Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.1 billion by 2034, driven by the rising prevalence of dry eye syndrome, which is becoming more common due to factors such as increased screen time from smartphones, computers, and tablets. Additionally, environmental elements like air pollution, dust, and extended exposure to air-conditioned spaces are contributing to the worsening of dry eye symptoms. As people, especially younger and middle-aged groups, experience more frequent eye discomfort, the demand for OTC dry eye products is growing.

Another key factor supporting the market's growth is the shift toward self-care, with more consumers opting for OTC remedies to manage their eye health. As individuals become more health-conscious and aware of their conditions, many prefer to address their dry eye symptoms with OTC solutions, reducing the need for medical consultations. This trend is further amplified by the accessibility of OTC eye drops through retail pharmacy chains and online platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.8% |

The preservative-containing segment was valued at USD 989.3 million in 2024, due to its affordability, availability, and effectiveness. These products use preservatives like benzalkonium chloride (BAK) to prevent microbial growth in multi-dose containers, making them a preferred choice for many. Their extended shelf life, ease of use, and lower price point make them particularly attractive to consumers, driving widespread adoption. Well-established brands continue to dominate this segment due to consumer trust and brand loyalty, with many customers choosing preservative-based solutions because of familiarity and the convenience of portable, multi-dose packaging.

Based on product types, the branded segment holds the largest market share, capturing 63.4% in 2024. Leading pharmaceutical companies maintain a strong presence in the OTC dry eye drops market, benefitting from decades of trust and recognition. The perception of branded products being more reliable and effective contributes significantly to their popularity, especially for consumers suffering from chronic dry eye conditions. These products often cater to specific needs, such as preservative-free solutions, making them appealing to a wide audience.

U.S. OTC Dry Eye Drops Market held 37.4% share in 2024, driven by the widespread use of digital devices, with more people spending prolonged hours on screens, leading to a rise in eye strain and dry eye symptoms. As a result, there is a growing awareness of the condition, prompting more individuals to seek over-the-counter (OTC) solutions to manage the discomfort. U.S. market benefits from the presence of several key pharmaceutical companies, which dominate the OTC dry eye product landscape. These companies leverage well-established distribution networks and retail partnerships, making products widely accessible through brick-and-mortar stores and online platforms.

Key players in the Global OTC Dry Eye Drops Market include Bausch Health Companies, Rohto Pharmaceutical, Alcon, Santen Pharmaceutical, Thea Pharmaceuticals, Prestige Consumer Healthcare, Similasan Corporation, URSAPHARM Arzneimittel, OASIS, NovaBay Pharmaceuticals, Jadran-Galenski Laboratorij, Medicom Healthcare, Scope Eyecare, and AbbVie. To strengthen their market presence, companies in the OTC Dry Eye Drops Market are focusing on expanding product portfolios to address diverse consumer needs. They invest in research and development to create more effective formulations, such as preservative-free and fast-acting products. Furthermore, strategic partnerships with retail pharmacies and e-commerce platforms are helping companies enhance accessibility. Effective marketing and branding efforts are also crucial in maintaining customer loyalty, especially as consumers become more discerning about the products they use for self-care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dry eye disease

- 3.2.1.2 Growing awareness and self-care practices

- 3.2.1.3 Increased screen time and digital device usage

- 3.2.1.4 Technological advancements in product formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and allergic reactions

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan

- 3.4.3.2 China

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Trump administration tariffs

- 3.8.1 Impact on trade

- 3.8.1.1 Trade volume disruptions

- 3.8.1.2 Retaliatory measures

- 3.8.2 Impact on the industry

- 3.8.2.1 Supply-side impact

- 3.8.2.1.1 Price volatility in key materials

- 3.8.2.1.2 Supply chain restructuring

- 3.8.2.1.3 Production cost implications

- 3.8.2.2 Demand-side impact (selling price)

- 3.8.2.2.1 Price transmission to end markets

- 3.8.2.2.2 Market share dynamics

- 3.8.2.2.3 Consumer response patterns

- 3.8.2.1 Supply-side impact

- 3.8.3 Key companies impacted

- 3.8.4 Strategic industry responses

- 3.8.4.1 Supply chain reconfiguration

- 3.8.4.2 Pricing and product strategies

- 3.8.4.3 Policy engagement

- 3.8.5 Outlook and future considerations

- 3.8.1 Impact on trade

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preservative

- 5.3 Preservative-free

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Viscosity, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low viscosity

- 7.3 High viscosity

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacies

- 8.3 Online pharmacies

- 8.4 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Alcon

- 10.3 Bausch Health Companies

- 10.4 Jadran-Galenski Laboratorij

- 10.5 Medicom Healthcare

- 10.6 NovaBay Pharmaceuticals

- 10.7 OASIS

- 10.8 Prestige Consumer Healthcare

- 10.9 Rohto Pharmaceutical

- 10.10 Santen Pharmaceutical

- 10.11 Similasan Corporation

- 10.12 Scope Eyecare

- 10.13 Thea Pharmaceuticals

- 10.14 URSAPHARM Arzneim