PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750576

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750576

Residential Heating Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

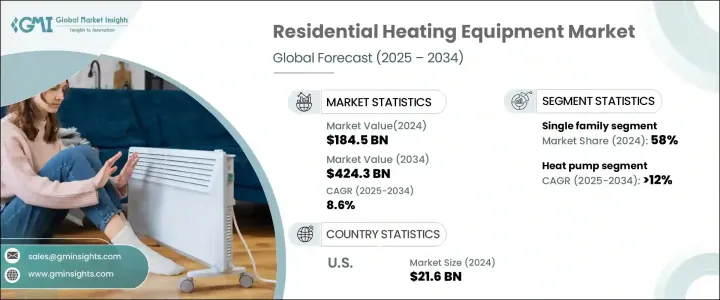

The Global Residential Heating Equipment Market was valued at USD 184.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 424.3 billion by 2034, driven by increasing awareness of energy efficiency and environmental sustainability, prompting consumers to adopt advanced and eco-friendly heating systems. Governments worldwide are setting carbon neutrality targets and implementing policies encouraging homeowners to invest in energy-efficient solutions, facilitating the transition toward smart and sustainable home heating. Urban housing development and the ongoing focus on reducing energy consumption fuel the adoption of efficient heating technologies. Additionally, the integration of advanced electric heat pumps into hybrid systems supports sustainable emission reduction within the residential sector.

The growing frequency and intensity of extreme cold spells across the U.S. have made dependable residential heating systems not just a preference but a necessity. In response, more homeowners are turning to advanced heating technologies that ensure consistent indoor temperatures regardless of external conditions. At the same time, the integration of intelligent controls, such as IoT-enabled systems and smart thermostats, is enabling users to manage energy usage with greater precision. These innovations help households cut down on unnecessary heating, which not only reduces monthly utility bills but also aligns with broader sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.5 Billion |

| Forecast Value | $424.3 Billion |

| CAGR | 8.6% |

The heat pump residential heating equipment market is expected to grow at a CAGR of 12% through 2034. The increasing need for energy-efficient solutions, coupled with favorable government policies, will boost the adoption of residential heat pumps. Ongoing technological developments will enhance their operational efficiency and promote environmentally friendly practices. The market is segmented into single-family and multi-family applications.

The single-family residential heating equipment segment is anticipated to drive business growth at a CAGR of 8% through 2034, holding a share of 58% in 2024. The growing demand for customized solutions to meet diverse heating needs will increase product adoption. Additionally, integrating remote monitoring systems, predictive maintenance, and process optimization will propel the industry outlook.

U.S. Residential Heating Equipment Market was valued at USD 21.6 billion in 2024, fueled by environmental mandates, rising consumer awareness, and government-backed programs that incentivize energy-efficient upgrades. The market is also benefiting from widespread retrofitting activities, where older heating systems are being replaced with high-performance alternatives that comply with newer carbon emission standards. Additionally, the shift toward electrification in residential spaces creates new opportunities for heat pumps and hybrid systems.

Key players in the market include Whirlpool, Vaillant Group, Bradford White Corporation, Ferroli, Crane, SAMSUNG, Panasonic Corporation, A.O. Smith, Carrier Corporation, DAIKIN INDUSTRIES, Lennox International, Robert Bosch, Hoval, Trane Technologies, Rinnai America, Rheem Manufacturing Company, GE Appliances, LG Electronics, Ariston Holding, Havells India, BDR Thermea Group, Arovast Corporation, Johnson Control International, VIESSMANN. To strengthen their market presence, companies in the residential heating equipment industry are adopting various strategies. These include launching innovative products, expanding distribution networks, and forming strategic partnerships and acquisitions. For instance, companies are developing advanced heating systems that integrate renewable energy sources and smart technologies to meet the growing demand for energy-efficient solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Heat pump

- 5.3 Boiler

- 5.4 Furnace

- 5.5 Water heater

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Single-family

- 6.3 Multi-family

Chapter 7 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Dealer

- 7.4 Retail

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Portugal

- 8.3.7 Romania

- 8.3.8 Netherlands

- 8.3.9 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Egypt

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Holding

- 9.3 Arovast Corporation

- 9.4 BDR Thermea Group

- 9.5 Bradford White Corporation

- 9.6 Carrier Corporation

- 9.7 Crane

- 9.8 DAIKIN INDUSTRIES

- 9.9 Ferroli

- 9.10 GE Appliances

- 9.11 Havells India

- 9.12 Hoval

- 9.13 Johnson Control International

- 9.14 Lennox International

- 9.15 LG Electronics

- 9.16 Panasonic Corporation

- 9.17 Rheem Manufacturing Company

- 9.18 Rinnai America

- 9.19 Robert Bosch

- 9.20 SAMSUNG

- 9.21 Trane Technologies

- 9.22 Vaillant Group

- 9.23 VIESSMANN

- 9.24 Whirlpool