PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750580

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750580

Glaucoma Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

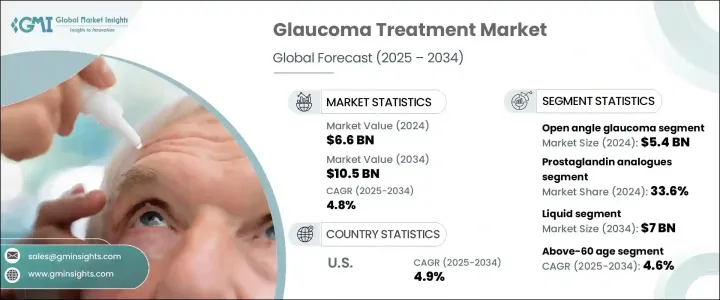

The Global Glaucoma Treatment Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 10.5 billion by 2034, attributed to the rising incidence of glaucoma worldwide, especially among older adults. As the global population continues to age, cases of age-related ocular disorders are becoming more frequent and severe, prompting a greater need for early diagnosis and long-term care. Chronic illnesses such as diabetes and hypertension-both significant risk factors for developing glaucoma-are also on the rise, which further contributes to increasing demand for effective and long-lasting treatment options across various demographics.

Governments and health agencies have started focusing on awareness campaigns to promote early screening and routine eye examinations, which is helping detect glaucoma at earlier stages. This has led to a notable rise in treatment initiations. The market is also benefiting from the adoption of novel drug classes, including Rho kinase inhibitors and fixed-dose combination therapies, which are expanding treatment alternatives and improving patient outcomes. Additionally, improving healthcare infrastructure and growing disposable incomes-especially in emerging markets-are making ophthalmic care more accessible, enabling a broader segment of the population to pursue timely and advanced glaucoma management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 4.8% |

Open-angle glaucoma remains the most diagnosed form of the disease, accounting for more than 70% of global cases and valued at USD 5.4 billion in 2024. Treating glaucoma revolves around managing intraocular pressure (IOP) to prevent irreversible optic nerve damage. Most therapies focus on medications that help reduce IOP, including beta-blockers, alpha agonists, carbonic anhydrase inhibitors, and prostaglandin analogs. Open angle glaucoma condition develops slowly and often without obvious symptoms until significant vision loss occurs. Its chronic nature means patients require continuous and long-term care, creating sustained demand for pharmaceutical solutions and regular monitoring services.

Prostaglandin analogs, which help lower eye pressure by enhancing fluid drainage, commanded the highest share of the treatment market in 2024, making up 33.6% share and is projected to reach USD 3.7 billion by 2034. Their effectiveness and relatively mild side effect profile make them widely prescribed for managing open-angle glaucoma. With aging populations increasing, the demand for these medications is expected to climb further, particularly as more patients opt for preservative-free and user-friendly eye drop formulations.

U.S. Glaucoma Treatment Market generated USD 2.24 billion in 2024 and is set to grow at a 4.9% CAGR through 2034. The country's aging population and high awareness levels, coupled with the strong presence of pharmaceutical innovators, continue to fuel demand for advanced treatment options. A well-established healthcare infrastructure supports early diagnosis and widespread access to prescription therapies, while ongoing investments in clinical trials and FDA approvals are rapidly expanding the available drug pipeline. Increased insurance coverage and favorable reimbursement policies are further supporting treatment adoption among the elderly and high-risk groups.

Companies like Novartis, Pfizer, Santen Pharmaceutical, Sun Pharmaceutical, Thea, Alcon, Cipla, AbbVie, Bausch & Lomb, Inotek Pharmaceuticals, Eyepoint Pharmaceuticals, Teva Pharmaceutical, Merck, and Grevis Pharmaceuticals are actively competing in this space. To secure a competitive edge in the glaucoma treatment market, leading companies are investing heavily in R&D to develop next-generation therapies with improved efficacy and safety. They are focusing on fixed-dose combinations to simplify treatment regimens and improve patient adherence. Expanding into high-growth emerging markets through partnerships and distribution networks is another key strategy. Additionally, firms are enhancing digital engagement tools and remote patient monitoring technologies to support early intervention and ongoing care. Strategic collaborations, pipeline diversification, and product lifecycle management remain central to strengthening market positioning across global regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of glaucoma disease worldwide

- 3.2.1.2 Technological advancements in therapeutic interventions

- 3.2.1.3 Increasing ongoing clinical trials and product launches for glaucoma treatment

- 3.2.1.4 Growing awareness initiatives regarding eye care in underdeveloped and developing nations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with the drugs

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Open angle glaucoma

- 5.3 Angle closure glaucoma

- 5.4 Other disease types

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prostaglandin analogs

- 6.3 Beta-blockers

- 6.4 Alpha adrenergic agonist

- 6.5 Carbonic anhydrase inhibitors

- 6.6 Other drug classes

Chapter 7 Market Estimates and Forecast, By Formulation, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Solid

- 7.3 Liquid

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 18

- 8.3 19 - 40

- 8.4 41 - 60

- 8.5 Above 60

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Alcon

- 11.3 Bausch & Lomb

- 11.4 Cipla

- 11.5 Eyepoint Pharmaceuticals

- 11.6 Grevis Pharmaceuticals

- 11.7 Inotek Pharmaceuticals

- 11.8 Merck

- 11.9 Novartis

- 11.10 Pfizer

- 11.11 Santen Pharmaceutical

- 11.12 Sun Pharmaceutical

- 11.13 Teva Pharmaceutical

- 11.14 Thea