PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750581

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750581

Food Emulsifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

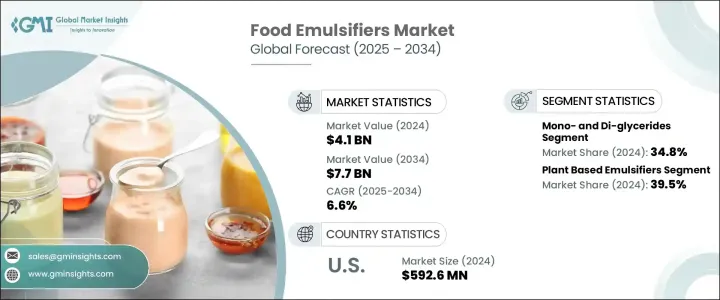

The Global Food Emulsifiers Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 7.7 billion by 2034, driven by the increasing demand for convenience foods, plant-based ingredients, and clean-label products. Emulsifiers play a vital role in improving the structure, stability, and shelf life of food products. They are used across various food sectors such as bakery, dairy, frozen desserts, beverages, processed meats, ready-to-eat meals, and infant nutrition. With an increasing shift toward clean label and vegan-friendly options, natural and plant-based emulsifiers such as lecithin, sunflower, and soy are gaining traction. Moreover, the demand for mono- and diglycerides continues to dominate due to their versatility, cost-effectiveness, and wide application in functional and convenience foods.

In terms of regional growth, the Asia Pacific market is expanding rapidly due to changing dietary preferences and rising urbanization. Europe and North America, while mature markets, continue to maintain strong demand for natural, sustainable, and clean-label ingredients. The growing regulatory support for food safety and label transparency is also driving the innovation of emulsifier blends, strengthening their presence in modern food production processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 6.6% |

The mono- and diglycerides segment holds 34.8% share and is forecasted to grow at a CAGR of 6.4% by 2034. These emulsifiers are highly regarded for their versatility, cost-effectiveness, and wide application across multiple sectors, including bakery, dairy, confectionery, and processed foods. Their ability to act as stabilizers, emulsifiers, and texturizers, combined with their long shelf life and consistency, has cemented their position as one of the most used emulsifiers in the food industry. This widespread usage, coupled with their multifunctionality, ensures that mono and diglycerides remain a dominant choice in food manufacturing.

The plant-based emulsifiers segment held 39.5% share in 2024 and is expected to grow at a CAGR of 6.2% through 2034, driven by a noticeable shift in consumer preferences toward natural, plant-derived ingredients that align with a more sustainable and health-conscious lifestyle. As more consumers seek eco-friendly and clean-label products, the demand for emulsifiers derived from soy, sunflower, and canola is growing. These plant-based emulsifiers are gaining popularity due to their nutritional benefits, clean labeling, and sustainable sourcing, all of which align with the rising consumer demand for healthier and environmentally responsible food options.

U.S. Food Emulsifiers Market was valued at USD 592.6 million in 2024 due to its strong food processing industry and high consumption of convenience foods. The country's robust bakery, dairy, and frozen dessert sectors further support the demand for emulsifiers. Additionally, the growing health and wellness trends among U.S. consumers are driving the need for more innovative emulsifiers, including plant-based and natural alternatives. The well-established supply chains and marketing systems in the U.S. contribute to its competitive advantage in obtaining raw materials from both local and international sources.

Leading players in the Global Food Emulsifiers Market, such as Cargill, Inc., Corbion N.V., Archer Daniels Midland Company (ADM), Kerry Group plc, and Croda International Plc, are focusing on diversifying their product portfolios and expanding their market presence. These companies are investing heavily in research and development to create cleaner, plant-based emulsifiers that meet the growing consumer demand for sustainable products. They are also enhancing their production processes to improve efficiency and reduce costs. Partnerships, mergers, and acquisitions are key strategies used by these companies to expand their market footprint and improve their competitive positioning in the global food emulsifier sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021 - 2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021 - 2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only.

- 3.4 Consumer trends and preferences

- 3.4.1 Clean label movement

- 3.4.1.1 Consumer perception of emulsifiers

- 3.4.1.2 Natural vs. synthetic preferences

- 3.4.1.3 Impact on product formulation

- 3.4.2 Health and wellness trends

- 3.4.2.1 Nutritional concerns

- 3.4.2.2 Allergen considerations

- 3.4.2.3 Dietary restrictions impact

- 3.4.3 Sustainability and ethical considerations

- 3.4.3.1 Environmental impact awareness

- 3.4.3.2 Sustainable sourcing preferences

- 3.4.3.3 Packaging considerations

- 3.4.4 Plant-based vegan trends

- 3.4.4.1 Demand for plant-derived emulsifiers

- 3.4.4.2 Vegan certification impact

- 3.4.5 Transparency and traceability demands

- 3.4.6 Regional consumer preference variations

- 3.4.1 Clean label movement

- 3.5 Consumer behavior analysis

- 3.5.1 Purchase decision factors

- 3.5.2 Price sensitivity analysis

- 3.5.3 Brand loyalty patterns

- 3.6 Social media and digital influence on consumer perception

- 3.7 Supply chain and raw material analysis

- 3.7.1 Raw material sourcing analysis

- 3.7.1.1 Key raw materials

- 3.7.1.2 Sourcing regions

- 3.7.1.3 Sustainability in sourcing

- 3.7.2 Production process analysis

- 3.7.2.1 Manufacturing technologies

- 3.7.2.2 Quality control measures

- 3.7.2.3 Cost structure analysis

- 3.7.3 Distribution channel analysis

- 3.7.3.1 Direct vs. indirect channels

- 3.7.3.2 E-commerce impact

- 3.7.3.3 Distribution challenges

- 3.7.4 Supply chain challenges

- 3.7.4.1 Raw material price volatility

- 3.7.4.2 Supply chain disruptions

- 3.7.4.3 Logistics challenges

- 3.7.5 Supply chain optimization strategies

- 3.7.6 Sustainable supply chain practices

- 3.7.7 Technology integration in supply chain

- 3.7.1 Raw material sourcing analysis

- 3.8 Pricing analysis and cost structure

- 3.8.1 Price point analysis by product type

- 3.8.2 Price trend analysis 2021–2025

- 3.8.3 Price forecast 2025–2034

- 3.8.4 Factors affecting pricing

- 3.8.4.1 Raw material costs

- 3.8.4.2 Production costs

- 3.8.4.3 Regulatory compliance costs

- 3.8.4.4 Market competition

- 3.8.4.5 Regional price variations

- 3.8.4.6 Pricing strategies of key players

- 3.8.4.7 Cost structure analysis

- 3.8.4.8 Raw material costs

- 3.8.4.9 Manufacturing costs

- 3.8.4.10 Distribution costs

- 3.8.4.11 Marketing and sales costs

- 3.8.5 Profitability analysis by product segment

- 3.9 Technological advancements and innovations

- 3.9.1 Recent technological developments

- 3.9.2 Emerging technologies in emulsifier production

- 3.9.2.1 Enzymatic modification

- 3.9.2.2 Microencapsulation

- 3.9.2.3 Nanotechnology applications

- 3.9.3 Clean label innovations

- 3.9.3.1 Natural emulsifier alternatives

- 3.9.3.2 Enzyme-based solutions

- 3.9.3.3 Plant-based innovations

- 3.9.4 Sustainable production technologies

- 3.9.5 Functional improvements

- 3.9.5.1 Enhanced stability

- 3.9.5.2 Improved texture properties

- 3.9.5.3 Extended shelf life solutions

- 3.9.6 Digital technologies in production and quality control

- 3.9.7 Patent analysis and r&d trends

- 3.9.8 Future technology roadmap

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental footprint of emulsifiers

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Water usage assessment

- 3.10.1.3 Waste generation and management

- 3.10.2 Sustainable sourcing practices

- 3.10.2.1 Palm oil sustainability issues

- 3.10.2.2 Soy sourcing challenges

- 3.10.2.3 Alternative sustainable sources

- 3.10.3 Biodegradability and eco-toxicity assessment

- 3.10.4 Circular economy approaches

- 3.10.5 Industry sustainability initiatives

- 3.10.6 Regulatory pressures for sustainability

- 3.10.7 Consumer demand for sustainable products

- 3.10.8 Cost-benefit analysis of sustainable practices

- 3.10.1 Environmental footprint of emulsifiers

- 3.11 Market challenges and opportunities

- 3.11.1 Key market challenges

- 3.11.1.1 Health concerns and negative perception

- 3.11.1.2 Regulatory hurdles

- 3.11.1.3 Raw material price volatility

- 3.11.1.4 Clean label formulation challenges

- 3.11.2 Market opportunities

- 3.11.2.1 Plant-based emulsifier development

- 3.11.2.2 Emerging markets expansion

- 3.11.2.3 Functional food applications

- 3.11.2.4 Sustainable emulsifier solutions

- 3.11.3 Impact of macro-economic factors

- 3.11.4 Technological opportunity assessment

- 3.11.5 Strategic opportunity mapping

- 3.11.1 Key market challenges

- 3.12 Future market outlook and forecast

- 3.12.1 Market forecast by product type 2025–2030

- 3.12.2 Market forecast by application 2025–2030

- 3.12.3 Market forecast by region 2025–2030

- 3.12.4 Emerging market trends

- 3.12.5 Future growth drivers

- 3.12.6 Market evolution scenarios

- 3.12.6.1 Optimistic scenario

- 3.12.6.2 Realistic scenario

- 3.12.6.3 Pessimistic scenario

- 3.12.7 Investment opportunities assessment

- 3.12.8 Future competitive landscape projection

- 3.13 Strategic recommendations

- 3.13.1 Market entry strategies

- 3.13.2 Product development recommendations

- 3.13.3 Regional expansion opportunities

- 3.13.4 Competitive positioning strategies

- 3.13.5 Sustainability implementation roadmap

- 3.13.6 Digital transformation strategies

- 3.13.7 Regulatory compliance strategies

- 3.13.8 Marketing and branding recommendations

- 3.13.9 Risk mitigation strategies

- 3.13.10 Investment prioritization framework

- 3.14 Supplier landscape

- 3.15 Profit margin analysis

- 3.16 Key news & initiatives

- 3.17 Regulatory landscape

- 3.18 Impact forces

- 3.18.1 Growth drivers

- 3.18.1.1 Growing beverage industry may fuel product demand

- 3.18.1.2 Increasing consumption of processed foods will foster industry growth

- 3.18.1.3 Growth in consumption of dairy products is likely to favor food emulsifier industry growth

- 3.18.2 Industry pitfalls & challenges

- 3.18.2.1 Growing health concerns

- 3.18.2.2 Clean label requirements for the product

- 3.18.1 Growth drivers

- 3.19 Growth potential analysis

- 3.20 Porter’s analysis

- 3.21 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Mono- and Di-glycerides

- 5.3 Lecithin

- 5.4 Sorbitan esters

- 5.5 Stearoyl lactylates

- 5.6 Polyglycerol esters

- 5.7 Polysorbates

- 5.8 Others (DATEM, CSL, etc.)

Chapter 6 Market Size and Forecast, By Source, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Plant-based emulsifiers

- 6.3 Soy-derived

- 6.4 Sunflower-derived

- 6.5 Palm-derived

- 6.6 Other plant sources

- 6.7 Animal-based emulsifiers

- 6.8 Synthetic emulsifiers

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery and confectionery

- 7.2.1 Bread and rolls

- 7.2.2 Cakes and pastries

- 7.2.3 Biscuits and cookies

- 7.2.4 Chocolate and confectionery

- 7.3 Dairy and frozen desserts

- 7.3.1 Ice cream and frozen desserts

- 7.3.2 Milk and cream products

- 7.3.3 Cheese products

- 7.3.4 Yogurt and fermented dairy

- 7.4 Processed meat and seafood

- 7.4.1 Sausages and processed meats

- 7.4.2 Seafood products

- 7.5 Convenience foods and ready meals

- 7.5.1 Soup and sauces

- 7.5.2 Dressings and mayonnaise

- 7.5.3 Ready-to-eat meals

- 7.6 Beverages

- 7.6.1 Carbonated drinks

- 7.6.2 Fruit juices and nectars

- 7.6.3 Alcoholic beverages

- 7.6.4 Plant-based beverage

- 7.7 Infant nutrition and baby food

- 7.7.1 Infant formula

- 7.7.2 Baby food products

- 7.8 Other

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company (ADM)

- 9.2 Cargill, Inc.

- 9.3 Croda International Plc

- 9.4 Kerry Group plc

- 9.5 Corbion N.V.

- 9.6 Ingredion Incorporated

- 9.7 Lasenor Emul, S.L.

- 9.8 Palsgaard A/S

- 9.9 Lonza

- 9.10 Riken Vitamin