PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750590

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750590

Parkinson's Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

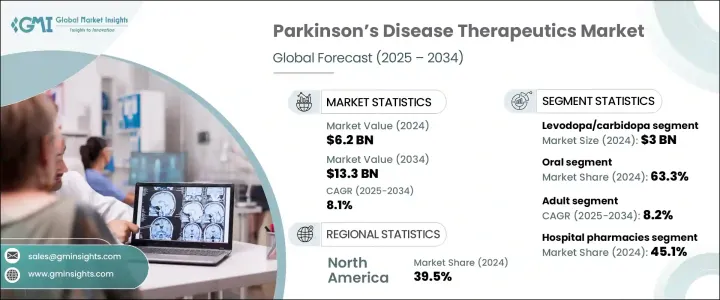

The Global Parkinson's Disease Therapeutics Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.3 billion by 2034, driven by the increasing incidence of Parkinson's disease, particularly among aging populations worldwide. As life expectancy improves, the prevalence of age-related neurodegenerative conditions like Parkinson's is expanding rapidly. Countries across North America, Europe, and parts of the Asia-Pacific region are witnessing a notable rise in the elderly demographic, which is fueling demand for more effective treatments. Healthcare systems are responding by prioritizing therapeutic innovations and expanding access to specialized care tailored to patients with Parkinson's disease.

The market is experiencing significant transformation as pharmaceutical advancements continue to emerge. While traditional therapies remain widely used, there's increasing attention on alternative treatments that provide more targeted symptom control. Drug classes targeting different neural pathways are being explored to manage disease progression more effectively. Innovative delivery platforms are also making an impact. These include user-friendly systems that improve patient adherence, especially for individuals requiring long-term care. Transdermal systems, inhalation routes, and infusion therapies are popular due to their ability to deliver steady, controlled medication with fewer complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 8.1% |

The Levodopa/carbidopa generated USD 3 billion in 2024. Its continued dominance is attributed to its ability to address varied motor symptoms. Enhanced formulations offering extended release and continuous delivery have helped reduce complications and provide consistent symptom management. This drug's widespread use, affordability, and established clinical efficacy make it a cornerstone in Parkinson's treatment across high-income and emerging economies.

Oral medications accounted for a 63.3% share in 2024. Their ease of use, cost-effectiveness, and availability make them the preferred route for patients undergoing lifelong treatment. Many of the most prescribed Parkinson's therapies, particularly those for motor symptom relief, are developed in oral formulations. This not only improves adherence but also limits the need for hospital-based administration, making oral drugs a dominant force in the therapeutic landscape.

U.S. Parkinson's Disease Therapeutics Market generated USD 2.3 billion in 2024. Its robust healthcare system, advanced regulatory pathways, and early access to cutting-edge treatments contribute to its leadership in Parkinson's care. The country also benefits from strong patient support networks and collaborative R&D efforts, which promote drug discovery and accelerate the commercialization of novel therapies.

Prominent players in this industry include Teva Pharmaceutical, Newron Pharmaceuticals, UCB, Sumitomo Dainippon Pharma, F. Hoffmann-La Roche, Kyowa Kirin, Orion Pharma, Boehringer Ingelheim, Supernus Pharmaceuticals, AbbVie, Amneal Pharmaceuticals, Novartis, Desitin Arzneimittel, Acorda Therapeutics (Merz Therapeutics), and Acadia Pharmaceuticals. To strengthen their position in the Parkinson's disease therapeutics market, companies emphasize strategic R&D investments to develop next-generation therapies with better safety and efficacy. They pursue regulatory designations to accelerate approvals and gain early market access. Collaborations with academic institutions and biotech firms allow for diversified innovation pipelines. Expanding global distribution networks, especially in emerging economies, ensures wider medications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of Parkinson’s disease due to an aging population

- 3.2.1.2 Advancements in drug delivery technologies and novel formulations

- 3.2.1.3 Growing research and development investments by biopharmaceutical companies

- 3.2.1.4 Strong support from non-profits and advocacy organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced therapies and limited reimbursement in low income regions

- 3.2.2.2 Lack of curative treatments and persistent side effects of current medications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Epidemiology landscape

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Levodopa/carbidopa

- 5.3 Dopamine agonists

- 5.4 Adenosine A2A antagonists

- 5.5 COMT inhibitors

- 5.6 MAO-B inhibitors

- 5.7 Glutamate antagonists

- 5.8 Cholinesterase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Transdermal

- 6.4 Subcutaneous

- 6.5 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Acadia Pharmaceuticals

- 10.3 Acorda Therapeutics (Merz Therapeutics)

- 10.4 Amneal Pharmaceuticals

- 10.5 Boehringer Ingelheim

- 10.6 Desitin Arzneimittel

- 10.7 F. Hoffmann-La Roche

- 10.8 Kyowa Kirin

- 10.9 Newron Pharmaceuticals

- 10.10 Novartis

- 10.11 Orion Pharma

- 10.12 Sumitomo Dainippon Pharma

- 10.13 Supernus Pharmaceuticals

- 10.14 Teva Pharmaceutical

- 10.15 UCB