PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750592

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750592

Robotic Prosthetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

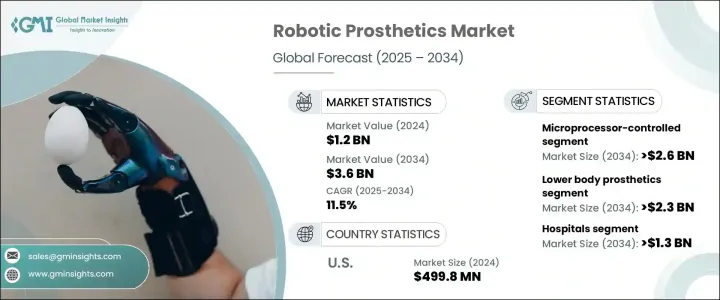

The Global Robotic Prosthetics Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 3.6 billion by 2034, driven by advancements in prosthetic technology, especially robotic applications, and the increasing demand for mobility aids. Factors like an aging population, rising instances of loss due to trauma, diabetes, and vascular diseases are also fueling market expansion.

Robotic prosthetics, particularly microprocessor-controlled (MPC) and AI-driven models, offer improved functionality and adaptability, allowing users to move with ease and increasing the overall quality of life. The advancement of lightweight materials such as carbon fiber and titanium has significantly contributed to improving the strength and durability of prosthetics. These materials not only enhance the overall performance of prosthetic devices but also make them more comfortable, reliable, and user-friendly. The use of such materials ensures that the prosthetics are lightweight without compromising on strength, enabling users to move freely and with ease. This has expanded the market, as more individuals seek prosthetic solutions that cater to both functionality and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 11.5% |

The market is segmented into various categories, including technology and body part classifications, each playing a crucial role in driving growth. The microprocessor-controlled (MPC) prosthetics segment, for instance, is expected to witness considerable growth, with a projected CAGR of 11.2%. By 2034, this segment is anticipated to reach USD 2.6 billion in market value. MPC prosthetics offer substantial benefits, such as improved balance, better energy management, and enhanced adaptability. These features empower users to move more naturally and maintain greater independence, which makes MPC technology increasingly popular among amputees seeking advanced mobility solutions.

Another important segment, lower body prosthetics, is also set for strong growth, with a forecasted CAGR of 11.4%, reaching USD 2.3 billion by 2034, includes robotic knees and ankles, which play an essential role in restoring movement and balance following limb loss. These prosthetic devices are crucial for improving a user's ability to walk, run, and stand for longer periods, significantly enhancing their overall quality of life. By restoring autonomy and mobility, lower body prosthetics help individuals lead more active and fulfilling lives.

United States Robotic Prosthetics Market was valued at USD 499.8 million in 2024 due to the country's well-established healthcare infrastructure and substantial healthcare spending. The U.S. has a significant population of amputees, contributing to the rising demand for advanced prosthetic technologies. The nation's commitment to research funding and the continuous technological advancements in the field of prosthetics have positioned it as a global leader in the market. This has further fueled the demand for high-quality, innovative robotic prosthetic solutions.

Prominent players in the Global Robotic Prosthetics Industry, such as Axile Bionics, Brain Robotics, and Blatchford Group, are adopting various strategies to strengthen their market positions. These companies focus on continuous technological innovation, with an emphasis on improving the functionality, comfort, and affordability of robotic prosthetics. For instance, Ottobock and Fillauer LLC invest in R&D to develop lighter, more durable prosthetic materials. Collaborations with healthcare professionals and government funding have allowed companies like Motorica and Myomo to refine their products and expand their market share. Additionally, strategic partnerships with insurance providers and healthcare organizations are helping companies ensure wider accessibility of robotic prosthetics to those in need.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in the number of limb amputation procedures

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing prevalence of peripheral vascular disease and other chronic conditions

- 3.2.1.4 Rising number of accident injuries & trauma cases

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of robotic prosthetics devices

- 3.2.2.2 Concerns over infection risks with reusable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pricing analysis

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microprocessor-controlled (MPC)

- 5.3 Myoelectric

Chapter 6 Market Estimates and Forecast, By Extremity, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Lower body prosthetics

- 6.2.1 Prosthetic knee

- 6.2.2 Prosthetic ankle

- 6.2.3 Other lower body prosthetics

- 6.3 Upper body prosthetics

- 6.3.1 Prosthetic arm

- 6.3.2 Prosthetic hand

- 6.3.3 Other upper body prosthetics

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Speciality clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Axile Bionics

- 9.2 Blatchford Group

- 9.3 Brain Robotics

- 9.4 Fillauer LLC

- 9.5 Mobius Bionics

- 9.6 Motorica

- 9.7 Myomo

- 9.8 Open Bionics

- 9.9 Ossur

- 9.10 Ottobock

- 9.11 Proteor

- 9.12 ProtUnics

- 9.13 Psyonic

- 9.14 RSL Steeper