PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750596

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750596

Biosensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

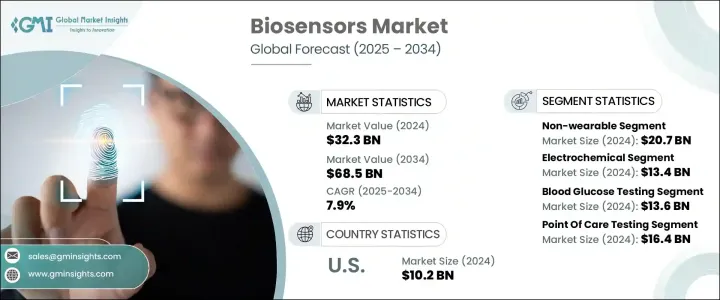

The Global Biosensors Market was valued at USD 32.3 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 68.5 billion by 2034, driven by increasing applications of biosensors across several sectors, particularly healthcare, where they play a crucial role in detecting biological signals. These devices offer high sensitivity and precision, allowing for the quick detection of biomarkers that aid in the early diagnosis of various diseases. Additionally, the expanding use of biosensors in drug discovery and biomedicine further supports the market's growth. The growing demand for portable biosensors, especially in regions like Asia Pacific and Europe, alongside technological advancements, is key factor propelling the industry.

Another key factor driving the growth of the biosensors market is the increasing prevalence of chronic conditions, such as diabetes and cardiovascular diseases, which require continuous monitoring and management to avoid serious complications. For example, diabetes, if left unmanaged, can lead to severe health issues like kidney failure, stroke, or lower limb amputations. This has led to a growing demand for devices that can offer real-time monitoring of blood glucose levels, allowing patients to take immediate action when necessary. In addition to diabetes, cardiovascular diseases are also on the rise, creating an increasing need for early detection and ongoing management through advanced diagnostic tools like biosensors. These technologies are helping improve patient outcomes by providing timely data that allows for more precise treatment plans.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.3 Billion |

| Forecast Value | $68.5 Billion |

| CAGR | 7.9% |

The non-wearable biosensor segment accounted for USD 20.7 billion in 2024. These sensors, integrated into diagnostic devices used for point-of-care testing, are valued for their ease of use, high accuracy, and ability to provide immediate results without continuous user interaction. As healthcare providers seek efficient and timely diagnostic tools, the demand for these non-wearable devices is expected to rise. Technological innovations such as improved sensitivity, miniaturization, and digital connectivity enhance their effectiveness and usability in clinical settings.

The electrochemical biosensor segment holds a substantial share of the market, representing 41.6% share, which was USD 13.4 billion in 2024. These biosensors are widely used in medical devices such as glucose meters for diabetic patients and in systems that monitor cardiac biomarkers and blood gases. The increasing prevalence of chronic conditions, including cardiovascular diseases and diabetes, drives the demand for electrochemical sensors as essential diagnostic tools.

United States Biosensors Market generated USD 10.2 billion in 2024, driven by the rising number of chronic disease cases, especially diabetes and heart-related conditions. Despite a strict regulatory environment, the U.S. remains a hub for the development, approval, and commercialization of innovative medical technologies, including biosensors. Regulatory bodies like the FDA are increasingly focused on accelerating the approval process for new biosensor technologies, recognizing their critical role in improving healthcare outcomes.

To strengthen their position in the market, companies are focusing on innovation and partnerships. Many firms invest heavily in R&D to develop more advanced biosensor technologies with greater sensitivity and precision. Collaborations with healthcare providers and research institutions help in driving innovation. Furthermore, some companies are working to expand their product portfolios to cater to various medical needs, such as disease-specific biosensors and wearable health monitoring devices. Market leaders, such as Thermo Fisher Scientific, Masimo, and Danaher, are adopting these strategies to enhance their market presence and remain competitive in this rapidly growing industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing application of biosensors in medical field

- 3.2.1.2 Rising prevalence of diabetes globally

- 3.2.1.3 High demand for portable biosensors in Asia Pacific and Europe

- 3.2.1.4 Increasing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable

- 5.3 Non-wearable

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electrochemical

- 6.3 Optical

- 6.4 Thermal

- 6.5 Piezoelectric

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By Applications, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood glucose testing

- 7.3 Cholesterol testing

- 7.4 Blood gas analysis

- 7.5 Pregnancy testing

- 7.6 Drug discovery

- 7.7 Infectious disease testing

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Point of care testing

- 8.3 Home healthcare diagnostics

- 8.4 Research laboratories

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 ARKRAY

- 10.3 Bio-Rad Laboratories

- 10.4 Biosensors International Group

- 10.5 Dexcom

- 10.6 Danaher

- 10.7 F. Hoffmann-La Roche

- 10.8 Masimo

- 10.9 Nova Biomedical

- 10.10 Platinum Equity Advisors

- 10.11 PHC Holdings

- 10.12 Pinnacle Technology

- 10.13 Siemens Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trividia Health

Table of Contents

Chapter 11 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 12 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 13 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing application of biosensors in medical field

- 3.2.1.2 Rising prevalence of diabetes globally

- 3.2.1.3 High demand for portable biosensors in Asia Pacific and Europe

- 3.2.1.4 Increasing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory scenario

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 14 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 15 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable

- 5.3 Non-wearable

Chapter 16 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electrochemical

- 6.3 Optical

- 6.4 Thermal

- 6.5 Piezoelectric

- 6.6 Other technologies

Chapter 17 Market Estimates and Forecast, By Applications, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Blood glucose testing

- 7.3 Cholesterol testing

- 7.4 Blood gas analysis

- 7.5 Pregnancy testing

- 7.6 Drug discovery

- 7.7 Infectious disease testing

- 7.8 Other applications

Chapter 18 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Point of care testing

- 8.3 Home healthcare diagnostics

- 8.4 Research laboratories

- 8.5 Other end users

Chapter 19 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 20 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 ARKRAY

- 10.3 Bio-Rad Laboratories

- 10.4 Biosensors International Group

- 10.5 Dexcom

- 10.6 Danaher

- 10.7 F. Hoffmann-La Roche

- 10.8 Masimo

- 10.9 Nova Biomedical

- 10.10 Platinum Equity Advisors

- 10.11 PHC Holdings

- 10.12 Pinnacle Technology

- 10.13 Siemens Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trividia Health