PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750607

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750607

North America Fruit Snacks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

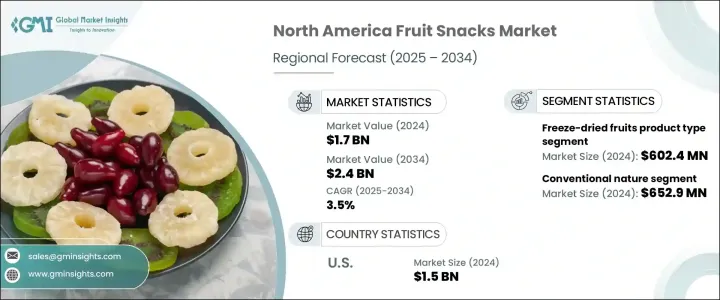

North America Fruit Snacks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 2.4 billion by 2034. People across the region are increasingly leaning toward convenient, healthier snack options that offer both taste and nutrition. The rise in demand for fruit-based snacks is largely driven by the growing awareness around wellness, especially among younger demographics and busy professionals seeking portable and guilt-free snacking alternatives. The market has also benefited from the rising popularity of natural ingredients, with plant-based and minimally processed options becoming more favored. As preferences evolve, product innovation continues to play a crucial role, with companies focusing on clean labels, simple ingredient lists, and transparency to meet shifting expectations.

Within this market, the freeze-dried fruits segment has seen impressive momentum, valued at USD 602.4 million in 2024. It is forecasted to grow at a CAGR of 3.8% through 2034. This category is gaining traction thanks to its longer shelf life, ease of storage, and the ability to retain the flavor and nutritional value of fresh fruit. Consumers appreciate the convenience and health benefits of freeze-dried snacks, making them a preferred option in both individual and family households. As health-consciousness continues to spread, demand for such products is expected to rise even further, creating more opportunities for brands that can deliver quality, freshness, and variety in this format.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 3.5% |

Meanwhile, the conventional fruit snacks segment continues to dominate in terms of market share. Valued at USD 652.9 million in 2024, this segment is projected to expand at a CAGR of 3.4% between 2025 and 2034, capturing approximately 38.2% of the total market. The prominence of conventional fruit snacks is largely due to their affordability and widespread availability across mainstream retail channels. While organic and non-GMO variants are gaining ground, their relatively higher cost and limited shelf presence make conventional options more appealing to budget-conscious buyers. Moreover, the lower production and distribution costs associated with conventional products allow brands to maintain competitive pricing and scale up distribution easily.

The U.S. remains the largest and most influential market within the region, with a valuation of USD 1.5 billion in 2024 and a projected CAGR of 3.4% from 2025 to 2034. Consumers in the country are increasingly turning to fruit snacks that cater to their fast-paced lifestyles, prioritizing options that are not only easy to consume on the go but also align with their wellness goals. This growing appetite for functional, clean-label, and better-for-you snacks has driven significant changes in product offerings, with manufacturers responding to evolving preferences through innovative formulations and marketing strategies focused on transparency and health benefits.

The competitive landscape of the North America fruit snacks market is shaped by a combination of factors, including formulation innovation, marketing of health attributes, pricing models, and distribution strength. Companies are continuously upgrading their portfolios to meet the demand for organic, low-sugar, non-GMO, and clean-label products. New product formats using alternative ingredients and value-added features like added vitamins or real fruit infusions are becoming central to competition. Volume-based packaging strategies are also common, especially among family-focused buyers who seek cost-effective options with multiple servings.

Distribution has become a key area of focus, with leading brands utilizing a mix of traditional retail and digital channels to maximize reach. The shift toward e-commerce, particularly in the snack foods sector, has prompted companies to expand their online presence to capture emerging purchasing behaviors. Simultaneously, investments in marketing, brand building, and strategic collaborations have intensified as brands look to forge stronger emotional connections with their audiences.

To stay ahead, many players are channeling resources into research and development, targeting unmet consumer needs such as adult-focused fruit snacks and premium offerings with elevated health profiles. Companies are also exploring growth via acquisitions to broaden their product lines and enhance capabilities in natural and plant-based innovations, ensuring they remain competitive in a fast-evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.2 Research scope & assumptions

- 1.3 List of data sources

- 1.4 Market estimation technique

- 1.5 Market size calculation models

- 1.6 Market breakdown and data triangulation

- 1.7 Primary research validation methods

- 1.8 Secondary research verification process

- 1.9 Research limitations and challenges

Chapter 2 Executive Summary

- 2.1 Market snapshot

- 2.2 North America fruit snacks market highlights

- 2.3 Regional market highlights

- 2.4 Segmental market highlights

- 2.5 Competitive landscape snapshot

- 2.6 Investment highlights and strategic recommendations

- 2.7 Key market trends and future growth indicators

- 2.8 Analyst perspective and critical insights

Chapter 3 Industry Insights

- 3.1 Market introduction and definition

- 3.2 Value chain analysis

- 3.3 Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Demand-side impact (selling price)

- 3.3.3.1 Price transmission to end markets

- 3.3.3.2 Market share dynamics

- 3.3.3.3 Consumer response patterns

- 3.3.4 Key companies impacted

- 3.3.5 Strategic industry responses

- 3.3.5.1 Supply chain reconfiguration

- 3.3.5.2 Pricing and product strategies

- 3.3.5.3 Policy engagement

- 3.3.6 Outlook and future considerations

- 3.3.1 Impact on trade

- 3.4 Trade statistics (HS code)

- 3.4.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.4.2 Major importing countries, 2021-2024 (kilo tons)

- 3.5 Manufacturing process analysis

- 3.5.1 Freeze-drying process

- 3.5.2 Dehydration techniques

- 3.5.3 Fruit puree processing

- 3.5.4 Vacuum cooking methods

- 3.5.5 Extrusion technology

- 3.6 Raw material analysis and sourcing strategies

- 3.6.1 Fruit selection and quality parameters

- 3.6.2 Ingredient sourcing challenges

- 3.6.3 Organic vs. conventional sourcing

- 3.6.4 Supply chain sustainability

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.8.1 FDA regulations for fruit snacks

- 3.8.2 Labeling requirements and compliance

- 3.8.3 Organic certification standards

- 3.8.4 Food safety modernization act (FSMA) impact

- 3.8.5 Canadian food inspection agency (CFIA) regulations

- 3.8.6 Mexican regulatory standards

- 3.9 Consumer behavior analysis

- 3.9.1 Snacking patterns and preferences

- 3.9.2 Health and wellness trends

- 3.9.3 Demographic analysis

- 3.9.4 Purchase decision factors

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for healthy and natural snack alternatives

- 3.10.1.2 Increasing consumer preference for plant-based and clean-label products

- 3.10.1.3 Expansion of distribution channels, including e-commerce and health-focused retail

- 3.10.1.4 Innovation in product formats and fruit combinations

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High production costs for premium and cold-pressed products

- 3.10.2.2 Limited shelf life and supply chain complexities for certain fruit-based ingredients

- 3.10.3 Market Opportunities

- 3.10.3.1 Innovation in flavors and ingredients

- 3.10.3.2 Expansion of distribution channels

- 3.10.3.3 Development of functional fruit snacks

- 3.10.3.4 Growing demand for organic and non-GMO products

- 3.10.4 Market Challenges

- 3.10.4.1 Maintaining nutritional value during processing

- 3.10.4.2 Shelf-life extension without preservatives

- 3.10.4.3 Meeting clean label requirements

- 3.10.4.4 Addressing consumer concerns about sugar content

- 3.10.1 Growth drivers

- 3.11 Impact Of Covid-19 On North America Fruit Snacks Market

- 3.12 Future outlook and emerging trends

- 3.12.1 Technological innovations in processing and packaging

- 3.12.2 Emerging flavor trends and consumer preferences

- 3.12.3 Functional and fortified fruit snacks

- 3.12.4 Sustainable and eco-friendly packaging solutions

- 3.12.5 Plant-based and vegan fruit snack innovations

- 3.12.6 Digital marketing and e-commerce strategies

- 3.12.7 Personalized nutrition and custom formulations

- 3.12.8 Impact of artificial intelligence and automation on production

- 3.13 Raw material analysis & procurement strategies

- 3.14 Pricing analysis and trends

- 3.15 Pestle analysis

- 3.16 Porter's five forces analysis

- 3.17 Growth potential analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis of key players

- 4.2 Competitive benchmarking

- 4.3 Strategic dashboard

- 4.4 Competitive positioning matrix

- 4.5 Competitive strategies adopted by key players

- 4.5.1 Mergers and acquisitions

- 4.5.2 Joint ventures and collaborations

- 4.5.3 Product launches and innovations

- 4.5.4 Expansion and investment strategies

- 4.6 SWOT analysis of key players

- 4.7 Technological capabilities assessment

- 4.8 Production capacity analysis

- 4.9 Distribution network comparison

- 4.10 Marketing and branding strategies comparison

- 4.11 Future competitive scenario analysis

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fruit rolls and wraps

- 5.3 Fruit leathers

- 5.4 Freeze-dried fruits

- 5.5 Fruit chips and crisps

- 5.6 Fruit gummies and jellies

- 5.7 Fruit bars

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Nature, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

- 6.4 Non-GMO

Chapter 7 Market Estimates & Forecast, By Fruit Type, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Apple

- 7.3 Berries

- 7.3.1 Blueberry

- 7.3.2 Raspberry

- 7.3.3 Others

- 7.4 Tropical fruits

- 7.4.1 Mango

- 7.4.2 Pineapple

- 7.4.3 Banana

- 7.4.4 Others

- 7.5 Citrus fruits

- 7.5.1 Orange

- 7.5.2 Lemon

- 7.5.3 Others

- 7.6 Mixed fruits

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Target Consumer, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Children (2–12 years)

- 8.3 Teenagers (13–19 years)

- 8.4 Adults (20–45 years)

- 8.5 Older adults (above 45 years)

Chapter 9 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Pouches

- 9.2 Boxes and Cartons

- 9.3 Trays

- 9.4 Jars and bottles

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Supermarkets and hypermarkets

- 10.3 Convenience stores

- 10.4 Specialty stores

- 10.5 Online retail

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Country, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 U.S.

- 11.3 Canada

- 11.4 Mexico

Chapter 12 Company Profiles

- 12.1 Bare Snacks (PepsiCo, Inc.)

- 12.2 Brothers All Natural

- 12.3 Calbee America, Inc.

- 12.4 Crispy Green Inc.

- 12.5 Crunchies Natural Food Company

- 12.6 General Mills, Inc.

- 12.7 Kellogg Company

- 12.8 Made in Nature, LLC

- 12.9 Mount Franklin Foods, LLC

- 12.10 Natierra (BrandStorm Inc.)

- 12.11 Peaceful Fruits

- 12.12 PepsiCo, Inc. (Frito-Lay)

- 12.13 Sunkist Growers, Inc.

- 12.14 Solely

- 12.15 Stretch Island Fruit Co. (Kellogg Company)

- 12.16 That's it Nutrition, LLC

- 12.17 Welch Foods Inc.

- 12.18 Fruit Bliss