PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755185

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755185

Car Door Latch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

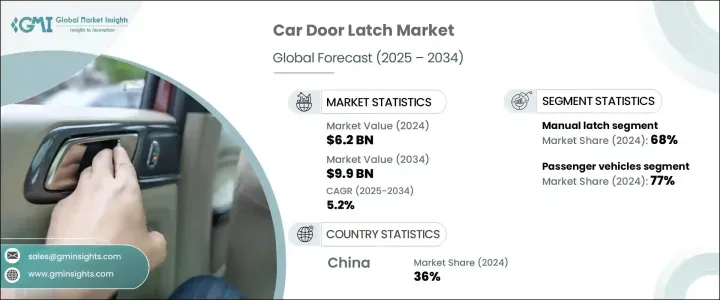

The Global Car Door Latch Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 9.9 billion by 2034, fueled by increasing vehicle production worldwide, stronger consumer interest in enhanced safety features, and regulatory standards that push for improved crash safety performance. The shift toward electric and high-end vehicles has accelerated the adoption of smart and electronic latching systems, further stimulating industry expansion. As automotive production rises, particularly across fast-growing economies such as Brazil, China, and India, so does the demand for essential mechanical and safety components like door latches. Middle-class expansion and rapid urban development are increasing personal vehicle ownership, driving the need for dependable latch systems.

The growing importance of safety in automobiles continues to influence this market's direction. With more stringent government regulations and heightened consumer expectations, automakers are integrating advanced latch systems to enhance passenger protection. Demand rises for electronic and power latches that improve child safety and crash response. As automakers focus on security and convenience, innovation in latch technology is gaining momentum, particularly in the premium vehicle segment where these systems are often standard.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 billion |

| Forecast Value | $9.9 billion |

| CAGR | 5.2% |

The manual latches segment held a 68% share in 2024 and is forecasted to grow at 4.5% CAGR through 2034. Their dominance stems from simplicity, cost-efficiency, and adaptability in lower and mid-range vehicles. Compared to automatic or electronic alternatives, manual latches are easier to install, require less maintenance, and are more durable. In regions where cost-conscious consumers dominate, especially in developing nations, automakers rely on manual latch systems that deliver functionality without the complexity of advanced electronics. Their ruggedness and long service life add to their appeal in high-volume manufacturing.

Passenger vehicles segment accounted for 77% share in 2024 and is expected to grow at a CAGR of 5.5% during 2034 due to massive global output and rising sales volume. As consumers in major automotive markets such as the U.S., Europe, India, and China increasingly turn to affordable, personal vehicles, automakers emphasize scalable and efficient latching technologies. These include manual and powered systems that provide flexibility for vehicle classes and market preferences.

China Car Door Latch Market held a 36% share in 2024 and generated USD 1.02 billion in 2024 attributed to China's massive vehicle production capacity, rising car ownership, and competitive supply chain network. The region benefits from lower production costs, high local demand, and government initiatives favoring electric vehicles. As a result, there's a growing adoption of electronic latch systems. Domestic manufacturers ramp up research and development to align with evolving safety standards and smart mobility solutions in the global market.

Major players in the Global Car Door Latch Market include Magna, U-Shin, Brose Fahrzeugteile, Huf Hulsbeck & Furst, Shiroki Corporation, Kiekert AG, Inteva Products, WITTE Automotive, AISIN Corporation, Mitsui Kinzoku ACT. To strengthen their position in the global car door latch market, companies invest in R&D for electronic and smart latch technologies that meet evolving safety and convenience demands. Strategic alliances with vehicle manufacturers help ensure the integration of new systems during vehicle development. Global expansion of manufacturing and supply operations supports regional demand, while innovation in lightweight, energy-efficient components aligns with sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component & sub-component manufacturers

- 3.2.3 Car door latch manufacturers

- 3.2.4 Automotive original equipment manufacturers

- 3.2.5 Aftermarket suppliers/distributors

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Price trends

- 3.6 Cost breakdown analysis

- 3.7 Sustainability & ESG trends

- 3.7.1 Environmental impact of latch production

- 3.7.2 Use of recycled/eco-friendly materials

- 3.7.3 Energy efficiency in manufacturing processes

- 3.8 Innovation & R&D analysis

- 3.9 Consumer behavior & buying trends

- 3.10 Patent analysis

- 3.11 Key news & initiatives

- 3.12 Regulatory landscape

- 3.13 Impact forces

- 3.13.1 Growth drivers

- 3.13.1.1 Increasing global vehicle production and sales

- 3.13.1.2 Increasing demand for vehicle safety

- 3.13.1.3 Electrification and smart locking systems

- 3.13.1.4 Technological advancements in mechatronics

- 3.13.1.5 Rise of electric vehicles (EVs) and autonomous vehicles (AVs)

- 3.13.2 Industry pitfalls & challenges

- 3.13.2.1 Rising raw material costs

- 3.13.2.2 Integration complexity of advanced systems

- 3.13.1 Growth drivers

- 3.14 Growth potential analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Manual latch

- 5.3 Electronic latch (E-latch)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Side door latch

- 7.3 Tailgate latch

- 7.4 Hood latch

- 7.5 Back door latch

Chapter 8 Market Estimates & Forecast, By Mechanism, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Cable latch

- 8.3 Rod latch

- 8.4 Deadbolt latch

- 8.5 Spring-loaded latch

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AISIN Corporation

- 11.2 Brose Fahrzeugteile

- 11.3 Continental AG

- 11.4 Dura Automotive Systems

- 11.5 Eberhard Manufacturing

- 11.6 Huf Hulsbeck & Furst

- 11.7 IFB Automotive

- 11.8 Inteva Products

- 11.9 Kiekert AG

- 11.10 Magna

- 11.11 Minda VAST Access Systems

- 11.12 Mitsui Kinzoku ACT

- 11.13 Prabha Engineering

- 11.14 Robert Bosch

- 11.15 Sandhar Technologie

- 11.16 Shiroki Corporation

- 11.17 Shivani Locks

- 11.18 STRATTEC Security Corporation

- 11.19 U-Shin

- 11.20 WITTE Automotive