PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755198

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755198

Refined Lactose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

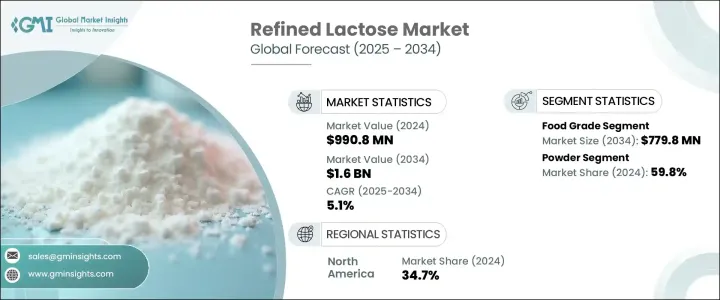

The Global Refined Lactose Market was valued at USD 990.8 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.6 billion by 2034, driven by increasing demand across various industries, including food and beverage, pharmaceuticals, and animal feed. In the food sector, refined lactose is utilized as a sweetener and filler in bakery items, confectioneries, and dairy products. Consumers' preference for natural and minimally processed ingredients has further fueled the demand for refined lactose, positioning it as a healthier alternative to synthetic sweeteners. In pharmaceuticals, refined lactose serves as an excipient in tablet and capsule formulations due to its excellent compressibility and solubility, contributing to the expansion of the market.

Additionally, incorporating refined lactose into animal feed formulations-especially for young livestock such as piglets and calves-has proven highly effective in promoting digestive health and supporting early-stage energy metabolism. This functional benefit drives its adoption in the livestock and dairy farming sectors, where animal health and rapid growth are critical for economic viability. As producers aim to improve feed efficiency and minimize synthetic additives, lactose is a natural, palatable, and nutrient-rich component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $990.8 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 5.1% |

The food-grade segment is projected to reach USD 779.8 million by 2034, growing at a CAGR of 5.2% fueled by increasing consumer demand for clean-label, naturally derived ingredients in processed foods. Food-grade lactose is widely used not only for its mild sweetness and textural properties but also due to its digestibility and essential role in infant nutrition. Its rising usage in bakery, confectionery, and dairy products-coupled with innovation in formulation and functional food development-is expected to drive sustained momentum in this segment throughout the forecast period.

Among the various forms of refined lactose, the powder form held the largest market share, accounting for 59.8% in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. The powder form's versatility and ease of handling make it suitable for various applications in pharmaceuticals, food and beverage industries, and infant nutrition. However, challenges such as fluctuating raw material prices and the requirement for consistent quality standards may impact growth. Innovations in processing techniques to enhance purity and performance are expected to drive the continued expansion of the refined lactose market.

North America Refined Lactose Market held a 34.7% share in 2024 due to the region's developed dairy sector and the growing need for lactose in pharmaceutical applications. The United States significantly contributes to this region's market share, owing to its sophisticated production capabilities and high investment in research and development for refining lactose. Additionally, the increasing use of lactose-based excipients in drug formulations continues to bolster market growth in this region.

Key players in the Global Refined Lactose Market include Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Limited, Lactalis Ingredients, FrieslandCampina Ingredients, Agropur Cooperative, and Hilmar Cheese Company, Inc. These companies are focusing on expanding their product portfolios, enhancing production capacities, and investing in research and development to meet the rising demand for refined lactose across various applications. To strengthen their market presence, companies in the Global Refined Lactose Industry are adopting several key strategies. These include expanding production capacities to meet the growing demand, investing in research and development to innovate and improve product quality, and forming strategic partnerships and collaborations to enhance distribution networks and market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand in food & beverage industry

- 3.4.1.2 Health & wellness trends

- 3.4.1.3 Pharmaceutical industry demand

- 3.4.1.4 Expansion in animal feed industry

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Increasing lactose intolerance

- 3.4.2.2 Raw material price fluctuations

- 3.4.3 Market opportunities

- 3.4.4 Market challenges

- 3.4.5 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends (USD/Ton)

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends (USD/Ton)

- 3.7 Regulatory framework and standards

- 3.7.1 Food safety regulations

- 3.7.2 Pharmaceutical quality standards

- 3.7.3 Infant formula regulations

- 3.7.4 Labeling requirements

- 3.7.5 Import/Export regulations

- 3.8 Porter's analysis

- 3.9 Pestel analysis

- 3.10 Manufacturing process analysis

- 3.10.1 Whey processing

- 3.10.2 Crystallization techniques

- 3.10.3 Purification methods

- 3.10.4 Drying & milling

- 3.10.5 Quality control procedures

- 3.11 Raw material analysis & procurement strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & acquisition

- 4.6.3 Collaborations

- 4.6.4 New product launches

- 4.6.5 Research & development

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Grade, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Food grade

- 5.2.1 Standard food grade

- 5.2.2 High purity food grade

- 5.2.3 Other food grades

- 5.3 Pharmaceutical Grade

- 5.3.1 USP/EP/JP grade

- 5.3.2 Anhydrous lactose

- 5.3.3 Spray-dried lactose

- 5.3.4 Monohydrate lactose

- 5.3.5 Other pharmaceutical grades

- 5.4 Technical grade

- 5.5 Other grades

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.2.1 Fine powder

- 6.2.2 Coarse powder

- 6.3 Granules

- 6.3.1 Milled granules

- 6.3.2 Agglomerated granules

- 6.4 Crystals

- 6.5 Other forms

Chapter 7 Market Estimates & Forecast, By Production Method, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whey-derived lactose

- 7.2.1 Sweet whey-derived

- 7.2.2 Acid whey-derived

- 7.3 Milk-derived lactose

- 7.4 Other production methods

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Confectionery

- 8.2.2 Bakery products

- 8.2.3 Dairy products

- 8.2.4 Processed foods

- 8.2.5 Beverages

- 8.2.6 Other food applications

- 8.3 Pharmaceuticals

- 8.3.1 Tablet formulations (excipient)

- 8.3.2 Capsule formulations

- 8.3.3 Inhalation products

- 8.3.4 Injectable formulations

- 8.3.5 Other pharmaceutical applications

- 8.4 Infant formula

- 8.4.1 Standard infant formula

- 8.4.2 Follow-on formula

- 8.4.3 Specialty formula

- 8.4.4 Other infant nutrition products

- 8.5 Animal feed

- 8.6 Cosmetics & personal care

- 8.7 Other applications

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage industry

- 9.2.1 Large food manufacturers

- 9.2.2 Medium & small food processors

- 9.2.3 Artisanal food producers

- 9.3 Pharmaceutical industry

- 9.3.1 Large pharmaceutical companies

- 9.3.2 Generic drug manufacturers

- 9.3.3 Contract manufacturing organizations

- 9.4 Infant formula manufacturers

- 9.4.1 Animal feed industry

- 9.4.2 Cosmetics & personal care industry

- 9.4.3 Other end-use industries

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales/B2B

- 10.3 Distributors & wholesalers

- 10.4 Online channels

- 10.5 Other distribution channels

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Arla Foods Ingredients Group P/S

- 12.2 Fonterra Co-operative Group Limited

- 12.3 Lactalis Ingredients

- 12.4 FrieslandCampina Ingredients

- 12.5 Agropur Cooperative

- 12.6 Hilmar Cheese Company, Inc.

- 12.7 Leprino Foods Company

- 12.8 Meggle Group GmbH

- 12.9 DFE Pharma

- 12.10 Kerry Group plc

- 12.11 Milei GmbH (Hochdorf Group)

- 12.12 Molkerei MEGGLE Wasserburg GmbH & Co. KG

- 12.13 Actus Nutrition