PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755199

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755199

U.S. Sleep Apnea Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

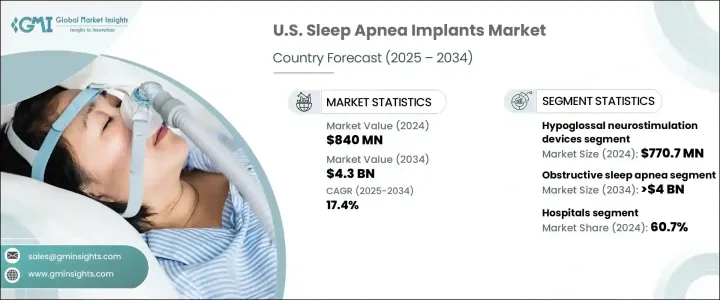

U.S. Sleep Apnea Implants Market was valued at USD 840 million in 2024 and is estimated to grow at a CAGR of 17.4% to reach USD 4.3 billion by 2034. This growth is driven by the increasing prevalence of obstructive sleep apnea (OSA), poor compliance with CPAP therapy, and a growing awareness of sleep apnea's long-term health impacts. Sleep apnea implants are becoming an attractive option due to their ability to provide long-term treatment without the need for nightly equipment setup. Advances in technology, such as the development of minimally invasive procedures, have made these implants safer, more efficient, and increasingly popular. These implants, which are inserted under the skin, work to modify the obstructed airway, normalize breathing, and improve oxygen delivery to the lungs.

Such innovations are encouraging patients who struggle with CPAP therapy to explore alternative treatment options, fueling further market growth. Many individuals find CPAP devices uncomfortable, difficult to use consistently, or disruptive to their sleep. As a result, they often seek more convenient, effective, and personalized treatments that better suit their lifestyle. Advances in sleep apnea implants, including improvements in device design and surgical techniques, are helping to bridge this gap by offering long-term solutions that require minimal patient involvement after the initial procedure. The ability to provide effective, non-invasive treatments that address the underlying causes of sleep apnea has become a game-changer for those who have previously found CPAP therapy challenging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $840 Million |

| Forecast Value | $4.3 Billion |

| CAGR | 17.4% |

The hypoglossal neurostimulation (HGNS) devices segment generated USD 770.7 million in 2024. This technology is proving to be particularly effective for patients with moderate to severe OSA who are unable to tolerate CPAP machines due to discomfort, noise, or other factors. Numerous clinical studies have shown substantial improvements in oxygen saturation and AHI (apnea-hypopnea index) scores, driving the adoption of HGNS devices. Additionally, the support from regulatory agencies for these devices has broadened the treatment options for a wider group of OSA patients, which has contributed to the growth of the market.

The segment focused on obstructive sleep apnea is anticipated to witness significant growth, with a CAGR of 17.6%, reaching USD 4 billion by 2034. OSA affects 30 million Americans, many of whom remain undiagnosed, and public awareness of the condition's risks, such as cardiovascular disease, diabetes, and cognitive decline, is increasing. This has led to a higher demand for effective treatments, especially among those who cannot tolerate CPAP machines. Hypoglossal nerve stimulation devices, as an alternative to CPAP, are gaining considerable traction, offering a promising solution for OSA patients.

The hospitals segment accounted for the largest share in 2024, generating 60.7%. Sleep apnea implants, including phrenic nerve stimulators and hypoglossal nerve stimulators, require skilled surgical intervention and post-operative care, making hospitals the ideal setting for their implantation. Hospitals provide optimal care, offering necessary follow-up treatments, monitoring, and adjustments that improve patient outcomes. Advanced sleep medicine clinics within hospitals also play a crucial role in diagnosing and managing sleep disorders and providing comprehensive care, including polysomnography and device optimization.

Key players in the U.S. Sleep Apnea Implants Market include Inspire and Asahi KASEI. To strengthen their position in the U.S. sleep apnea implants market, companies are focusing on technological innovation and the development of minimally invasive implant solutions. Many manufacturers are actively improving the design and functionality of hypoglossal neurostimulation devices to enhance their efficacy and patient comfort. Additionally, companies are collaborating with healthcare providers to expand patient access to these treatments, while also investing in comprehensive post-implantation care to improve long-term outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of obstructive sleep apnea

- 3.2.1.2 Low compliance and adherence towards CPAP

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising awareness regarding sleep apnea

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of sleep apnea implants

- 3.2.2.2 Complications associated with sleep apnea implants

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Pricing analysis

- 3.6 Product pipeline analysis

- 3.7 Patient journey map

- 3.8 Regulatory landscape

- 3.9 Hypoglossal neurostimulation devices market, 2021 - 2034 (Units)

- 3.10 Reimbursement scenario

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hypoglossal neurostimulation devices

- 5.3 Phrenic nerve stimulators

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea

- 6.3 Central sleep apnea

Chapter 7 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

Chapter 8 Company Profiles

- 8.1 Asahi KASEI

- 8.2 Inspire