PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755207

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755207

AI in Logistics and Supply Chain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

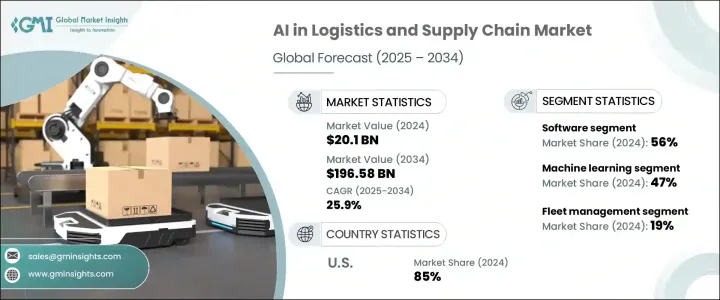

The Global AI in Logistics and Supply Chain Market was valued at USD 20.1 billion in 2024 and is estimated to grow at a CAGR of 25.9% to reach USD 196.58 billion by 2034, driven by the increasing need for real-time supply chain visibility, optimized route planning, accurate demand forecasting, and automation in warehouses. Companies are increasingly incorporating AI into their operations to enhance decision-making processes, reduce operational costs, and manage complex logistics networks. AI-enabled solutions such as predictive analytics, robotic process automation, and autonomous vehicles are transforming traditional supply chains into intelligent, adaptable ecosystems.

The growing intricacy of global supply chains has created a need for predictive analytics and real-time data, allowing businesses to analyze massive amounts of data from sensors, GPS, and enterprise resource planning (ERP) systems to optimize inventory management and reduce costs. AI helps companies adapt quickly to shifts in market conditions, prevent disruptions, and improve customer satisfaction. The expansion of e-commerce and omnichannel retail further emphasizes the need for speed, accuracy, and flexibility, where AI technologies help streamline order processing, automate delivery schedules, and forecast customer behavior.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.1 Billion |

| Forecast Value | $196.58 Billion |

| CAGR | 25.9% |

In 2024, the software sector led the market with a share of 56%, anticipated to grow at a CAGR of 26% through 2034. Software helps in empowering intelligent decision-making, automation, and real-time data analysis throughout the supply chain. AI-driven software solutions, including route optimization, demand forecasting, and warehouse automation, are widely adopted by logistics providers to optimize operations, reduce costs, and enhance efficiency. These solutions are key to improving planning accuracy, minimizing human error, and quickly adjusting to market fluctuations. The emphasis on predictive analytics and real-time visibility significantly contributes to the growing demand for AI-powered software applications.

The machine learning (ML) segment held a 47% share in 2024. Its capability to process massive datasets and generate actionable insights in real time makes it essential for analyzing structured and unstructured data from IoT devices, GPS systems, and customer interactions. ML algorithms optimize inventory management, uncover demand patterns, and eliminate operational bottlenecks, thus enhancing efficiency and cost-effectiveness. These algorithms evolve continuously, providing predictive insights and automation opportunities that outperform traditional systems.

United States AI in the Logistics and Supply Chain Market held an 85% share and generated USD 6.2 billion in 2024 due to its advanced digital infrastructure and widespread adoption of emerging technologies. U.S.-based logistics firms are among the first to integrate AI for solutions such as route optimization, demand forecasting, warehouse automation, and predictive maintenance. The country's leading position is further bolstered by the presence of major tech companies and AI providers, accelerating AI adoption in logistics. Public and private sector investments in AI research and development, coupled with government initiatives like the National AI Initiative Act, support the adoption of AI technologies across the logistics and supply chain landscape.

Prominent players in the AI in Logistics and Supply Chain Market include Amazon Web Services, Oracle, Blue Yonder, SAP SE, FourKites, C3.ai, Google, Microsoft, IBM, and Manhattan Associates. To strengthen their market position, companies are focusing on strategic partnerships and acquisitions to enhance their AI capabilities and broaden service offerings. Leveraging cutting-edge technologies, these companies are integrating machine learning, robotics, and automation into logistics and supply chain operations to improve efficiency and reduce costs. Many firms invest in AI-driven software solutions for real-time analytics, route optimization, and demand forecasting, allowing them to stay competitive in a rapidly evolving market. Additionally, AI solution providers are increasing their focus on the e-commerce sector, ensuring quick, flexible, and accurate delivery systems to meet growing consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 System integrators and consulting firms

- 3.2.3 Logistics technology providers

- 3.2.4 Hardware and robotics companies

- 3.2.5 Managed service providers (MSPs)

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Offering cost implications

- 3.4.3 Strategic industry responses

- 3.4.3.1 Supply chain reconfiguration

- 3.4.3.2 Pricing and Offering strategies

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for real-time supply chain visibility

- 3.11.1.2 Growth of e-commerce and omnichannel retailing

- 3.11.1.3 Advancements in predictive analytics and machine learning

- 3.11.1.4 Integration of IoT and AI for smart warehousing

- 3.11.1.5 Adoption of autonomous vehicles and drones

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial implementation costs

- 3.11.2.2 Data privacy and security concerns

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Robots (e.g., automated guided vehicles, drones)

- 5.3 Software

- 5.3.1 Predictive analytics

- 5.3.2 Transportation management systems

- 5.3.3 Inventory management

- 5.3.4 Warehouse management

- 5.4 Services

- 5.4.1 Managed services

- 5.4.2 Professional services

- 5.4.2.1 Deployment & integration

- 5.4.2.2 Consulting

- 5.4.2.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Machine learning

- 6.3 Natural language processing (NLP)

- 6.4 Computer vision

- 6.5 Context-aware computing

- 6.6 Robotics process automation (RPA)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Fleet management

- 7.3 Supply chain planning

- 7.4 Inventory & warehouse management

- 7.5 Freight brokerage & risk management

- 7.6 Demand forecasting

- 7.7 Customer service (chatbots, virtual assistants)

- 7.8 Order fulfillment & last-mile delivery

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Retail & e-commerce

- 8.3 Manufacturing

- 8.4 Automotive

- 8.5 Food & beverage

- 8.6 Healthcare & pharmaceuticals

- 8.7 Transportation & logistics

- 8.8 Energy & utilities

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amazon Web Services

- 10.2 Blue Yonder

- 10.3 C3.ai

- 10.4 ClearMetal

- 10.5 Fetch Robotics

- 10.6 FourKites

- 10.7 GE Digital

- 10.8 Google

- 10.9 Honeywell International

- 10.10 Infor

- 10.11 Korber Supply Chain

- 10.12 Llamasoft

- 10.13 Manhattan Associates

- 10.14 Microsoft Corporation

- 10.15 NVIDIA Corporation

- 10.16 SAP SE

- 10.17 Siemens AG

- 10.18 Zebra Technologies