PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755208

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755208

Welding Consumables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

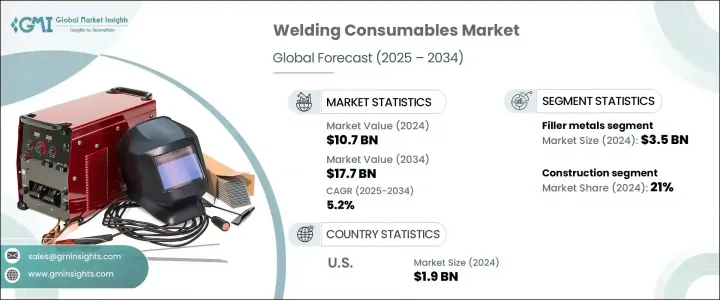

The Global Welding Consumables Market was valued at USD 10.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 17.7 billion by 2034. This growth is driven by the increasing demand for welding consumables in infrastructure and construction projects with the rising adoption of automation and robotics in industrial applications. Additionally, the growing preference for eco-friendly welding materials and the expansion of the automotive sector in emerging markets are further contributing to market growth. In developing nations, urbanization and rising disposable incomes are expected to lead to significant investments in infrastructure, which in turn will fuel the demand for welding consumables.

As the industrial sector in these regions continues to thrive, the need for welding will grow, creating new opportunities in the market. Advances in welding technology, such as the development of stronger, more durable materials, are also supporting market growth. The automotive sector, particularly in both developed and emerging economies, is seeing a rise in the application of welding processes as manufacturers demand more custom-made products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 5.2% |

Filler metals held the largest market share in 2024, generating USD 3.5 billion, and is expected to grow at a CAGR of 5.6% between 2025 and 2034. The demand for filler metals is rising as manufacturers introduce innovative products to meet the evolving needs of industries like pipeline installation, heavy machinery production, and offshore fabrication. These industries are increasingly turning to higher-strength materials to improve the durability and performance of their products.

The construction segment held a 21% share in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2034. Welding is an essential process in construction, especially in the fabrication of structural metal frameworks. With large-scale construction projects and increasing metal usage, welding plays a critical role in ensuring the structural integrity of buildings and infrastructure. The demand for welding consumables in this sector is closely tied to the growth of the overall construction industry, with welding playing a significant role in both prefabricated and on-site assembly work.

United States Welding Consumables Market held a 77% share and was valued at USD 1.9 billion in 2024. The surge in infrastructure development, coupled with the adoption of robotics and automation in manufacturing, is propelling the growth of this market. In addition to robotics, collaborative welding robots (cobots) are increasingly being used in manufacturing facilities to assist human welders, making welding processes more efficient and precise. The demand for eco-friendly consumables and the automotive sector's expansion in emerging regions are also contributing to market growth in the U.S.

Key players operating in the Global Welding Consumables Market include Lincoln Electric, Panasonic, ESAB, D&H Secheron, Miller Electric, Kobe Steel, Hyundai Welding, Ador Welding, Hobart Welding Products, Berkenhoff, EWM, Welding Alloys, Diffusion Engineers, Hilco Welding, and Nouveaux. To strengthen their position in the welding consumables market, companies are focusing on technological advancements in their product offerings, such as the development of new filler metals with enhanced mechanical and chemical properties. They are also emphasizing eco-friendly solutions to cater to the growing demand for sustainable practices in manufacturing. Additionally, manufacturers are investing heavily in R&D to develop products that meet the increasing need for customized solutions, especially in the automotive and construction sectors. Expanding their presence in emerging markets and focusing on automation and robotics are also key strategies, enabling companies to improve production efficiency while reducing labor costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Pricing trend analysis

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surge in infrastructure and construction projects

- 3.6.1.2 Growth in automotive and manufacturing sectors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating raw material prices

- 3.6.2.2 Geopolitical and trade barriers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Electrodes

- 5.2.1 Shielded metal arc welding electrodes

- 5.2.2 Gas metal arc welding electrodes

- 5.2.3 Others

- 5.3 Fluxes

- 5.3.1 Submerged arc welding flux

- 5.3.2 Oxy-fuel welding flux

- 5.3.3 Others (brazing flux etc.)

- 5.4 Gases

- 5.4.1 Shielding Gases

- 5.4.2 Backing Gases

- 5.4.3 Others

- 5.5 Filler metals

- 5.5.1 Solid wire

- 5.5.2 flux-cored wire

- 5.5.3 Metal cored wire

- 5.5.4 Welding rods

- 5.5.5 Others (specialty filler metals etc.)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Mild steel

- 6.3 Stainless steel

- 6.4 Aluminum

- 6.5 Nickel alloys

- 6.6 Copper alloys

- 6.7 Others (cobalt alloys etc.)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automobile

- 7.4 Energy

- 7.5 Shipbuilding

- 7.6 Aerospace

- 7.7 Heavy engineering

- 7.8 Others (defense etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Ador Welding

- 10.2 Berkenhoff

- 10.3 D&H Secheron

- 10.4 Diffusion Engineers

- 10.5 ESAB

- 10.6 EWM

- 10.7 Hilco Welding

- 10.8 Hobart Welding Products

- 10.9 Hyundai Welding

- 10.10 Kobe Steel

- 10.11 Lincoln Electric

- 10.12 Miller Electric

- 10.13 Nouveaux

- 10.14 Panasonic

- 10.15 Welding Alloys