PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755213

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755213

Rocker Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

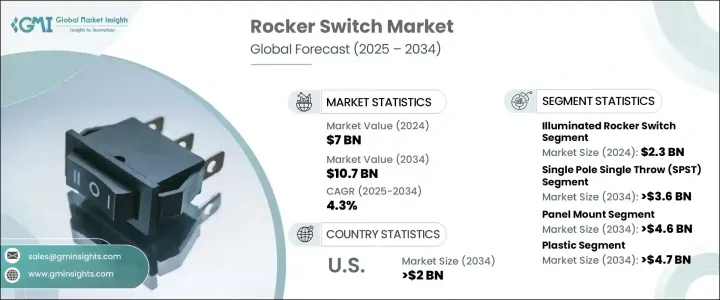

The Global Rocker Switch Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 10.7 billion by 2034, driven by shifting demand dynamics and evolving regulatory environments. Trade tariffs on materials like plastics, metals, and electronic contacts used in rocker switch production have significantly raised manufacturing costs. These import barriers impact global supply chains, especially for OEMs that depend on cross-border sourcing, ultimately slowing product innovation and reducing cost competitiveness in global markets.

Nonetheless, demand continues to rise due to the increased adoption of electric vehicles (EVs) and smart home solutions. As EV production expands, rocker switches play a critical role in vehicle functions such as lighting, heating, and window controls, owing to their reliable and intuitive design. Additionally, government-led initiatives such as tax incentives and infrastructure development for EVs are boosting the demand for rocker switches in automotive applications. Similarly, the proliferation of smart homes has sparked a growing interest in responsive and user-friendly interfaces for controlling lighting, HVAC systems, and security devices. This trend is accelerating the integration of smart rocker switches into everyday home automation systems, offering a combination of functionality, aesthetics, and convenience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4.3% |

The illuminated rocker switch segment generated USD 2.3 billion in 2024, underscoring the expanding preference for switches that offer visual indication and functionality. These switches are equipped with internal lighting that signals their operational status, making them especially useful in environments with low visibility. Their presence is increasingly felt across automotive interiors, marine applications, and home appliances, where they enhance both safety and user interaction.

The panel mount switches segment is projected to achieve USD 4.6 billion by 2034, driven by their popularity in industrial machinery and automotive systems. These switches are designed to be easily accessible and durable, with a secure panel-mounting mechanism that ensures consistent performance in high-use environments. Their robustness and simplicity make them a preferred choice for equipment requiring reliable user interaction.

U.S. Rocker Switch Market is expected to generate USD 2 billion by 2034, fueled by sustained demand from the automotive, aerospace, and smart home sectors. As home automation continues to evolve and industrial construction undergoes modernization, rocker switch integration remains essential. Additionally, the defense sector's demand for rugged and reliable switch systems enhances the application landscape. Domestic innovation is supporting the development of resilient supply chains and pushing new advancements in smart switching technologies.

Leading players in the Global Rocker Switch Market include Leviton Manufacturing Co., Inc., OTTO Engineering, Carling Technologies, Eaton Corporation, TE Connectivity, and Honeywell International Inc. To strengthen their presence in the market, key companies are prioritizing innovation in switch design, focusing on smart and illuminated functionalities tailored for connected environments. They are also increasing investment in R&D to improve performance, reduce size, and enhance energy efficiency. Strategic collaborations with EV manufacturers and smart home developers allow for better integration and quicker deployment across industries. Additionally, players are strengthening regional manufacturing to minimize tariff impact and boost supply chain resilience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Electric vehicle adoption

- 3.8.1.2 Smart home & consumer electronics expansion

- 3.8.1.3 Industrial automation growth

- 3.8.1.4 Miniaturization & customization demand

- 3.8.1.5 Emerging market manufacturing growth

- 3.8.2 Industry pitfalls and challenges

- 3.8.2.1 Price pressure from commoditization

- 3.8.2.2 Supply chain disruptions & tariff risks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Regulatory landscape

- 3.11 Technology landscape

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Illuminated rocker switch

- 5.2 Non-Illuminated rocker switch

- 5.3 Sealed/Waterproof rocker switch

- 5.4 Miniature/Micro rocker switch

- 5.5 Smart rocker switch

Chapter 6 Market estimates & forecast, By Switch Configuration, 2021 - 2034 (USD Million)

- 6.1 Single Pole Single Throw (SPST)

- 6.2 Single Pole Double Throw (SPDT)

- 6.3 Double Pole Single Throw (DPST)

- 6.4 Double Pole Double Throw (DPDT)

- 6.5 Others

Chapter 7 Market estimates & forecast, By Mounting Type, 2021 - 2034 (USD Million)

- 7.1 Panel mount

- 7.2 PCB mount

- 7.3 Surface mount

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million)

- 8.1 Plastic

- 8.2 Metal

- 8.3 Composite

Chapter 9 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Automotive

- 9.2 Consumer electronics

- 9.3 Industrial equipment & machinery

- 9.4 Aerospace & defense

- 9.5 Telecommunications

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Eaton Corporation

- 11.2 Honeywell International Inc.

- 11.3 TE Connectivity

- 11.4 Carling Technologies (a Littelfuse brand)

- 11.5 OTTO Engineering

- 11.6 Leviton Manufacturing Co., Inc.

- 11.7 APEM (part of IDEC Group)

- 11.8 C&K Components

- 11.9 NKK Switches Co., Ltd.

- 11.10 Schurter AG

- 11.11 Omron Corporation

- 11.12 Panasonic Corporation

- 11.13 ABB Ltd.

- 11.14 Schneider Electric SE

- 11.15 Marquardt GmbH

- 11.16 HELLA GmbH & Co. KGaA

- 11.17 Zippy Technology Corp.

- 11.18 E-Switch Inc.

- 11.19 Bulgin Ltd.

- 11.20 ALPS Alpine Co., Ltd.

- 11.21 Defond Group