PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755219

Single-Mode Optical Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

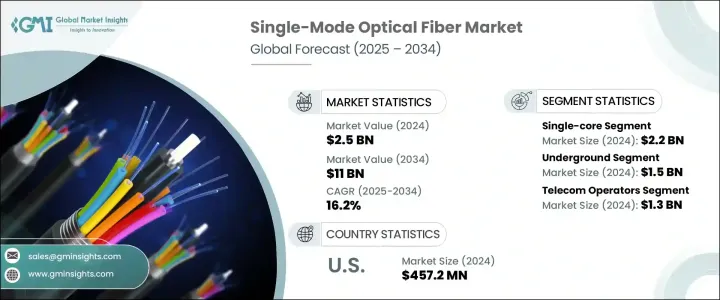

The Global Single-Mode Optical Fiber Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 11 billion by 2034. This sharp increase is being fueled by the global implementation of 5G networks and the explosion of data traffic driven by cloud computing and IoT expansion. As network infrastructure demands faster speeds and broader coverage, telecom providers are turning to single-mode fibers for their ability to transmit data over extended distances with minimal signal loss. The shift toward next-gen digital connectivity is propelling adoption across industries, where bandwidth-intensive applications like smart cities, autonomous systems, and hyperscale data centers rely on reliable high-capacity fiber networks.

Past trade restrictions, such as tariffs on certain imports, were introduced to improve competitiveness for domestic manufacturers but had mixed results. While they supported local production, they also disrupted international supply chains and pushed up the cost of importing optical fibers. This led to delays and uncertainty in fiber network deployments. Despite this, the rapid rollout of 5G networks remains the key driver of global demand for single-mode optical fiber, enabling higher speed and lower latency connectivity between base stations and data centers. The technology's suitability for long-distance, high-volume data transmission makes it essential for expanding mobile and fixed broadband infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $11 Billion |

| CAGR | 16.2% |

The single-core segment generated USD 2.2 billion in 2024, making it the dominant category. This growth is primarily supported by its broad compatibility with existing global telecom infrastructure. Single-core SMFs are widely integrated into long-distance and metro networks because of their low dispersion and attenuation characteristics. As telecom providers push forward with upgrades, these fibers enable high-performance expansion without the need for replacing legacy systems. The fast pace of FTTH deployment and growing 5G connectivity further reinforce the role of single-core designs in enabling rapid and reliable service delivery to end users across regions.

The underground deployment segment generated USD 1.5 billion in 2024. The need for concealed and protected infrastructure in dense urban landscapes continues to drive the trend toward underground installation. Urban development and smart city initiatives are encouraging telecom operators to adopt underground cable systems to maintain aesthetics and safeguard against external damage. These deployments also align with national broadband strategies in various countries, calling for resilient and high-capacity infrastructure capable of withstanding environmental factors. Underground networks are increasingly essential for metro and intercity data transport, offering reliable performance for data centers, enterprise parks, and access rings.

U.S. Single-Mode Optical Fiber Market generated USD 457.2 million in 2024 and is projected to grow through 2034. National 5G deployments are demanding greater fiber backhaul capacity to support low latency and high-speed data transfers. Federal funding initiatives have created strong momentum in broadband expansion, driving demand for advanced long-distance optical fiber networks. Growth in hyperscale data center infrastructure continues to increase demand for high-bandwidth fiber connections linking various facilities, further boosting single-mode fiber adoption in domestic deployments.

Key industry players in the Global Single-Mode Optical Fiber Market include Corning, CommScope, Prysmian, LS Cable and System, Yangtze Optical Fiber and Cable, Sumitomo Electric, Humanetics, HTGD, Nexans, Fujikura, Birla Furukawa, and Furukawa. To secure a stronger market position, single-mode optical fiber companies are prioritizing innovation, cost efficiency, and geographic expansion. Many are heavily investing in R&D to develop fibers with lower attenuation and higher transmission capacity, making them ideal for evolving applications like 5G, FTTH, and hyperscale data networks. Strategic partnerships with telecom operators and infrastructure providers are enabling faster product adoption across regions. Manufacturers are also optimizing production processes and expanding facility footprints in emerging markets to reduce lead times and logistics costs. In addition, diversification of material sourcing and strengthening supply chain resilience have become crucial strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing data traffic from cloud services & IoT

- 3.3.1.2 Global rollout of 5G network

- 3.3.1.3 Growing demand for FTTH (fiber to the home)

- 3.3.1.4 Smart city and infrastructure projects

- 3.3.1.5 Shift towards industrial automation and industry 4.0

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Complex installation in urban environments

- 3.3.2.2 Intense market competition and price pressure

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Core, 2021 – 2034 (USD Million & Megameter)

- 5.1 Key trends

- 5.2 Single-core

- 5.3 Dual-core

- 5.4 Multi-core

Chapter 6 Market Estimates and Forecast, By Deployment, 2021 – 2034 (USD Million & Megameter)

- 6.1 Key trends

- 6.2 Underground

- 6.3 Underwater

- 6.4 Utility poles

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Megameter)

- 7.1 Key trends

- 7.2 Government/defense

- 7.3 Telecom operators

- 7.4 Cloud providers

- 7.5 Oil & gas

- 7.6 Industrial automation

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Megameter)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AFL

- 9.2 Birla Furukawa

- 9.3 CommScope

- 9.4 Corning Incorporated

- 9.5 Exail

- 9.6 Fujikura

- 9.7 Furukawa

- 9.8 HTGD

- 9.9 Humanetics

- 9.10 LS Cable & System

- 9.11 Nexans

- 9.12 Optical Cable Corporation

- 9.13 Prysmian Group

- 9.14 Sr. Indus Electro Systems Pvt. Ltd

- 9.15 STL Tech

- 9.16 Sumitomo Electric Industries, Ltd.

- 9.17 Yangtze Optical Fiber & Cable

- 9.18 ZTT