PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755224

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755224

Chemical High Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

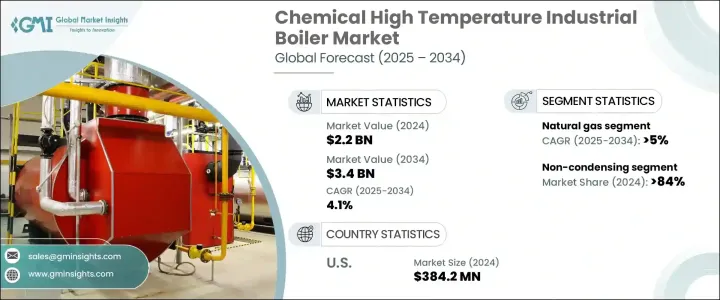

The Global Chemical High Temperature Industrial Boiler Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 3.4 billion by 2034, driven by the rising demand for advanced heating technologies in in industries across developing economies, fueled by rapid urbanization. The increasing complexity and scale of chemical production processes, including chemical synthesis, polymerization, and distillation, propel the need for efficient, high-temperature steam systems.

Furthermore, adopting IoT and automation technologies enhances real-time monitoring, maintenance predictions, and performance optimization, making these boilers increasingly efficient. This shift is critical for improving energy efficiency, minimizing downtime, and complying with strict emissions standards. Retrofitting existing boilers with advanced technologies is becoming common among chemical plants, extending boiler lifespans and ensuring compliance with updated regulations. However, global trade disruptions, particularly tariffs on imported components during the Trump presidency, could impact international trade dynamics and operational costs, creating a shift toward domestic manufacturing in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.1% |

The natural gas-powered segment of the chemical high-temperature industrial boiler market is poised for significant growth, with an anticipated CAGR of 5% by 2034 fueled by the continuous expansion of natural gas infrastructure and a heightened focus on energy security across industries. The increasing demand for cleaner energy sources, natural gas is considered more environmentally friendly than coal or oil, further supports this market shift. Additionally, natural gas boilers offer several advantages, including lower emissions and better fuel efficiency, making them an attractive choice for industries aiming to comply with stricter environmental regulations.

The condensing boilers segment will grow at a 4% CAGR by 2034. These boilers are becoming increasingly popular due to their superior energy efficiency. Condensing technology enables the capture and reuse of heat from exhaust gases, which not only reduces energy consumption but lowers greenhouse gas emissions. With growing environmental concerns and the push for greener technologies, industries are adopting condensing boilers to comply with more stringent emission control standards and to reduce operational costs.

United States Chemical High Temperature Industrial Boiler Market was valued at USD 384.2 million by 2024 attributed to the ongoing efforts toward modernizing existing infrastructure and replacing outdated boiler systems. The U.S. market has been supported by new and revised regulations concerning energy efficiency and emission controls, which have prompted chemical plants and other industrial operators to invest in advanced boiler technologies. The government's increasing focus on sustainability and the need for businesses to meet environmental standards are key drivers of this growth.

Companies operating in this market include Babcock & Wilcox Enterprises, Bharat Heavy Electricals, Clayton Industries, Cleaver-Brooks, Cochran, Doosan Heavy Industries & Construction, FERROLI, Fonderie Sime, FONDITAL, Forbes Marshall, GE Vernova, Groupe Atlantic, Hoval, Hurst Boiler and Welding, IHI Corporation, John Cockerill, John Wood Group, Mitsubishi Heavy Industries, Miura America, Rentech Boilers, Robert Bosch, Siemens, Sofinter, The Fulton Companies, Thermax, Victory Energy Operations, Viessmann, and Walchandnagar Industries. Key strategies in the chemical high-temperature industrial boiler market include extensive R&D investment to integrate innovative technologies, such as IoT and AI, which improve operational performance and reduce maintenance costs. Additionally, companies are focusing on retrofitting older units with energy-efficient solutions, ensuring compliance with stricter environmental and emissions standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 180°F - 200°F

- 5.3 > 200°F - 220°F

- 5.4 > 220°F - 240°F

- 5.5 > 240°F

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Fire-tube

- 6.3 Water-tube

Chapter 7 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 < 10 MMBTU/hr

- 7.3 10 - 25 MMBTU/hr

- 7.4 25 - 50 MMBTU/hr

- 7.5 50 - 75 MMBTU/hr

- 7.6 75 - 100 MMBTU/hr

- 7.7 100 - 175 MMBTU/hr

- 7.8 175 - 250 MMBTU/hr

- 7.9 > 250 MMBTU/hr

Chapter 8 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 Oil

- 8.4 Coal

- 8.5 Others

Chapter 9 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Condensing

- 9.3 Non-condensing

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 France

- 10.3.2 UK

- 10.3.3 Poland

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.3.7 Germany

- 10.3.8 Sweden

- 10.3.9 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Philippines

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.4.6 Australia

- 10.4.7 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 Iran

- 10.5.3 UAE

- 10.5.4 Nigeria

- 10.5.5 South Africa

- 10.6 Latin America

- 10.6.1 Argentina

- 10.6.2 Chile

- 10.6.3 Brazil

Chapter 11 Company Profiles

- 11.1 Babcock and Wilcox Enterprises

- 11.2 Bharat Heavy Electricals

- 11.3 Clayton Industries

- 11.4 Cleaver-Brooks

- 11.5 Cochran

- 11.6 Doosan Heavy Industries & Construction

- 11.7 FERROLI

- 11.8 Fonderie Sime

- 11.9 FONDITAL

- 11.10 Forbes Marshall

- 11.11 GE Vernova

- 11.12 Groupe Atlantic

- 11.13 Hoval

- 11.14 Hurst Boiler and Welding

- 11.15 IHI Corporation

- 11.16 John Cockerill

- 11.17 John Wood Group

- 11.18 Mitsubishi Heavy Industries

- 11.19 Miura America

- 11.20 Rentech Boilers

- 11.21 Robert Bosch

- 11.22 Siemens

- 11.23 Sofinter

- 11.24 The Fulton Companies

- 11.25 Thermax

- 11.26 Victory Energy Operations

- 11.27 Viessmann

- 11.28 Walchandnagar Industries