PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755226

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755226

Hyper Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

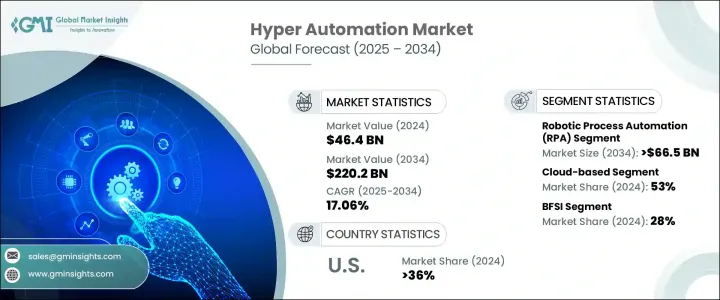

The Global Hyper Automation Market was valued at USD 46.4 billion in 2024 and is estimated to grow at a CAGR of 17.06% to reach USD 220.2 billion by 2034 as businesses strive to enhance efficiency and minimize resource consumption, hyper automation is emerging as a crucial solution. By leveraging AI, machine learning, and robotic process automation (RPA), it automates repetitive, labor-intensive tasks, helping organizations eliminate bottlenecks, reduce errors, and improve workflow precision. This allows companies to respond quickly to market changes and operate more efficiently, increasing productivity and driving smarter operations.

As industries undergo digital transformation, hyper automation plays a vital role by enabling the automation of processes and fostering real-time decision-making, facilitating a shift from traditional manual methods to more flexible, digital workflows. Whether in customer service or supply chain management, hyper automation accelerates operations. Its scalable nature enables businesses to grow without major system overhauls, making it an essential tool for companies aiming to keep pace with technological advancements and evolving customer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.4 Billion |

| Forecast Value | $220.2 Billion |

| CAGR | 17.06% |

In 2024, the robotic process automation (RPA) segment generated over USD 15.6 billion in revenue and is expected to surpass USD 66.5 billion by 2034. RPA enhances hyper automation by automating mundane tasks, such as data entry and invoice processing, allowing organizations to run more efficiently without the risk of human error. RPA tools integrate seamlessly into existing workflows, offering organizations the benefits of automation without requiring a complete overhaul of their technological infrastructure. This makes RPA an attractive solution for industries burdened with repetitive tasks, such as banking and logistics, where operational efficiency is critical.

The cloud-based segment held a 53% share in 2024. Cloud-based hyper automation solutions offer flexibility and ease of access, making them ideal for businesses looking for fast deployment and remote capabilities. These systems eliminate the need for heavy infrastructure investments and enable organizations to scale their automation strategies while reducing hardware costs. Additionally, automatic updates allow teams to collaborate in real time, improving operational agility and responsiveness.

North America Hyper Automation Market held 36% share in 2024 fueled by robust digital infrastructure and strong government support for emerging technologies. Companies across various industries are integrating AI, machine learning, and robotic process automation to enhance operational flexibility and reduce costs. This shift enables businesses to respond rapidly to market dynamics and evolving customer demands. Collaborations between educational institutions, technology firms, and industry leaders foster continuous innovation, while the availability of a highly skilled workforce accelerates implementation.

Key players in the Global Hyper Automation Industry include Google, Oracle, ServiceNow, UiPath, Honeywell International, Microsoft Corporation, SAP SE, Automation Anywhere, TCS, and WorkFusion. To maintain and grow their market presence, companies in the hyper automation industry are focused on several strategic initiatives. One of the primary strategies is the expansion of their product portfolios, incorporating advanced AI, machine learning, and RPA capabilities to meet diverse customer needs. Companies are also forming strategic partnerships with industry leaders across sectors like manufacturing, healthcare, and logistics to create tailored solutions that address specific challenges in automation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.3.1 RPA Providers

- 3.3.2 AI/ML Solution Vendors

- 3.3.3 BPM & Workflow Platforms

- 3.3.4 Cloud & Integration Enablers

- 3.3.5 ERP & Enterprise Automation Vendors

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Demand for enhanced operational efficiency

- 3.9.1.2 Rapid digital transformation across industries

- 3.9.1.3 Increasing need for cost reduction and scalability

- 3.9.1.4 Rising complexity of business processes

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Implementing hyper automation at scale

- 3.9.2.2 Undermining the effectiveness of hyper automation initiatives

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021 - 2034 (USD, Mn)

- 5.1 Robotic process automation (RPA)

- 5.2 Artificial intelligence (AI) and machine learning (ML)

- 5.3 Business process management (BPM)

- 5.4 Intelligent document processing (IDP)

- 5.5 Low-code/No-code platforms

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD, Mn)

- 6.1 Cloud-based

- 6.2 On-premises

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 (USD, Mn)

- 7.1 Software

- 7.1.1 Automation software

- 7.1.2 Intelligent document processing (IDP) solutions

- 7.1.3 Cloud automation platforms

- 7.1.4 Advanced analytics & reporting tools

- 7.2 Services

- 7.2.1 Professional services

- 7.2.1.1 Deployment & integration

- 7.2.1.2 Consulting

- 7.2.1.3 Support & maintenance

- 7.2.2 Managed services

- 7.2.1 Professional services

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Mn)

- 8.1 BFSI (Banking, Financial Services, and Insurance)

- 8.2 Healthcare

- 8.3 Manufacturing

- 8.4 Retail

- 8.5 IT and Telecom

- 8.6 Government and public sector

- 8.7 Transportation and logistics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD, Mn)

- 9.1 Large enterprises

- 9.2 SME (Small and Medium Enterprises)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Allerin Tech

- 11.2 Appian

- 11.3 Automation Anywhere

- 11.4 Catalytic

- 11.5 Celonis

- 11.6 Fortra

- 11.7 Google

- 11.8 Honeywell International

- 11.9 Microsoft Corporation

- 11.10 Mitsubishi Electric Corporation

- 11.11 OneGlobe

- 11.12 Oracle Corporation

- 11.13 Redwood Software

- 11.14 SAP SE

- 11.15 ServiceNow

- 11.16 SolveXia

- 11.17 Tata Consultancy Services (TCS)

- 11.18 UiPath

- 11.19 Wipro Ltd

- 11.20 WorkFusion