PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755227

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755227

Smart Wheelchair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

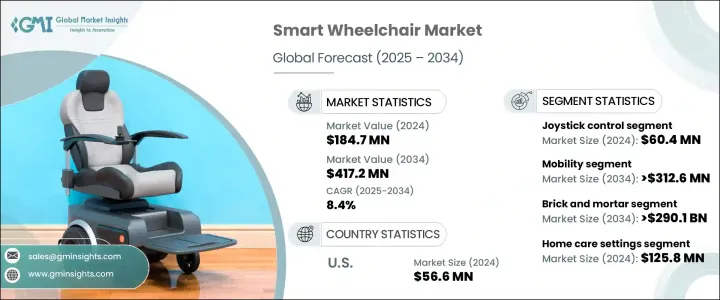

The Global Smart Wheelchair Market was valued at USD 184.7 million in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 417.2 million by 2034. The growth is attributed to a surge in the aging population, rising disability rates, expanding home healthcare models, and increasing support from governments and nonprofit organizations for disability inclusion. Conditions like arthritis, neuromuscular disorders, and osteoporosis often make movement difficult for elderly individuals. As a result, the demand for advanced mobility solutions such as smart wheelchairs is increasing. These devices offer features like remote control, obstacle detection, and automated navigation, significantly improving independence and mobility for aging users.

At the same time, the number of individuals living with disabilities-both acquired and congenital-continues to rise globally. Healthcare systems today are more focused on rehabilitation, which has driven the adoption of smart wheelchairs as a vital mobility solution. These chairs help in enhancing freedom, integration into daily life, and overall quality of living for people with mobility impairments. Smart wheelchairs integrate intelligent technology to help users navigate their surroundings more safely and effectively. These systems eliminate physical barriers and enhance autonomy, enabling a better standard of living for individuals relying on mobility aids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.7 Million |

| Forecast Value | $417.2 Million |

| CAGR | 8.4% |

In 2024, the joystick-controlled smart wheelchairs segment generated USD 60.4 million. Their widespread popularity is fueled by their affordability and intuitive control, making them ideal for users with upper-body strength and coordination. Joystick models are commonly adopted in clinical and homecare environments due to their straightforward design and short learning curve. These devices are available in various ergonomic shapes and can be easily customized for responsiveness, making them suitable for different age groups, including seniors and children.

The brick-and-mortar distribution segment is set to grow at a CAGR of 8.2%, with revenue expected to reach USD 290.1 million by 2034. Physical stores, including rehabilitation centers and medical supply outlets, offer personalized consultations, assessments, and hands-on product trials. Buyers benefit from expert guidance and can evaluate comfort, adjustability, and performance before purchasing. These stores also offer after-sales service and work closely with healthcare providers and insurers, making them a reliable source for certified medical-grade equipment.

United States Smart Wheelchair Market reached USD 56.6 million in 2024 and is anticipated to grow at a CAGR of 7.3% through 2034. The US continues to lead the market, supported by a well-developed healthcare infrastructure and robust innovation in medical mobility devices. The high prevalence of chronic conditions like spinal cord injuries and arthritis, combined with a growing elderly population, contributes to the increasing demand for smart wheelchairs across the country.

Key companies active in the Global Smart Wheelchair Market include: LUCI, SCEWO, Airwheel, YAMAHA, QUANTUM, ottobock, WHILL, KARMA, permobil, and INVACARE. To solidify their position in the competitive landscape, leading manufacturers are leveraging strategic initiatives such as product innovation, user-centric design, and enhanced software integration. Many are investing in technologies like AI-based navigation and obstacle detection to differentiate their offerings. Expanding their retail presence and forming partnerships with hospitals and rehabilitation centers are helping companies build brand credibility and improve consumer trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population and increasing disability rates

- 3.2.1.2 Growing adoption of assistive and autonomous technologies

- 3.2.1.3 Government and NGO initiatives for disability inclusion

- 3.2.1.4 Increasing focus on home-based healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited reimbursement

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends and opportunities

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Patent analysis

- 3.11 Reimbursement scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Control System, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Joystick control

- 5.3 Bluetooth connected

- 5.4 Touchscreen interface

- 5.5 Voice control

- 5.6 Other control systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mobility

- 6.3 Neurological conditions

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home care settings

- 8.3 Healthcare facilities

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airwheel

- 10.2 INVACARE

- 10.3 KARMA

- 10.4 LUCI

- 10.5 ottobock

- 10.6 permobil

- 10.7 QUANTUM

- 10.8 SCEWO

- 10.9 WHILL

- 10.10 YAMAHA