PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755236

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755236

Aluminium Fishing Boat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

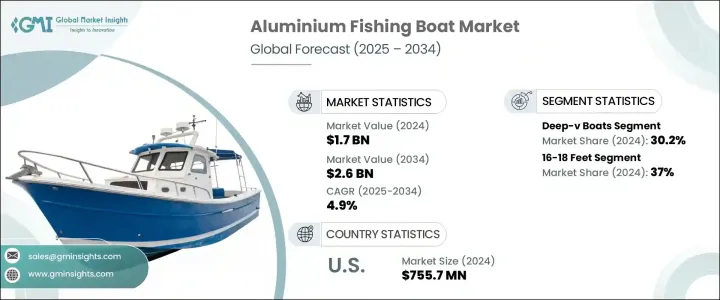

The Global Aluminium Fishing Boat Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 2.6 billion by 2034. The market growth is largely driven by the increasing popularity of recreational fishing, as well as the expansion of inland and freshwater fishing areas. More people are engaging in outdoor activities, particularly as nature-based tourism gains momentum. Aluminium boats are becoming the preferred option due to their lightweight design, fuel efficiency, and long-lasting durability.

With government initiatives promoting angling tourism and enhancing freshwater fishing infrastructure, these boats are now transitioning from niche tools to mainstream recreational assets, leading to increased demand in both developed and emerging markets. The surge in recreational boating, particularly among younger individuals and families, is also reshaping the market. Consumers are increasingly seeking boats that offer flexibility and ease of use in various freshwater environments such as lakes, rivers, and reservoirs. Manufacturers are responding to this demand by introducing customizable features and improved ergonomic designs to meet diverse consumer needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 4.9% |

In 2024, the deep-V boat segment led the market with a 30.2% share and is expected to continue growing at a CAGR of 5.5% during 2025-2034. Deep-V aluminium boats are favored for their stability, versatility, and high performance, particularly among recreational anglers. These boats perform well in choppy waters, offering enhanced control and speed, making them ideal for inland lakes, large rivers, and even nearshore coastal regions. They are also popular among sports anglers, fishing guides, and enthusiasts who seek long trips or need multi-purpose boats for varied fishing conditions.

In 2024, the 16-18 feet boat segment accounted for 37% share and is projected to grow at a CAGR of 6% from 2025 to 2034. These boats offer a practical balance of space and maneuverability, making them the top choice for recreational anglers and small fishing operations. Their size makes them easy to tow, store, and navigate in both freshwater and inland waters. They are also popular due to their affordability and versatility, supporting a range of fishing activities and offering numerous configurations such as rod holders and live wells.

United States Aluminium Fishing Boat Market held a 75.3% share and generated USD 755.7 million in 2024 driven by its well-established culture of recreational fishing, extensive freshwater networks, and a robust marine manufacturing infrastructure. States with a strong angling culture, like Minnesota, Wisconsin, and Michigan, are key markets for aluminium boats. Local manufacturers are setting high standards in terms of hull design, motor integration, and customer-centric innovations, solidifying their leadership in the sector. Government-backed programs supporting outdoor recreation and access to fishing licenses further bolster market growth.

Key players in the Global Aluminium Fishing Boat Market include G3 Boats, Alumacraft Boat, Legend Boats, MirroCraft, SeaArk Boats, Brunswick, Princecraft Boats, Smoker Craft, White River Marine Group, and Xpress Boats. To strengthen their market position, companies in the aluminium fishing boat sector are focusing on product innovation and expanding their service offerings. Manufacturers are continuously improving boat designs to incorporate advanced materials and technologies, enhancing durability, performance, and fuel efficiency.

They are also prioritizing customer-centric features, such as ergonomic seating and customizable configurations, to cater to the growing demand for personalized recreational boating experiences. In addition, key players are forging partnerships with major retailers and expanding their distribution networks to reach new markets. Companies are also exploring sustainable manufacturing processes, using eco-friendly materials, and adopting practices that appeal to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Boat

- 2.2.3 Length

- 2.2.4 Propulsion

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising popularity of recreational fishing

- 3.2.1.2 Expansion of inland and freshwater fishing zones

- 3.2.1.3 Increasing boat ownership rates

- 3.2.1.4 Government support for marine tourism

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost for premium builds

- 3.2.2.2 Dependence on seasonal demand

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing Analysis

- 3.8.1 Region

- 3.8.2 Propulsion

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Boat, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Deep-V boats

- 5.3 Jon boats

- 5.4 Utility boats

- 5.5 Bass boats

- 5.6 Pontoon boats

Chapter 6 Market Estimates & Forecast, By Length, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Less than 14 feet

- 6.3 14–16 feet

- 6.4 16–18 feet

- 6.5 More than 18 feet

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric motors

- 7.5 Natural gas

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Recreational fishing

- 8.3 Commercial fishing

- 8.4 Rental services

- 8.5 Government/Rescue operations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alumacraft Boat

- 10.2 Brunswick

- 10.3 Crestliner Boats

- 10.4 Duckworth Boats

- 10.5 G3 Boats

- 10.6 Hewescraft Boats

- 10.7 Legend Boats

- 10.8 Lowe Boats

- 10.9 Lund Boats

- 10.10 MirroCraft

- 10.11 Polar Kraft Boats

- 10.12 Princecraft Boats

- 10.13 Quintrex

- 10.14 SeaArk Boats

- 10.15 Smoker Craft

- 10.16 Stabicraft Marine

- 10.17 Sylvan Marine

- 10.18 Weldcraft Marine

- 10.19 White River Marine Group

- 10.20 Xpress Boats