PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755247

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755247

Solid Rocket Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

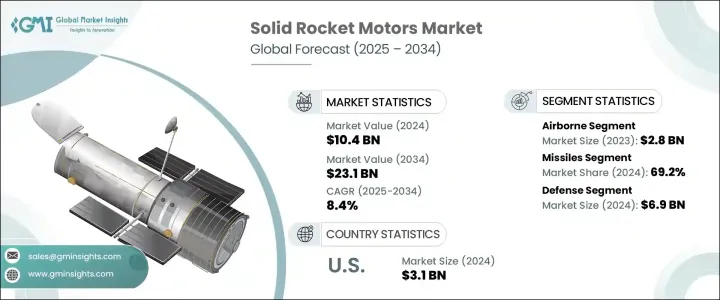

The Global Solid Rocket Motors Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 23.1 billion by 2034, driven by rising global defense budgets and the need for modern missile and launch vehicle systems. Solid rocket motors are gaining traction due to their simplicity, high-thrust output, fast ignition, and long shelf life, making them ideal for military and aerospace use. Economic and political developments have affected supply chains and increased component costs, further influencing market trends. Despite these challenges, countries continue to invest heavily in national security initiatives and missile technologies, reinforcing the demand for reliable and scalable propulsion systems.

Solid rocket motors are vital components across defense programs, offering high performance in a compact form factor suitable for surface-to-air, tactical ballistic, and interceptor missile systems. Modular and adaptable propulsion technologies are becoming essential as they support specific mission requirements while optimizing cost. The market benefits from ongoing innovations to enhance maneuverability, range, and launch precision. As nations intensify their focus on deterrence and space capabilities, solid motors remain an indispensable part of defense and aerospace infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 8.4% |

The satellite launch vehicle segment is projected to hold a 30.8% share in 2024, driven by the growing need for cost-efficient, high-reliability launch solutions. Solid propulsion systems are widely favored in small to medium-sized launch platforms due to their minimal maintenance and ease of deployment. As both public and private initiatives in satellite deployment grow, solid rocket motors are increasingly used to meet the needs of rapid and dependable orbital launches.

In 2024, the defense segment generated USD 6.9 billion, establishing itself as the dominant end-use category in the solid rocket motors market. The consistent demand for advanced tactical weapon systems and missile upgrades is a direct result of global military forces prioritizing rapid response capabilities and technological superiority. Solid rocket motors, known for their high thrust-to-weight ratio, minimal maintenance requirements, and dependable storage, align well with these objectives. Ongoing modernization of armed forces across several regions, coupled with strategic defense initiatives, has further amplified the adoption of solid propulsion systems.

United States Solid Rocket Motors Market generated USD 3.1 billion in 2024, reinforcing the country's role as a global leader in solid propulsion technologies. A robust budget allocation toward national defense and aerospace programs continues to drive this momentum. Investments in hypersonic systems, next-generation missile platforms, and reusable launch vehicles are helping fuel domestic production and innovation in solid motor technologies. The U.S. military's aggressive timeline for deploying advanced missile systems and NASA's renewed emphasis on deep space exploration are pushing demand for compact, high-efficiency propulsion solutions.

Leading firms such as Aerojet Rocketdyne, L3Harris Technologies, Inc., Northrop Grumman, and RAFAEL Advanced Defense Systems Ltd. are innovating solid motor systems that support government and commercial applications across various platforms. To solidify their market position, key companies are investing in modular motor technologies that provide enhanced flexibility and scalability across different launch and defense systems. Firms focus on improving manufacturing efficiencies, reducing production costs, and expanding R&D in next-gen composite materials. Collaborations with space and defense agencies help tailor solid propulsion solutions to evolving mission profiles, while strategic contracts and acquisitions enable deeper market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased defense expenditure globally

- 3.7.1.2 Surge in satellite launch programs

- 3.7.1.3 Favorable government contracts and R&D funding

- 3.7.1.4 Adoption in hypersonic and tactical missile systems

- 3.7.1.5 Technological advancements in propellants and materials

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stringent regulatory and safety compliance

- 3.7.2.2 High development costs and limited reusability

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Launch Platform, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Airborne

- 5.3 Ground-based

- 5.4 Naval

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Satellite launch vehicles

- 6.3 Missiles

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense

- 7.3 Space agencies

- 7.4 Commercial space

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anduril Industries

- 9.2 AVIO SPA

- 9.3 BrahMos Aerospace Private Limited

- 9.4 General Dynamics Corporation

- 9.5 Hanwha Group

- 9.6 ISRO

- 9.7 L3Harris Technologies, Inc.

- 9.8 Lockheed Martin Corporation

- 9.9 Mitsubishi Heavy Industries

- 9.10 Nammo AS

- 9.11 Northrop Grumman

- 9.12 RAFAEL Advanced Defense Systems Ltd.

- 9.13 ROKETSAN

- 9.14 Roxel Group

- 9.15 Tata Advanced Systems Limited

- 9.16 URSA MAJOR TECHNOLOGIES INC