PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755249

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755249

3D Printed Prosthetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

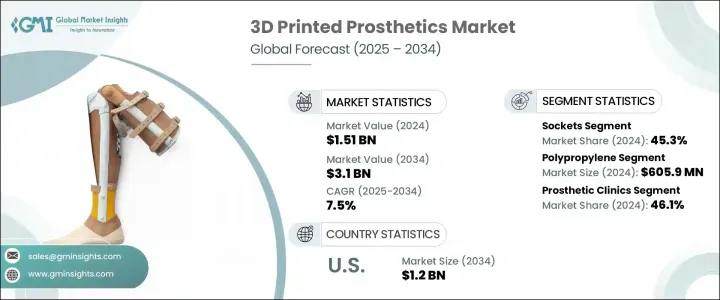

The Global 3D Printed Prosthetics Market was valued at USD 1.51 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 3.1 billion by 2034, driven by the increasing demand for highly personalized prosthetic solutions, as patients seek devices tailored to their specific anatomy and day-to-day needs. Unlike conventional manufacturing methods-which are often slow and expensive and involve numerous fitting sessions-3D printing technology offers a faster and more cost-efficient approach. These custom solutions improve the overall user experience while cutting down production time. Personalization is especially valuable for pediatric patients, whose needs change frequently as they grow, requiring replacements more often. Advanced 3D printing in prosthetics is a major leap forward in meeting global healthcare demands for individualized medical devices.

Technological advancements in additive manufacturing, including Stereolithography (SLA), Selective Laser Sintering (SLS), and Fused Deposition Modeling (FDM), are enabling the creation of durable, lightweight, and functional prosthetic components. With the approval of multiple 3D printed prosthetic devices by regulatory bodies like the U.S. FDA, the technology continues gaining credibility and momentum. The availability of biocompatible materials such as medical-grade polymers and alloys has further enhanced the durability, comfort, and adaptability of prosthetic devices. These innovations not only reduce production cycles but also elevate the quality and precision of prosthetics, making them more accessible for medical professionals and patients alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.51 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.5% |

Polypropylene led the material segment generating USD 605.9 million in 2024, owing to its favorable strength-to-weight ratio, fatigue resistance, and chemical stability. Widely adopted in medical manufacturing, polypropylene is valued for its biocompatibility and ability to withstand sterilization. It is extensively used to fabricate prosthetic sockets, surgical guides, and orthotic supports. As demand rises for lightweight and personalized medical solutions via 3D printing, the utilization of polypropylene continues to expand. Its blend of softness and functionality makes it a preferred choice in patient-centric designs.

The prosthetic clinics segment held a 46.1% share in 2024. These specialized centers are increasingly integrating 3D printing to manage growing patient volumes, especially in regions with high rates of amputation caused by chronic conditions like diabetes and vascular disease. Clinics benefit from 3D printing's efficiency, as it allows for quick modifications and frequent replacements-particularly vital for pediatric patients. These facilities often serve as all-in-one providers, offering rehabilitation, training, and follow-up services, encouraging greater adoption of 3D printed prosthetics. Their centralized approach simplifies the user experience and builds trust among patients seeking long-term solutions.

U.S. 3D Printed Prosthetics Market is expected to reach USD 1.2 billion by 2034 driven by rising incidences of obesity, diabetes, and peripheral artery disease, underscoring the urgent need for advanced prosthetic solutions. The integration of digital health innovations such as telehealth, cloud-based workflows, and remote patient scanning is creating fertile ground for the expansion of 3D printed prosthetics. These developments allow clinicians to deliver more accurate and timely care, contributing to broader adoption across the healthcare landscape.

Key players shaping the 3D Printed Prosthetics Industry include YouBionic, WillowWood, Mercuris, Limbitless Solutions, Stratasys, Bionic Prosthetics and Orthotics, Create Prosthetics, UNYQ, Protosthetics, Prothea, Open Bionics, Eqwal Group (Steeper Group), Materialise, Exone, and Motorica. To strengthen their market foothold, companies in the 3D printed prosthetics space are implementing multiple strategic approaches. A primary focus is expanding product customization by leveraging advanced software and scanning technologies. Firms are also investing in R&D to improve material quality and comfort. Strategic collaborations with hospitals, rehabilitation centers, and research institutions are helping to increase access and accelerate innovation. In addition, companies are enhancing digital workflows, such as remote limb scanning and cloud-based design, to streamline production and expand geographically through online platforms and localized printing hubs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for personalized and affordable prosthetic solutions

- 3.2.1.2 Technological advancements in 3D printing and materials

- 3.2.1.3 Rising incidence of limb loss due to diabetes, trauma, and vascular diseases

- 3.2.1.4 Growing support from non-profits and humanitarian initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized regulations and quality control

- 3.2.2.2 Limited availability of skilled professionals and technical knowledge

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Limbs

- 5.3 Sockets

- 5.4 Joints

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polypropylene

- 6.3 Polyethylene

- 6.4 Acrylics

- 6.5 Polyurethane

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Rehabilitation centers

- 7.4 Prosthetic clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bionic Prosthetics and Orthotics

- 9.2 Create Prosthetics

- 9.3 Eqwal Group (Steeper Group)

- 9.4 Exone

- 9.5 Limbitless Solutions

- 9.6 Materialise

- 9.7 Mercuris

- 9.8 Motorica

- 9.9 Open Bionics

- 9.10 Prothea

- 9.11 Protosthetics

- 9.12 Stratasys

- 9.13 UNYQ

- 9.14 WillowWood

- 9.15 YouBionic