PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755254

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755254

Chemical Anchors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

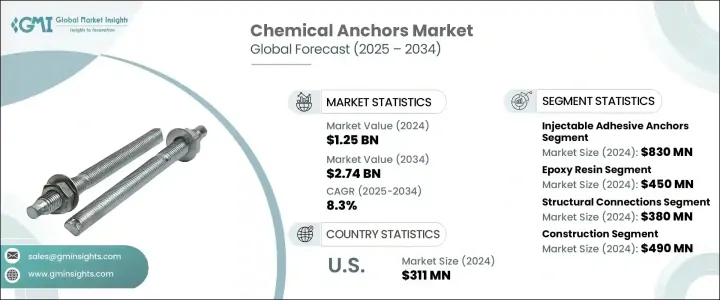

The Global Chemical Anchors Market was valued at USD 1.25 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 2.74 billion by 2034. This growth is largely driven by the increasing volume of construction activity worldwide. As urban populations expand and cities develop rapidly, the demand for advanced construction techniques and modern infrastructure continues to rise. In response, chemical anchors are becoming essential components for securing various structural elements in buildings of varying complexity and size. These anchoring solutions provide strong, long-lasting bonds in structural applications and are gaining traction across residential, commercial, and industrial sectors.

As urbanization intensifies, there is a growing need for anchoring systems that ensure both performance and safety in demanding environments. With more complex structures being built and an increased focus on sustainability, engineers and contractors are turning to chemical anchors for reliable fastening. They are particularly effective in delivering high-strength adhesion to concrete and reinforcement bars, which is why they are being increasingly adopted in infrastructure development and renovation projects globally. Their ability to handle dynamic and static loads makes them especially suitable for modern-day construction requirements. Companies are now concentrating on manufacturing high-performance anchoring solutions that meet stringent safety standards, driving adoption across diverse applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.25 billion |

| Forecast Value | $2.74 billion |

| CAGR | 8.3% |

In terms of product types, the market is segmented into injectable adhesive anchors, capsule adhesive anchors, and chemical anchor fixings. The injectable adhesive anchors segment led the market in 2024 with a valuation of USD 830 million and is expected to grow at a CAGR of 8.9% through 2034. Its dominance is attributed to its ease of use, versatility across multiple construction applications, and superior performance in demanding scenarios. These anchors are favored for their ability to provide strong, consistent bonding, even in areas that require precise load-bearing performance and fast installation times. Technological advancements in resin formulations have also contributed to their rising popularity by enabling faster curing and improved reliability.

Based on resin types, the market is categorized into vinyl ester resin, epoxy acrylate, epoxy resin, polyester resin, and hybrid systems. The epoxy resin segment was valued at USD 450 million in 2024 and is anticipated to expand at a CAGR of 9% during the forecast period. Epoxy-based chemical anchors are widely preferred in heavy construction environments due to their high mechanical strength, excellent resistance to chemicals, and dependable bonding in high-load settings. These resins also offer rapid curing capabilities and perform well under extreme environmental conditions, making them the go-to option in projects where structural integrity is critical.

When analyzed by application, the market includes structural connections, rebar connections, heavy equipment mounting, facade installations, handrails and safety barriers, seismic retrofitting, and others. The structural connections segment recorded a value of USD 380 million in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034. This segment holds a significant share as it fulfills a crucial role in ensuring stability and safety across a broad range of construction formats. With the evolution of high-rise buildings and modern infrastructure systems, the demand for strong anchoring solutions in structural joints is growing steadily. The use of chemical anchors in these applications allows for secure load transfer and minimal disruption to surrounding materials.

The construction segment emerged as the largest end-use industry in 2024, valued at USD 490 million, and is forecasted to grow at a CAGR of 7.8%, capturing a market share of 39.5%. The growing trend of rapid urban development, expansion in commercial real estate, and increased focus on safe and sustainable construction practices have all contributed to the segment's prominence. Builders and developers increasingly rely on chemical anchors for their adaptability, strength, and compatibility with modern construction requirements. As design complexity and structural heights continue to rise, the need for reliable anchoring solutions will remain high.

In terms of regional performance, the United States chemical anchors market was valued at USD 311 million in 2024 and is anticipated to grow at a CAGR of 8% through 2034. The rise in infrastructure upgrades, coupled with the increasing adoption of seismic retrofitting standards, is fueling demand. Additionally, market growth is supported by updates in construction regulations and rising investments in residential and commercial renovations. Technological enhancements and innovations from top manufacturers are also expanding the application scope of chemical anchors, offering new opportunities for market penetration.

Leading industry players maintain a competitive edge through continuous innovation, brand development, and broad international distribution channels. These companies focus on producing advanced formulations that offer superior load-bearing capabilities, faster curing times, and reliable performance under varying environmental conditions. With an emphasis on sustainability and compliance with global safety standards, major manufacturers are aligning their product lines with evolving regulatory requirements. Moreover, expansion efforts through partnerships, mergers, and strategic acquisitions are enabling them to strengthen their presence across emerging and mature markets. The industry is also shaped by specialized technical support, advanced training programs, and integrated solutions tailored to diverse construction needs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Resin type

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Injectable adhesive anchors

- 5.3 Capsule adhesive anchors

- 5.4 Chemical anchor fixings

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Epoxy resin

- 6.3 Epoxy acrylate

- 6.4 Polyester resin

- 6.5 Vinyl ester resin

- 6.6 Hybrid systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Structural connections

- 7.3 Rebar connections

- 7.4 Heavy equipment mounting

- 7.5 Facade installations

- 7.6 Handrails and safety barriers

- 7.7 Seismic retrofitting

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction

- 8.2.1 Residential

- 8.2.2 Commercial

- 8.2.3 Industrial

- 8.3 Infrastructure

- 8.3.1 Highways and bridges

- 8.3.2 Dams and tunnels

- 8.3.3 Railways

- 8.3.4 Others

- 8.4 Manufacturing

- 8.5 Marine and offshore

- 8.6 Oil & gas

- 8.7 Mining

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Hilti Corporation

- 10.2 Sika AG

- 10.3 Simpson Strong-Tie Company, Inc.

- 10.4 Illinois Tool Works Inc. (ITW)

- 10.5 BASF SE

- 10.6 3M Company

- 10.7 Henkel AG & Co. KGaA

- 10.8 Fischer Group

- 10.9 Powers Fasteners (Stanley Black & Decker)

- 10.10 MKT Fastening LLC

- 10.11 DEWALT (Stanley Black & Decker)

- 10.12 Mapei S.p.A.

- 10.13 Rawlplug

- 10.14 EJOT Holding GmbH & Co. KG

- 10.15 CELO Fixings

- 10.16 Chemfix Products Ltd

- 10.17 FIXDEX Fastening Technology

- 10.18 Evonik Industries AG

- 10.19 Good Use Hardware Co., Ltd.

- 10.20 Ripple Construction Products Pvt Ltd.