PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755255

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755255

Automotive Sun Visor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

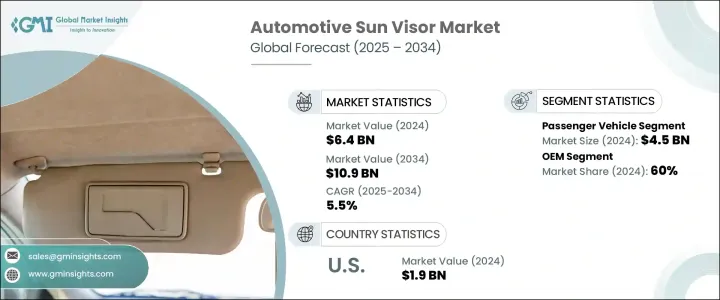

The Global Automotive Sun Visor Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.9 billion by 2034. The growth is driven by the increasing vehicle production worldwide, along with rising consumer expectations for better in-cabin comfort and road safety, is driving this expansion. As automakers scale output-especially in fast-developing economies-the demand for key interior components like sun visors continues to rise. Consumers seek advanced sun visor systems beyond basic shading and incorporate features like integrated lighting, touch controls, and glare-reducing technology. These upgrades cater to the growing desire for stylish yet functional interiors that prioritize comfort and visibility. Additionally, regulatory bodies and safety standards are prompting manufacturers to include enhanced visor features as part of standard offerings in both commercial and passenger vehicles.

The growing need for road safety also plays a critical role in boosting demand. Sun visors improve driver visibility and help prevent glare-related incidents, aligning with global initiatives to reduce traffic accidents. Electric vehicles contribute further to the market's growth, as their modern interiors often call for sophisticated, customizable visor systems. EV manufacturers prefer high-quality, tech-enhanced visors that blend seamlessly into their advanced cabin designs fueling innovation across the segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $10.9 Billion |

| CAGR | 5.5% |

Passenger vehicles accounted for a market value of USD 4.5 billion in 2024, leading the overall segment due to their large production volumes and everyday usage. These vehicles are central to personal mobility across regions, which fuels consistent demand for comfort-enhancing interior parts like sun visors. As automakers continue investing in aesthetic and safety improvements, sun visors are equipped with illuminated mirrors, extension flaps, and smart functionality to elevate the driving experience. From entry-level models to high-end sedans, the broad spectrum of vehicle offerings ensures a diverse range of visor solutions tailored to varying needs and preferences.

OEMs segment represented a 60% share in 2024, maintaining a dominant role in how sun visors are integrated into vehicles. These manufacturers source visors during the production stage to meet strict performance and safety criteria. Their ability to provide tailored, factory-fitted components gives them a competitive edge in delivering cost-effective and seamless visor solutions. Collaborations between automakers and Tier 1 suppliers have also intensified, allowing for innovative products with added features like lighted vanity mirrors and advanced materials that reflect brand identity and consumer expectations.

North America Automotive Sun Visor Market held USD 1.9 billion in 2024 and is set to grow at a CAGR of 5.8% through 2034. The American market continues to benefit from strong safety regulations and increasing demand for tech-integrated vehicle interiors. Manufacturers are shifting toward multi-functional sun visors that blend utility with aesthetics. A surge in luxury and electric vehicle sales drives the need for high-end sun visor designs that support the evolving concept of premium driving environments. Integrating modern materials, digital interfaces, and sleek styling transforms sun visors into essential components of the vehicle's cabin experience.

Leading players shaping the Automotive Sun Visor Market include Visteon, Tachi-S, Grupo Antolin, Continental, Setrag, IAC, Shiroki, Kasai Kogyo, Howa Textile, and Adient. These companies are investing in strategic product innovations to meet evolving consumer demands. Many focus on developing lightweight and modular designs that reduce overall vehicle weight while maintaining durability. Advanced material integration, such as anti-glare films and smart mirror solutions, is being used to improve performance. Firms are also strengthening collaborations with automakers to deliver OEM-specific designs that align with branding and ergonomics. Expanding manufacturing footprints, particularly in cost-effective regions, and diversifying product portfolios remain central strategies to enhance competitiveness and market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Illuminated

- 5.4 Dual-panel

- 5.5 LCD/digital

- 5.6 Custom/built-in

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Vinyl

- 6.4 Plastic

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicle

- 7.2.1 SUV

- 7.2.2 Hatchbacks

- 7.2.3 Sedan

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Sun glare protection

- 8.3 Driver and passenger comfort enhancement

- 8.4 Vanity mirror integration

- 8.5 Rear and side window applications

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AC Group

- 11.2 Adient

- 11.3 CIE Automotive

- 11.4 Continental

- 11.5 Faurecia

- 11.6 Ficosa

- 11.7 Grupo Antolin

- 11.8 Howa Textile

- 11.9 Kasai Kogyo

- 11.10 Lear Corporation

- 11.11 Magneti Marelli

- 11.12 Motherson Sumi

- 11.13 NHK Spring

- 11.14 Setrag

- 11.15 Shiroki

- 11.16 Tachi-S

- 11.17 Tokai Rika

- 11.18 Toyota Boshoku

- 11.19 Visteon

- 11.20 Yanfeng