PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755256

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755256

Retail Core Banking Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

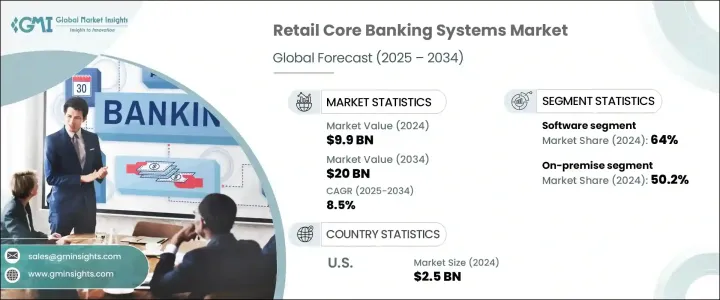

The Global Retail Core Banking Systems Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 20 billion by 2034. This growth is being driven by the increasing demand for digital banking platforms and the rising adoption of cloud-based solutions. With digital transformation accelerating, retail core banking systems are increasingly becoming essential to modern banking operations. Banks are shifting from traditional legacy systems to agile, cloud-enabled platforms that offer improved operational efficiency, real-time processing, and seamless omnichannel service. This transition is also propelled by the growing expectation for hyper-personalized banking experiences, especially from younger, tech-savvy customers.

In response, banks are adopting advanced core systems that support open banking APIs, cloud computing, and data analytics. These systems not only facilitate faster product rollouts but also ensure compliance with evolving regulations. As digital banking becomes the standard, core banking systems are evolving from simple backend utilities to key enablers of innovation and customer engagement. The rising need for flexible and responsive banking services is reshaping the financial landscape, leading to greater competition and more inclusive services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $20 Billion |

| CAGR | 8.5% |

In 2024, the software segment held a 64% share, with expectations to grow at a CAGR of 9% through 2034. Core banking software remains a critical component in the retail banking sector, serving as the backbone for account management, loan servicing, transaction processing, and customer onboarding. Whether used by large global banks or emerging digital-first institutions, core banking software plays a central role in delivering efficient and compliant banking operations. Vendors are continuously improving these platforms by incorporating scalable architectures, API integrations, and cloud-native features to cater to the needs of modern financial institutions.

The on-premise segment dominated the market in 2024, holding a 50.2% share, and is expected to grow at a CAGR of 8.3% by 2034. On-premise systems are particularly favored by established banks that operate large, complex infrastructures and require strict data control. These systems offer high levels of customization, enhanced security, and more direct oversight of infrastructure, making them especially appealing in regions with stringent regulatory requirements or lower adoption of cloud technologies. Financial institutions relying on on-premise systems often prioritize data sovereignty, internal governance protocols, and performance consistency.

United States Retail Core Banking Systems Market held an 81% share, with a value of USD 2.5 billion in 2024. The growth of this market in the U.S. is fueled by a highly advanced banking sector, rigorous regulatory standards, and aggressive digital transformation initiatives among major financial institutions. The presence of influential banks and a thriving fintech ecosystem has amplified the demand for cutting-edge core banking platforms that offer real-time, customer-centric services. U.S.-based vendors are driving innovation through cloud-first solutions, API-centric architectures, and AI-enhanced features, setting the pace for scalability, omnichannel integration, and compliance in the industry.

Key strategies employed by companies in the Global Retail Core Banking Systems Market to strengthen their market position include developing scalable, cloud-based platforms that integrate open banking APIs, enabling faster deployment of new products and services. Vendors are also incorporating AI and machine learning capabilities to enhance operational efficiency and customer personalization. Additionally, partnerships with fintech firms are being leveraged to expand product offerings and improve regulatory compliance. Companies are focusing on expanding their geographic footprint and enhancing customer experience to maintain competitiveness in the rapidly evolving market. Some of the notable players in the retail core banking industry are FIS Global, Jack Henry & Associates, Tata Consultancy Services, Temenos, SAP (SAP for Banking), Infosys Finacle, Oracle Financial Services, Fiserv, Avaloq, and Finastra.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Model

- 2.2.4 Bank

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for digital banking platforms

- 3.2.1.2 Increased adoption of cloud-based core banking solutions

- 3.2.1.3 Growing fintech partnerships and open banking trends

- 3.2.1.4 Expansion of neobanks and digital-only banks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and switching costs

- 3.2.2.2 Data security and privacy concerns in cloud-based systems

- 3.2.3 Market opportunities

- 3.2.3.1 Cross-industry collaborations with fintech and telecom sectors

- 3.2.3.2 Customization of solutions for ESG and green banking compliance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Core banking platform

- 5.2.2 API platforms

- 5.2.3 Digital banking modules

- 5.3 Services

- 5.3.1 Implementation & Integration

- 5.3.2 Support & Maintenance

- 5.3.3 Consulting

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Bank, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Large banks

- 7.3 Mid-sized banks

- 7.4 Small banks/ Community banks / Credit unions

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Transaction management

- 8.3 Customer Relationship Management (CRM)

- 8.4 Account management

- 8.5 Deposit & loan management

- 8.6 Risk & compliance management

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Retail banks

- 9.3 Cooperative banks

- 9.4 Neobanks / Digital-only banks

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Asseco Poland

- 11.2 Avaloq

- 11.3 CREALOGIX

- 11.4 Diasoft

- 11.5 EdgeVerve Systems

- 11.6 Finastra

- 11.7 FIS Global

- 11.8 Fiserv

- 11.9 Infosys Finacle

- 11.10 Infrasoft Technologies

- 11.11 Intellect Design Arena

- 11.12 Jack Henry & Associates

- 11.13 Mambu

- 11.14 Misys

- 11.15 Oracle Financial Services

- 11.16 SAP (SAP for Banking)

- 11.17 Silverlake Axis

- 11.18 Sopra Banking Software

- 11.19 Tata Consultancy Services

- 11.20 Temenos