PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755263

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755263

High Pressure Laminates and Plastic Resins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

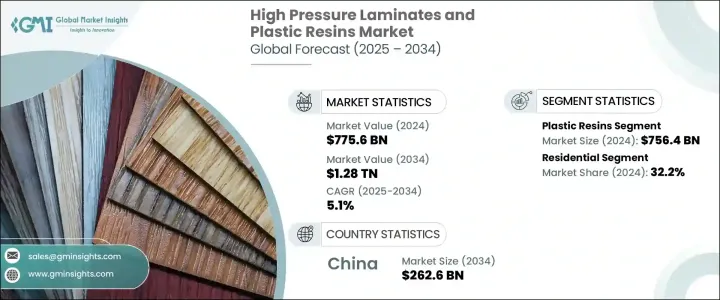

The Global High Pressure Laminates and Plastic Resins Market was valued at USD 775.6 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.28 trillion by 2034. Market momentum is being driven by widespread application across multiple sectors, especially in construction accessories, consumer packaging, industrial goods, and mobility solutions. The growing demand for lightweight, cost-efficient, and high-strength materials continues to fuel growth in both high-pressure laminates (HPL) and plastic resins, with resins leading the way in terms of market share. As plastic resins remain essential raw materials for a wide spectrum of goods due to their processability, durability, and versatility, they are expected to maintain their dominance in the global marketplace for the foreseeable future.

HPL, although smaller in market share, is gaining traction due to its increasing adoption in interior design and architectural applications. Known for their resilience and design flexibility, HPL materials are frequently preferred in residential and commercial installations. Trends in design are shifting towards surfaces that offer not only visual appeal but also require minimal upkeep, boosting interest in laminates. As demand grows for materials that combine function with aesthetics, HPL is becoming a stronger segment. Meanwhile, plastic resins remain in high-volume circulation due to their cost-efficient nature and adaptability in mass manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $775.6 Billion |

| Forecast Value | $1.28 Trillion |

| CAGR | 5.1% |

Increased urban development and modernization of infrastructure across emerging and developed economies alike are further accelerating market growth. Industries seek advanced materials that deliver not just structural value but also sustainability. Design preferences are steadily moving toward engineered products that offer low maintenance, weather resistance, and lightweight performance-all attributes that both laminates and plastic resins bring to the table. This consistent demand for materials that fulfill evolving design and utility requirements ensures continued relevance for both segments, although at different scales.

By product type, the market is segmented into high pressure laminates (HPL), continuous-pressure laminates (CPL), and plastic resins. Among these, plastic resins accounted for a significant market share, with a recorded revenue of USD 756.4 billion in 2024. This segment is expected to expand at a CAGR of 5.1% throughout the forecast period. The key advantage of plastic resins lies in their ability to serve as foundational components across multiple industries, offering economic production value, ease of fabrication, and broad material diversity. Their performance in structural and non-structural applications-ranging from packaging to electronics-reinforces their leadership position.

Material innovation is shaping the future of this market. Efforts to improve environmental performance through advanced resin chemistry and recyclable polymers are reshaping how manufacturers operate. There is a noticeable shift toward producing high-performance, eco-conscious materials that support long-term sustainability goals. The adoption of recyclable and bio-based plastics is gradually rising, aligning with environmental compliance and green initiatives across sectors.

When analyzed by end-use industry, the market is classified into residential, commercial, healthcare, transportation, industrial, and others. The commercial segment currently commands the highest market share, largely due to the consistent use of both plastic resins and HPLs in public infrastructure, corporate offices, retail chains, and other high-traffic commercial environments. In 2024, the residential sector accounted for approximately 32.2% of the overall market. Increasing design consciousness and the need for durable, easy-to-clean surfaces in modern homes continue to stimulate HPL usage in residential applications. Plastic resins, on the other hand, dominate a wide array of uses across interiors, decor, and safety applications in both residential and commercial properties.

China plays a pivotal role in shaping the global trajectory of this market. In 2024, the Chinese market generated revenue of USD 156.4 billion and is on track to reach USD 262.6 billion by 2034, growing at a CAGR of 5.3%. China's extensive manufacturing base, combined with rising domestic consumption in end-user industries, places it at the forefront of global production and demand. The surge in urban development, infrastructure expansion, and consumer upgrades contributes to increased usage of both laminates and resins within the country.

The competitive landscape of the high-pressure laminates and plastic resins market is moderately consolidated, with the top five companies controlling over 30% of the global share. The plastic resins space is highly influenced by producers focused on volume scalability, global logistics capabilities, and multipurpose product lines. These players maintain their competitive edge through innovations in sustainable materials, aggressive R&D programs, and responsive production models. On the laminates side, companies with a strong brand identity, wide product variety, and expansive distribution continue to outperform. Sustainability, innovation, and efficient pricing remain core strategies as companies work to build consumer trust and meet evolving regulatory demands across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.1.1 High pressure laminates (HPL)

- 5.1.2 Horizontal grade

- 5.1.3 Vertical grade

- 5.1.4 Postforming grade

- 5.1.5 Special purpose grade

- 5.1.6 Compact grade

- 5.2 Continuous pressure laminates (CPL)

- 5.3 Plastic resins

- 5.3.1 Phenolic resins

- 5.3.2 Melamine resins

- 5.3.3 Epoxy resins

- 5.3.4 Polyester resins

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Kraft paper

- 6.3 Decorative paper

- 6.4 Overlay papers

- 6.5 Thermosetting resins

- 6.5.1 Phenolic resins

- 6.5.2 Melamine resins

- 6.6 Thermoplastic resins

- 6.6.1 Polyethylene (PE)

- 6.6.2 Polypropylene (PP)

- 6.6.3 Polyvinyl chloride (PVC)

- 6.6.4 Polystyrene (PS)

- 6.6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Furniture & cabinetry

- 7.2.1 Residential furniture

- 7.2.2 Commercial furniture

- 7.2.3 Kitchen cabinets

- 7.2.4 Office furniture

- 7.3 Flooring

- 7.3.1 Residential flooring

- 7.3.2 Commercial flooring

- 7.4 Wall panels & partitions

- 7.5 Countertops & worktops

- 7.5.1 Kitchen countertops

- 7.5.2 Laboratory countertops

- 7.5.3 Commercial worktops

- 7.6 Doors

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Offices

- 8.3.2 Retail

- 8.3.3 Hospitality

- 8.3.4 Education

- 8.4 Healthcare

- 8.4.1 Hospitals

- 8.4.2 Laboratories

- 8.4.3 Clinics

- 8.5 Transportation

- 8.5.1 Automotive

- 8.5.2 Marine

- 8.5.3 Aviation

- 8.6 Industrial

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abet Laminati S.p.A.

- 10.2 Arkema Group

- 10.3 Arpa Industriale S.p.A.

- 10.4 BASF SE

- 10.5 Century Plyboards (India) Ltd.

- 10.6 Changzhou Zhenghang Decorative Materials Co., Ltd.

- 10.7 Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd.

- 10.8 Covestro AG

- 10.9 Dow Chemical Company

- 10.10 DuPont de Nemours, Inc.

- 10.11 Fletcher Building Limited

- 10.12 Formica Group (Fletcher Building)

- 10.13 Greenlam Industries Ltd.

- 10.14 Jiangsu TRSK New Material Co., Ltd.

- 10.15 Kingboard Laminates Holdings Ltd.

- 10.16 LyondellBasell Industries N.V.

- 10.17 Merino Industries Ltd.

- 10.18 SABIC

- 10.19 Solera International

- 10.20 Wilsonart International Inc.