PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755268

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755268

Polybag Mailers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

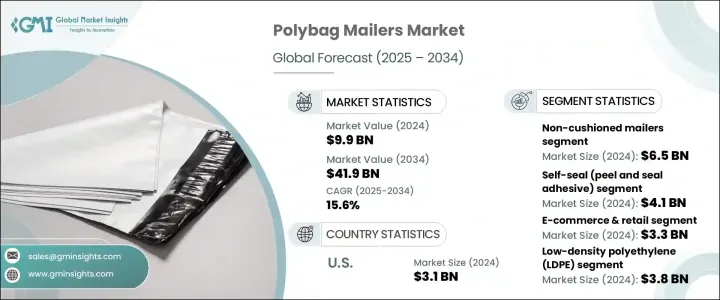

The Global Polybag Mailers Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 41.9 billion by 2034, driven by the continued surge in e-commerce, paired with increasing use across the retail and fashion industries. The market saw disruptions following US tariffs on certain imported plastic goods, including polybag mailers. These trade measures inflated import costs, disrupted supply chains, and increased operating expenses for retailers and logistics providers. While local manufacturers faced less overseas competition, they encountered challenges in scaling output and handling rising material prices. This scenario prompted businesses to diversify sourcing and ramp up domestic manufacturing capacity, leading to a reshaped and more resilient supply landscape.

Increased reliance on automated packaging systems drives polybag mailer adoption, as these products seamlessly integrate into high-speed packing lines. Enhanced product features like double-seal adhesive strips are becoming standard, particularly in e-commerce categories such as electronics, personal care, and clothing. These functional upgrades support easy returns, reduce shipping time, and meet growing consumer expectations for sustainable, convenient packaging. As parcel volumes continue to climb, brands prioritize compact, automation-ready mailers that support efficient logistics and enhance customer satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $41.9 Billion |

| CAGR | 15.6% |

Among materials, low-density polyethylene (LDPE) dominated the market, generating USD 3.8 billion in 2024. LDPE's affordability, strength, and adaptability make it the preferred choice, especially for small and mid-sized enterprises in e-commerce. Its thermoplastic nature allows for customization, printing, and production flexibility. Self-sealing closures and tamper-resistant options enhance product security during delivery, essential in today's heightened risk environments. LDPE's favorable cost-to-performance ratio ensures it remains the material of choice for scalable packaging solutions.

By product type, non-cushioned mailers held the largest market share, valued at USD 6.5 billion in 2024. Their use has grown alongside the rise of online fashion and consumer goods, which typically require minimal interior protection. These lightweight, cost-efficient mailers help reduce shipping expenses and support high-volume distribution models. Newer variations include resealable closures and dual adhesive strips to support streamlined return handling, especially in sectors where reverse logistics play a critical role in customer service.

United States Polybag Mailers Market generated USD 3.1 billion in 2024, driven by the increasing demand for lightweight, flexible packaging solutions like polybag mailers. Focusing on operational efficiency and faster fulfillment cycles has placed polybag mailers at the center of packaging strategies for major e-retailers and logistics providers. In addition, the rising popularity of same-day and next-day deliveries is pushing companies to opt for compact, cost-effective packaging that reduces shipping weight and improves logistics agility.

Key players in the Global Polybag Mailers Market include PAC Worldwide Corporation, Sealed Air, BRAVO PACK INC., Jflexy Packaging, Crown Packaging Corp., EcoEnclose LLC, Polycell International, Shenzhen Hongxiang Packaging Co., Ltd, Novolex, Polypak Packaging, WH Packaging, Abriso Jiffy, ProAmpac, Pregis LLC, Intertape Polymer Group Inc., and International Plastics. Companies invest heavily in R&D to produce mailers that align with automation requirements and sustainability goals. Major players are integrating recycled and recyclable materials into their product lines while enhancing durability and tamper resistance. Many firms are expanding production capabilities domestically to reduce supply chain risks and improve responsiveness to demand spikes. Additionally, strategic partnerships with e-commerce platforms and third-party logistics providers are helping boost market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rapid expansion of e-commerce industry

- 3.3.1.2 Growth of SMEs and D2C brands

- 3.3.1.3 Environmental regulations driving material innovation

- 3.3.1.4 Growing demand for cost effective packaging

- 3.3.1.5 Increasing adoption in retail and apparel industry

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns and plastic bans

- 3.3.2.2 Recycling infrastructure gaps

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Low-density polyethylene (LDPE)

- 5.3 High-density polyethylene (HDPE)

- 5.4 Co-extruded polyethylene

- 5.5 Recycled polyethylene

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Cushioned mailers

- 6.3 Non-cushioned mailers

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Self-seal

- 7.3 Heat seal

- 7.4 Zip/slider seal

- 7.5 Button or tie closure

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 E-commerce & retail

- 8.3 Apparel & footwear

- 8.4 Electronics & accessories

- 8.5 Healthcare & pharmaceuticals

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abriso Jiffy

- 10.2 BRAVO PACK INC.

- 10.3 Crown Packaging Corp.

- 10.4 EcoEnclose LLC

- 10.5 International Plastics

- 10.6 Intertape Polymer Group Inc.

- 10.7 Jflexy Packaging

- 10.8 Novolex

- 10.9 PAC Worldwide Corporation

- 10.10 Polycell International

- 10.11 Polypak Packaging

- 10.12 Pregis LLC

- 10.13 ProAmpac

- 10.14 Sealed Air

- 10.15 Shenzhen Hongxiang Packaging Co., Ltd

- 10.16 WH Packaging