PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755280

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755280

Mortgage Lender Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

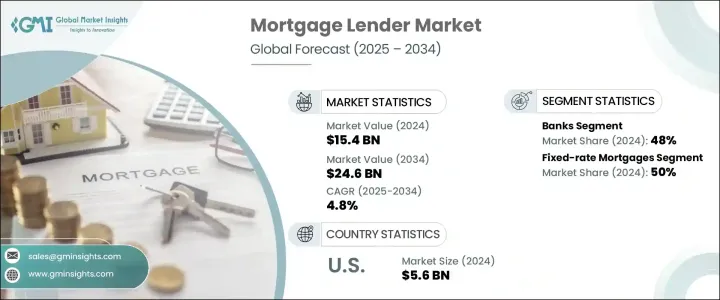

The Global Mortgage Lender Market was valued at USD 15.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 24.6 billion by 2034. The growth is fueled by increasing housing demand driven by urban migration, low-interest-rate environments, and greater access to financial services in emerging markets. The rising implementation of digital mortgage solutions and AI-based underwriting tools is streamlining the lending process and improving user satisfaction. Advanced technologies are also reducing operational costs and enhancing transparency. Automation and digitalization are reshaping the lending landscape, enabling lenders to process applications more quickly and provide real-time loan status updates, improving borrower trust and boosting scalability across all lending platforms.

The growing focus on environmentally sustainable financing is helping to expand the mortgage lender market. Green mortgages, which provide better terms for energy-efficient homes, are gaining popularity as eco-conscious borrowers seek financial products aligned with sustainability goals. These lending products are further supported by government-backed incentives such as lower rates and tax relief. As climate and ESG considerations move to the forefront, demand for sustainable mortgage instruments continues to rise, prompting lenders to develop tailored underwriting standards that align with environmental priorities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Billion |

| Forecast Value | $24.6 Billion |

| CAGR | 4.8% |

In 2024, the traditional banks segment accounted for 48% share and is projected to grow at a CAGR of 3% through 2034 attributed to strong brand credibility, large-scale infrastructure, and access to low-cost deposits. With expansive branch networks and digital tools, banks offer borrowers full-spectrum mortgage services that include cross-selling of financial products like savings accounts, insurance, and investments. This allows banks to build enduring customer relationships and foster long-term loyalty. Access to cheap capital and favorable regulations enables them to maintain competitive interest rates, giving them an edge, especially among creditworthy clients.

Fixed-rate mortgages captured a 50% share in 2024 due to their predictable repayment structures, offering borrowers financial stability over time. With a fixed monthly payment that doesn't change, homeowners avoid the risk of rate fluctuations. Such predictability appeals to budget-conscious consumers and first-time buyers. During low interest rates, borrowers take advantage of locking in favorable terms for 15 to 30 years, minimizing the long-term cost of borrowing. This stability is increasingly appealing amid global economic uncertainties.

North America Mortgage Lender Market held an 84% share and generated USD 5.6 billion in 2024. Despite headwinds from higher interest rates, the U.S. mortgage market remains resilient. Lenders are shifting focus toward higher-credit borrowers and tailoring loan offerings to align with evolving preferences. As demand for refinancing dips, institutions are tightening credit conditions to reduce risk exposure. At the same time, the focus on digital transformation has grown stronger, with lenders investing in automation tools, AI-based credit evaluations, and personalized lending platforms to deliver better borrower experience and improve operational efficiency.

Key companies in the Mortgage Lender Industry include Rocket Mortgage, JPMorgan Chase, CrossCountry Mortgage, U.S. Bank, Rate, Bank of America, DHI Mortgage, Fairway Independent Mortgage, Veterans United Home Loans, and United Wholesale Mortgage (UWM). These players are pursuing strategic investments in digital platforms, expanding their mobile lending capabilities, and enhancing AI-driven underwriting systems. They are also forming partnerships with fintech companies to introduce more flexible and personalized loan products. Market leaders are focusing on providing hybrid lending models that combine human interaction with digital convenience, while also exploring ESG-aligned loan offerings to attract eco-conscious borrowers and meet regulatory expectations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Lender

- 2.2.3 Loan

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in digital transformation and automation

- 3.2.1.2 Rise in homeownership demand

- 3.2.1.3 Growing adoption of green mortgages

- 3.2.1.4 Increase in government incentives and support

- 3.2.1.5 Growth in adjustable-rate mortgage popularity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Higher interest rate on mortgage loans

- 3.2.2.2 Regulatory pressures and compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into underserved markets

- 3.2.3.2 Rising demand for mortgage refinancing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable Practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

- 3.12 Mortgage statistics, 2021-2025

- 3.12.1 Historical mortgage interest rates

- 3.12.2 Mortgage debt outstanding

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Lender, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Banks

- 5.3 Credit unions

- 5.4 Mortgage brokers

- 5.5 Non-bank mortgage lenders

- 5.6 Government agencies

Chapter 6 Market Estimates & Forecast, By Loan, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Fixed-rate mortgages

- 6.3 Adjustable-rate mortgages (ARMs)

- 6.4 Jumbo loans

- 6.5 FHA loans

- 6.6 VA loans

- 6.7 Interest-only loans

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 First-time homebuyers

- 7.3 Repeat homebuyers

- 7.4 Real estate investors

- 7.5 Commercial property buyers

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Direct lending

- 8.3 Broker-mediated lending

- 8.4 Online platforms

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 AmeriHome Mortgage

- 10.2 Bank of America

- 10.3 Citibank

- 10.4 CrossCountry Mortgage

- 10.5 DHI Mortgage

- 10.6 Fairway Independent Mortgage

- 10.7 Guaranteed Rate

- 10.8 Guild Mortgage

- 10.9 JPMorgan Chase

- 10.10 LoanDepot

- 10.11 Navy Federal Credit Union

- 10.12 Newrez

- 10.13 Pennymac

- 10.14 Planet Home Lending

- 10.15 PNC Bank

- 10.16 Rate

- 10.17 Rocket Mortgage

- 10.18 U.S. Bank

- 10.19 United Wholesale Mortgage (UWM)

- 10.20 Veterans United Home Loans