PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755281

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755281

2D Transition Metal Carbides Nitrides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

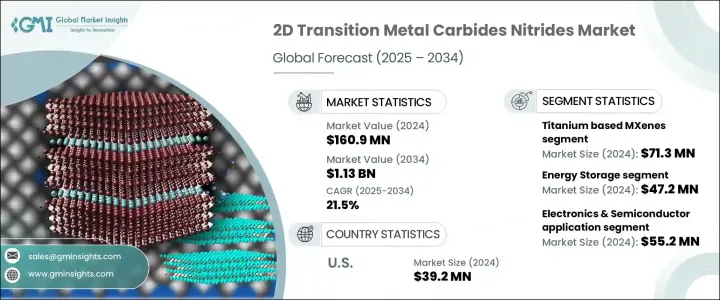

The Global 2D Transition Metal Carbides Nitrides Market was valued at USD 160.9 million in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 1.13 billion by 2034. The rising demand for advanced nanomaterials across industries is fueling this growth, with applications rapidly emerging in next-generation electronics, energy storage systems, and high-performance composite materials. Known as MXenes, these two-dimensional materials are gaining prominence due to their unique combination of metallic conductivity, structural flexibility, and versatile surface chemistry. The ability to engineer their surfaces while retaining high conductivity and mechanical strength makes them especially suitable for integration into commercial systems. Cutting-edge research and innovation from global institutions continue to enhance their commercial readiness, enabling the smooth adaptation of MXenes across multiple industrial applications.

The titanium-based MXenes segment stood at USD 71.3 million in 2024 and is expected to record a CAGR of 20.9% between 2025 and 2034. These MXenes are recognized for their outstanding conductivity, hydrophilic nature, and layer-by-layer structure, making them highly relevant for a wide array of applications. Their capability to support high energy density and stability positions them as valuable components in energy storage systems, electromagnetic interference shielding, and biosensing technologies. Their non-diffusive behavior during processes and minimal toxicity further support their growing adoption, particularly in electronics and defense-related technologies. The widespread research interest in these materials is driving commercialization efforts, helping accelerate their deployment across high-impact sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $160.9 million |

| Forecast Value | $1.13 billion |

| CAGR | 21.5% |

In the energy storage application segment, the market was valued at USD 47.2 million in 2024 and is projected to grow at a CAGR of 26.4% through 2034. Thanks to their ultra-large surface area and superior conductivity, MXenes are ideal candidates for high-performance supercapacitors. Their tunable interlayer spacing supports fast ion transport and enhances charge-discharge efficiency, which is crucial for scalable storage solutions such as electric vehicles and power grids. The growing global shift toward sustainable energy infrastructure is accelerating the demand for efficient and scalable energy storage materials, where MXenes play a critical role due to their high functionality and adaptability.

The electronics and semiconductor application segment accounted for USD 55.2 million in 2024, capturing a market share of 29.6%, and is estimated to register a CAGR of 20.7% during the forecast period. MXenes are increasingly indispensable in this field owing to their exceptional electrical performance and tunable surface characteristics. These attributes contribute to improved miniaturization, heat management, and circuit integration in advanced semiconductor devices. The continued expansion of the semiconductor sector, driven by growing consumer demand for faster and more efficient devices, is propelling the inclusion of MXenes in a wide range of electronic components.

In the United States, the 2D transition metal carbides nitrides market was valued at USD 39.2 million in 2024 and is projected to grow at a CAGR of 21.9% from 2025 to 2034. The region benefits from significant government backing in materials science and nanotechnology, along with a strong base in electronics and defense manufacturing. These factors, combined with domestic production capabilities and robust import-export dynamics, make the U.S. a key player in this evolving market. Investments in research, partnerships with academic institutions, and the presence of a mature industrial ecosystem further support the rapid adoption of MXenes across various domains.

China continues to maintain a strong foothold in the global market, driven by its expanding clean energy and electric vehicle sectors, which are major end-users of advanced materials. The country plays a crucial role in the supply chain for MXene-based components and technologies, particularly in the Asia Pacific and European regions. China's strategic focus on materials innovation and its large-scale production capabilities enable it to meet both domestic and international demand for these emerging materials.

Globally, leading market participants are channeling investments toward research-driven product development in areas such as bioelectronics, next-gen energy devices, and functional coatings. Companies are prioritizing customization and quality in their material offerings, pushing innovation across various use cases. Collaborative developments, proprietary synthesis methods, and exclusive licensing agreements are helping stakeholders solidify their competitive edge, fueling further advancements and broader commercial uptake of MXenes in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Form

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Competitive landscape

- 4.1.1 Company overview

- 4.1.2 Product portfolio and specifications

- 4.1.3 SWOT analysis

- 4.2 Company market share analysis, 2024

- 4.2.1 Global market share by company

- 4.2.2 Regional market share analysis

- 4.2.3 Product portfolio share analysis

- 4.3 Strategic initiative

- 4.3.1 Mergers and acquisitions

- 4.3.2 Partnerships and collaborations

- 4.3.3 Product launches and innovations

- 4.3.4 Expansion plans and investments

- 4.4 Company benchmarking

- 4.4.1 Product innovation benchmarking

- 4.4.2 Pricing strategy comparison

- 4.4.3 Distribution network comparison

- 4.4.4 Customer service and support comparison

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Titanium based MXenes

- 5.2.1 Ti3C2

- 5.2.2 Ti2C

- 5.2.3 Ti3CN

- 5.2.4 Other Titanium based MXenes

- 5.3 Niobium based MXenes

- 5.3.1 Nb2C

- 5.3.2 Nb4C3

- 5.3.3 Other Niobium based MXenes

- 5.4 Vanadium Based MXenes

- 5.4.1 V2C

- 5.4.2 V4C3

- 5.4.3 Other Vanadium based MXenes

- 5.5 Molybdenum based MXenes

- 5.5.1 Mo2C

- 5.5.2 Other Molybdenum based MXenes

- 5.6 Tantalum based MXenes

- 5.6.1 Ta4C3

- 5.6.2 Other tantalum based MXenes

- 5.7 Other MXene types

Chapter 6 Market Estimates & Forecast, By Synthesis Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrofluoric acid (HF) etching

- 6.3 Fluoride salt + HCl etching

- 6.3.1 LiF + HCl

- 6.3.2 NaF + HCl

- 6.3.3 KF + HCl

- 6.4 Other fluoride salt combinations

- 6.5 Electrochemical etching

- 6.6 Molten salt etching

- 6.7 Other synthesis methods

Chapter 7 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Dispersion/ink

- 7.3.1 Aqueous dispersions

- 7.3.2 Organic solvent dispersions

- 7.3.3 Other dispersion types

- 7.4 Film

- 7.4.1 Free standing films

- 7.4.2 Supported films

- 7.4.3 Other film types

- 7.5 Composite materials

- 7.6 Other forms

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Energy storage

- 8.2.1 Batteries

- 8.2.1.1 Lithium ion batteries

- 8.2.1.2 Sodium ion batteries

- 8.2.1.3 Other battery types

- 8.2.2 Supercapacitors

- 8.2.3 Other energy storage applications

- 8.2.1 Batteries

- 8.3 Electronics & optoelectronics

- 8.3.1 Transparent conductive films

- 8.3.2 Field effect transistors

- 8.3.3 Electromagnetic interference (emi) shielding

- 8.3.4 Other electronics applications

- 8.4 Sensors & biosensors

- 8.4.1 Gas sensors

- 8.4.2 Biosensors

- 8.4.3 Pressure/strain sensors

- 8.4.4 Other sensor applications

- 8.5 Catalysis

- 8.5.1 Electrocatalysis

- 8.5.2 Photocatalysis

- 8.5.3 Other catalytic applications

- 8.6 Environmental remediation

- 8.6.1 Water purification

- 8.6.2 Gas separation

- 8.6.3 Other environmental applications

- 8.7 Biomedical applications

- 8.7.1 Drug delivery

- 8.7.2 Bioimaging

- 8.7.3 Photothermal therapy

- 8.7.4 Other biomedical applications

- 8.8 Composites & coatings

- 8.9 Other applications

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Electronics & semiconductor

- 9.3 Energy & power

- 9.4 Healthcare & pharmaceuticals

- 9.5 Automotive & transportation

- 9.6 Environmental & water treatment

- 9.7 Aerospace & defense

- 9.8 Research & academia

- 9.9 Other end use industries

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Drexel University (Technology Transfer)

- 11.2 2D Materials Pte Ltd.

- 11.3 Nanochemazone

- 11.4 ACS Material, LLC

- 11.5 Alfa Chemistry

- 11.6 American Elements

- 11.7 Sigma-Aldrich (Merck KGaA)

- 11.8 Ossila Ltd.

- 11.9 Nanografi Nano Technology

- 11.10 SkySpring Nanomaterials, Inc.

- 11.11 Cheap Tubes Inc.