PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755286

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755286

Houseboats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

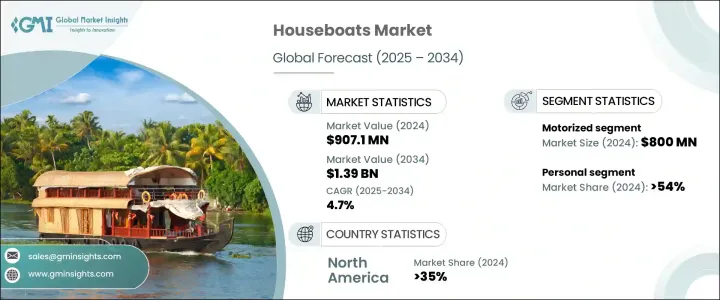

The Global Houseboats Market was valued at USD 907.1 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 1.39 billion by 2034, driven by the increasingly congested, and exploring alternative housing solutions, as an appealing option for city dwellers seeking refuge from urban overcrowding. Technological advancements in sustainable living are boosting the appeal of houseboats, which now incorporate green features such as solar panels, lithium battery systems, energy-efficient appliances, and wastewater treatment units. These eco-friendly houseboats are becoming popular among environmentally conscious consumers, offering off-grid capabilities and reduced carbon footprints. The rise of remote work has also created opportunities for houseboats to serve as both residential and mobile office spaces, with high-speed internet and ergonomic workspaces now commonly integrated into houseboat designs.

Additionally, houseboats are attracting attention in the tourism industry, particularly among affluent travelers seeking customized, luxury waterborne accommodations. Motorized houseboats are seeing rising demand, particularly in North America and Europe, as they provide the freedom to explore various waterways without the need for a towing vessel. This trend towards flexible, mobile living is contributing to the growth of the houseboats market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $907.1 Million |

| Forecast Value | $1.39 Billion |

| CAGR | 4.7% |

The motorized houseboat segment dominated the market in 2024, accounting for USD 800 million, and is expected to see continued growth in the coming years. These motorized vessels are popular among luxury travelers seeking high-end features like jacuzzis, home theaters, and gourmet kitchens, offering a unique and customized way to travel while enjoying hotel-like amenities. Houseboats are becoming a viable alternative to yachts and waterfront villas, particularly for those who desire both comfort and mobility. This appeal is driving significant growth in the premium segment of the market, especially in regions like Europe and North America, where the demand for personalized aquatic tourism is increasing.

In terms of end-users, the market is split between personal and commercial segments, with the personal segment holding a 54% share in 2024. Houseboats are increasingly seen as a cost-effective and flexible housing solution, especially in cities with high property costs. These vessels offer the unique advantage of being mobile and potentially tax-free, making them an attractive option for various demographics, including retirees, first-time homebuyers, and individuals seeking a minimalist lifestyle. Furthermore, personal houseboats are equipped with sustainable features such as solar power and water recycling systems, aligning with the growing trend of eco-conscious living.

North America Houseboats Market held a 35% share in 2024. The U.S. boasts a vast network of navigable waterways, including rivers and lakes, which supports the increasing popularity of houseboats for both recreational and residential purposes. The demand for off-grid, self-sufficient houseboats, especially those equipped with solar panels and other sustainable technologies, is rising as more consumers, particularly millennials and Gen Z, seek eco-friendly lifestyles. The U.S. market benefits from government incentives and policies that encourage the adoption of energy-efficient technologies, further driving the use of houseboats as permanent homes or remote workstations. This trend is not only fostering growth in the houseboats sector but also stimulating infrastructure development, including the construction of marinas and docking facilities.

Key players in the Global Houseboats Industry include Gibson Boats, Sumerset Houseboats, Destination Yachts, Barkmet Boats, Trifecta Houseboats, AH Wadia Boat, Catamaran Cruisers, Grandeur Marine International, La Mare Houseboats, and Fanyetent. To strengthen their market position, companies in the houseboats industry are focusing on incorporating cutting-edge, sustainable technologies into their offerings. These include solar panels, lithium battery systems, and eco-friendly materials that appeal to environmentally conscious consumers. Additionally, manufacturers are enhancing the appeal of houseboats by offering high-end features such as smart home integration, high-speed internet, and luxury interiors, positioning their products as premium living spaces. To meet the rising demand for mobile workspaces and off-grid living, companies are also adapting their designs to accommodate remote work trends. Partnerships with marinas and other waterfront developments are helping companies expand their reach and build infrastructure to support the growing houseboats market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Service provider

- 3.2.3 Technology provider

- 3.2.4 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Cost breakdown analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising interest in eco-friendly floating homes

- 3.9.1.2 Surge in luxury waterborne living demand

- 3.9.1.3 Increased tourism activities on inland waterways

- 3.9.1.4 Urban housing shortages fueling floating alternatives

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of premium houseboat models

- 3.9.2.2 Limited docking and mooring infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Houseboats, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Canal-style

- 5.3 Pontoon

- 5.4 Floating-home

- 5.5 Catamaran-style

- 5.6 Full-hull

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Motorized

- 6.3 Non-Motorized

Chapter 7 Market Estimates & Forecast, By Size, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 Upto 30 feet

- 7.3 30-50 feet

- 7.4 Above 50 feet

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.5.3 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AH Wadia Boat

- 10.2 Barkmet Boats

- 10.3 Bravada Yachts

- 10.4 Catamaran Cruisers

- 10.5 Destination Yachts

- 10.6 Fantasy Yachts

- 10.7 Fanyetent

- 10.8 Gibson Boats

- 10.9 Grandeur Marine International

- 10.10 Harbor Cottage Houseboats

- 10.11 Horizon Yachts

- 10.12 La Mare Houseboats

- 10.13 Lakeview Yachts

- 10.14 Navgathi

- 10.15 Sharpe Houseboats

- 10.16 Stardust Cruisers

- 10.17 Sumerset Houseboats

- 10.18 Sunstar Houseboats

- 10.19 Thurston Manufacturing

- 10.20 Trifecta Houseboats