PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755295

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755295

Hemodialysis Vascular Grafts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

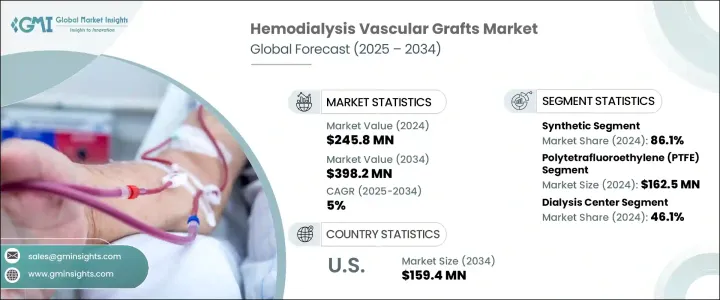

The Global Hemodialysis Vascular Grafts Market was valued at USD 245.8 million in 2024 and is estimated to grow at a CAGR of 5% to reach USD 398.2 million by 2034. These medical devices play a vital role in providing vascular access for patients undergoing hemodialysis, particularly those with end-stage renal disease (ESRD) who are not suitable candidates for arteriovenous fistulas. The increasing global burden of ESRD, driven by diabetes, hypertension, and aging populations, is contributing to a growing need for hemodialysis treatments. Moreover, innovations in graft technology, such as the development of bioengineered and hybrid materials, are enhancing the durability, flexibility, and biocompatibility of these grafts, which results in fewer complications, prolonged graft patency, and broader clinical adoption in both developed and emerging markets.

The rise in chronic kidney disease (CKD) and ESRD correlates with an aging global population. Elderly patients, who often have limited vascular access, rely more on synthetic or biological vascular grafts, further boosting the demand for graft-based dialysis access. The growth of dialysis centers in developing countries, along with enhanced healthcare service access, is increasing the utilization of vascular grafts. Government initiatives and rising investments in renal care also contribute to making advanced graft technologies more affordable and accessible, supporting global growth in renal healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $245.8 Million |

| Forecast Value | $398.2 Million |

| CAGR | 5% |

In 2024, the synthetic graft segment led the market with a significant share of 86.1%. Synthetic hemodialysis grafts offer immediate use, unlike arteriovenous fistulas, which require weeks for maturation. This immediate availability makes synthetic grafts essential for acute or emergency dialysis situations. Furthermore, synthetic materials such as expanded polytetrafluoroethylene (ePTFE) and polyurethane have improved the performance, flexibility, and durability of these grafts. Surface treatments and heparin-bonded coatings reduce the risk of thrombosis and infection, making synthetic grafts more effective for long-term dialysis therapies. The growing demand for emergency hemodialysis access, especially in hospitals and emergency settings, is increasing the adoption of synthetic grafts, which have shorter maturation times and are often preferred over their biological counterparts.

The dialysis centers segment held a 46.1% share in 2024. The rise in chronic kidney disease and end-stage renal disease cases worldwide has spurred the rapid growth of dialysis centers. As these facilities expand to accommodate more patients, the demand for vascular access solutions such as hemodialysis grafts increases. High-volume dialysis centers require reliable, effective vascular access options for their patients. Synthetic hemodialysis grafts, with their shorter maturation times compared to arteriovenous fistulas, are particularly beneficial in these settings, making them a preferred option. As a result, dialysis centers are frequently stocking synthetic grafts, contributing to the segment's growth.

U.S. Hemodialysis Vascular Grafts Market will reach USD 159.4 million by 2034. The U.S. faces a high prevalence of diabetes and hypertension, which are leading causes of chronic kidney disease and end-stage renal disease. The increasing incidence of these conditions means more patients require long-term dialysis, thereby driving demand for vascular access solutions. Medicare and other federal healthcare programs offer comprehensive coverage for dialysis treatments and vascular access procedures, which makes hemodialysis grafts more accessible to patients. These reimbursement policies incentivize healthcare providers to adopt advanced graft technologies, further fueling the market's growth.

Key market players in the Global Hemodialysis Vascular Grafts Industry include Artivion, Becton Dickinson and Company, BIOVIC, Cook Medical, CryoLife, Getinge, Laminate Medical Technologies, LeMaitre, Merit Medical Systems, ParaGen Technologies, Proteon Therapeutics, Terumo Medical, Vascudyne, Vascular Genesis, and W.L. Gore & Associates. Companies in the hemodialysis vascular grafts market are employing several key strategies to enhance their market position. These strategies include significant investments in research and development to improve graft performance, biocompatibility, and longevity. Manufacturers are also focusing on expanding their product portfolios by introducing advanced materials and hybrid grafts to meet the diverse needs of patients. Collaborations with healthcare providers, hospitals, and dialysis centers are helping companies penetrate new markets and improve product accessibility. To further strengthen their foothold, companies are increasing their geographic reach by entering emerging markets with growing demand for dialysis services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of end-stage renal disease (ESRD)

- 3.2.1.2 Advancements in graft materials and technology

- 3.2.1.3 Growing geriatric population

- 3.2.1.4 Expanding healthcare infrastructure and dialysis centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vascular graft procedures and devices

- 3.2.2.2 Risk of complications such as infections, thrombosis, and graft failure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biological

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polytetrafluoroethylene (PTFE)

- 6.3 Polyurethane

- 6.4 Polyester

- 6.5 Biological

- 6.6 Hybrid

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Dialysis centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Artivion

- 9.2 Becton Dickinson and Company

- 9.3 BIOVIC

- 9.4 Cook Medical

- 9.5 CryoLife

- 9.6 Getinge

- 9.7 Laminate Medical Technologies

- 9.8 LeMaitre

- 9.9 Merit Medical Systems

- 9.10 ParaGen Technologies

- 9.11 Proteon Therapeutics

- 9.12 Terumo Medical

- 9.13 Vascudyne

- 9.14 Vascular Genesis

- 9.15 W L Gore & Associates