PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755299

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755299

Video as a Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

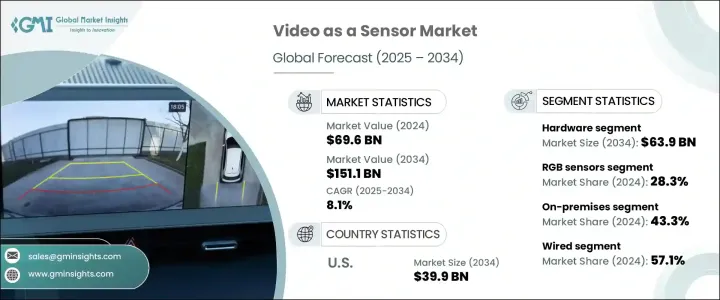

The Global Video as a Sensor Market was valued at USD 69.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 151.1 billion by 2034. The growth is driven by the rising demand for situational awareness across various sectors. As industries prioritize real-time environmental monitoring and rapid decision-making, video sensors are being deployed as critical tools that convert visual data into actionable insights. Integration of AI with video feeds enhances surveillance efficiency, allowing for faster interpretation and improved safety responses. Industries such as defense, industrial automation, and healthcare are integrating smart video sensors into their existing infrastructure to elevate operational control, security standards, and responsiveness, reinforcing the market's upward trajectory.

The imposition of tariffs on imported Chinese components has created cost pressures, particularly on hardware like camera modules and imaging sensors. These trade shifts disrupted the supply chain and extended lead times, resulting in delayed production and procurement. Rising inflation and tightening government budgets have introduced new layers of complexity to procurement processes, often resulting in longer approval times and delayed implementation of advanced surveillance technologies. These economic constraints are placing pressure on public sector agencies to prioritize spending, which may impact the pace at which video as a sensor solution is rolled out across critical sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.6 Billion |

| Forecast Value | $151.1 Billion |

| CAGR | 8.1% |

The hardware component of the market is experiencing notable traction, projected to reach USD 63.9 billion by 2034. This growth is largely driven by the surge in demand for intelligent, AI-integrated imaging systems capable of real-time, on-device data analysis. Such systems are pivotal for reducing latency, minimizing network load, and enabling quick, autonomous decision-making in dynamic operational settings.

The thermal sensors segment is expected to reach USD 44.4 billion by 2034 as thermal video sensors are witnessing broader integration across sensitive environments like hospitals, border checkpoints, and large-scale public spaces. These sensors play a vital role not only in enhancing safety and monitoring but also in supporting predictive maintenance operations by identifying temperature anomalies in industrial equipment before failure occurs.

United States Video as a Sensor Market reached USD 39.9 billion by 2034. The adoption curve is being shaped by the convergence of smart city infrastructure, defense modernization, and heightened emphasis on homeland security. These developments, alongside innovation in edge-based video analytics, are pushing the technology into the mainstream across both government and private sector applications.

Key companies influencing this market include Teledyne Technologies, OmniVision Technologies Inc., Canon Inc., Sony Corporation, and STMicroelectronics. Leading firms in the video as a sensor industry are focusing on innovation, partnerships, and AI integration to strengthen their global footprint. Companies are expanding R&D initiatives to create next-gen imaging solutions with edge-processing capabilities for faster and more secure data handling. Strategic alliances and collaborations are being formed with defense, healthcare, and industrial players to tailor offerings for sector-specific needs. Manufacturers are also localizing component sourcing to reduce reliance on volatile supply chains and counteract trade tariff impacts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for real-time situational awareness

- 3.3.1.2 Expansion of smart cities and infrastructure projects

- 3.3.1.3 Increased security and surveillance requirements

- 3.3.1.4 Proliferation of AI-powered video analytics

- 3.3.1.5 Growth in military budget

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Integration complexity with legacy systems

- 3.3.2.2 Latency in real-time processing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 RGB sensors

- 6.3 Infrared (IR) sensors

- 6.4 Thermal sensors

- 6.5 Depth sensors

- 6.6 Multispectral sensors

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Edge-based

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Wired

- 8.3 Wireless

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Security & surveillance

- 9.3 Traffic monitoring & smart mobility

- 9.4 Industrial automation & robotics

- 9.5 Retail analytics

- 9.6 Healthcare & patient monitoring

- 9.7 Environmental monitoring

- 9.8 Agriculture & livestock monitoring

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avnet EMEA

- 11.2 BAE Systems plc

- 11.3 Canon Inc.

- 11.4 Excelitas Technologies Corp.

- 11.5 FLUKE Corporation

- 11.6 Hamamatsu Photonics K.K.

- 11.7 InfraTec GmbH

- 11.8 Intevac, Inc.

- 11.9 IRCameras LLC

- 11.10 L3Harris Technologies

- 11.11 Leonardo DRS

- 11.12 Lynred

- 11.13 New Imaging Technologies (NIT)

- 11.14 OmniVision Technologies Inc.

- 11.15 Photonis Technologies

- 11.16 Sony Corporation

- 11.17 STMicroelectronics

- 11.18 Teledyne Technologies Incorporated

- 11.19 Thales Group

- 11.20 Xenics NV