PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755306

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755306

Ophthalmic Microscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

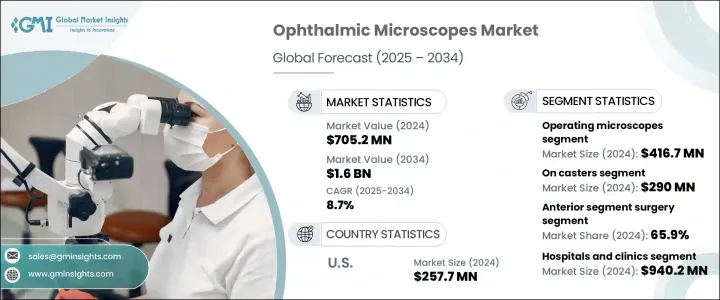

The Global Ophthalmic Microscopes Market was valued at USD 705.2 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 1.6 billion by 2034. The substantial growth can be attributed to the rising technological advancements in ophthalmic equipment, the increasing geriatric population, and the growing preference for minimally invasive ophthalmic surgeries. The prevalence of eye-related conditions like cataracts, glaucoma, and age-related macular degeneration is accelerating the demand for advanced surgical interventions.

Modern ophthalmic microscopes now feature 3D visualization, optical coherence tomography (OCT), and augmented reality overlays that improve the precision of surgeries, enhance training, and reduce surgical time. As the demand for better-equipped, ergonomically designed surgical instruments increases, these microscopes, with their high-precision optics, continue to evolve, becoming more multifunctional and widely adopted across clinics and hospitals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $705.2 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.7% |

These devices are essential for a wide range of ophthalmic surgeries, particularly those involving both the anterior and posterior segments of the eye. By providing surgeons with high-resolution, magnified images, they facilitate precise and intricate procedures, such as cataract removal, corneal transplants, retinal surgeries, and glaucoma treatments. The ability to visualize delicate structures, such as the cornea, lens, retina, and vitreous, allows surgeons to perform these operations with unparalleled accuracy. This high-definition imaging ensures that even the most complex surgeries are conducted with minimal risk, reducing the likelihood of errors and improving patient outcomes.

In 2024, the operating microscope segment led the market, generating USD 416.7 million. With the increasing incidence of age-related eye diseases, particularly among the elderly, the demand for ophthalmic surgeries has surged. Moreover, the trend toward outpatient and daycare surgeries is driving the need for compact, mobile, and versatile operating microscopes. These microscopes are designed with modular components for easy maintenance and mobility, making them ideal for ambulatory surgery centers. Their ability to be easily transported and used across various clinics aligns with the growing need for flexible, cost-effective solutions in the healthcare sector.

The hospitals and clinics segment held the largest share in 2024 and is expected to reach USD 940.2 million by 2034. As demand for specialized ophthalmology services rises, many hospitals and multi-specialty clinics are establishing dedicated ophthalmic units, which require advanced surgical microscopes for a variety of eye procedures. With increasing investments in urban healthcare infrastructure, particularly in healthcare hubs, there has been a marked rise in the purchase of ophthalmic microscopes. These medical centers prioritize equipment that ensures high surgical accuracy, safety, and overall patient outcomes. Ophthalmic microscopes not only enhance visualization but also minimize surgical errors and postoperative complications, driving their demand.

U.S. Ophthalmic Microscopes Market was valued at USD 257.7 million in 2024. The rising incidence of ophthalmic conditions such as cataracts, glaucoma, and age-related macular degeneration is boosting the demand for these advanced devices. Furthermore, favorable reimbursement policies for cataract surgeries in the U.S. support the adoption of high-end surgical systems by healthcare providers. This reimbursement structure accelerates the investment in new technologies for ophthalmic procedures, streamlining cost recovery. Additionally, the U.S. serves as a hub for leading manufacturers and innovators in the ophthalmic microscopes market.

Prominent companies operating in the Global Ophthalmic Microscopes Market include ZEISS, Alcon, HAAG-STREIT GROUP, HAI Laboratories, Inami, KARL KAPS, Keeler, LABOMED, Leica, MOPTIM, Reichert, Rexxam, TAKAGI, and TOPCON. In the ophthalmic microscopes market, companies are employing several key strategies to solidify their positions. These include ongoing innovation in product features, such as enhanced digital integration, 3D imaging capabilities, and ergonomic designs, to cater to evolving surgical needs. Manufacturers are investing in advanced technologies to improve the functionality and precision of microscopes, making them indispensable tools for eye surgeries. To expand market share, many companies are forming strategic partnerships and collaborations with healthcare institutions and clinics. Additionally, firms are targeting emerging markets with cost-effective models that meet local healthcare demands while ensuring superior quality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of ophthalmic disorders

- 3.2.1.2 Growing adoption of minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements

- 3.2.1.4 Surge in cataract and refractive surgery volumes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced ophthalmic microscopes

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Product comparison outlook

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Operating microscopes

- 5.3 Examination microscopes

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On casters

- 6.3 Ceiling-mounted

- 6.4 Table-top

- 6.5 Wall-mounted

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Anterior segment surgery

- 7.2.1 Cataract surgery

- 7.2.2 Refractive surgery

- 7.2.3 Glaucoma surgery

- 7.2.4 Corneal surgery

- 7.2.5 Laser eye surgery

- 7.3 Posterior segment surgery

- 7.3.1 Virectomy

- 7.3.2 Retinal detachment repair

- 7.3.3 Macular hole repair

- 7.3.4 Maculopathy surgery

- 7.3.5 Posterior scelerectomy

- 7.3.6 Radial optic neurotomy

- 7.3.7 Macular translocaion surgery

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centres

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ZEISS

- 10.2 Alcon

- 10.3 HAAG-STREIT GROUP

- 10.4 HAI Laboratories

- 10.5 Inami

- 10.6 KARL KAPS

- 10.7 Keeler

- 10.8 LABOMED

- 10.9 Leica

- 10.10 MOPTIM

- 10.11 Reichert

- 10.12 Rexxam

- 10.13 TAKAGI

- 10.14 TOPCON