PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755308

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755308

Automotive Interior Ambient Lighting System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

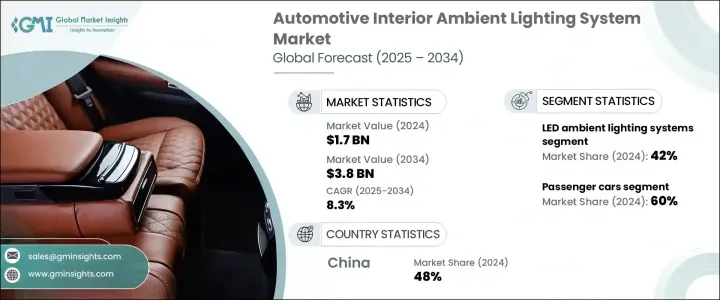

The Global Automotive Interior Ambient Lighting System Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 3.8 billion by 2034, driven by increasing consumer demand for enhanced in-vehicle comfort and aesthetics, rising adoption of premium vehicles, and advancements in lighting technologies like LED and OLED. These technologies allow for customizable, energy-efficient, and visually appealing lighting solutions. The expansion of the automotive sector in emerging markets such as India, China, Brazil, and Southeast Asia contributes to the demand for advanced in-vehicle features, including ambient lighting. With rising disposable incomes and urbanization, consumers are increasingly seeking vehicles that offer personalized driving experiences, which has pushed automakers to integrate stylish and customizable interior lighting, contributing to market growth.

LED technology plays a significant role in this growth due to its energy efficiency, longer lifespan, and the flexibility it offers in design. LEDs are more power-efficient and provide greater brightness compared to traditional lighting solutions. Furthermore, their compact size supports innovative interior designs, which helps automakers enhance vehicle aesthetics and functionality. OLED and LED innovations are crucial for boosting the appeal of automotive interiors, improving safety, and meeting consumer demand for premium features while lowering energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 billion |

| Forecast Value | $3.8 billion |

| CAGR | 8.3% |

In 2024, the LED ambient lighting systems segment held a 42% share and is expected to grow at a CAGR of 9% during 2034. The popularity of LED technology can be attributed to its low power consumption, longer lifespan, and design flexibility. LED lights are particularly advantageous as they can offer customizable color options and dynamic lighting effects, which elevate the aesthetic experience inside vehicles. This customization is a strong selling point for automakers looking to differentiate their vehicles in a competitive market. The ability to integrate these lights into mid-range vehicles has made them an appealing choice for automakers aiming to offer luxury features at a lower cost.

In 2024, the passenger car segment held a 60% share, driven by high production volumes and growing consumer demand for comfort, safety, and aesthetic features. As disposable incomes rise, consumers are increasingly seeking vehicles that offer a premium driving experience. Ambient lighting, which enhances the interior environment, has become a key feature in high-end and mass-market vehicles. Automakers are expanding the availability of these lighting systems across a range of models, including compact and mid-range cars, to appeal to younger, tech-savvy buyers. Features such as customizable colors, synchronization with entertainment systems, and door lighting enhancements are becoming standard offerings.

China Automotive Interior Ambient Lighting System Market held 48% share and generated USD 448.2 million in 2024 driven by a combination of consumer preferences for personalized in-cabin experiences, technological advancements, and supportive government policies. The demand for advanced ambient lighting systems is particularly strong in electric vehicles, where manufacturers are integrating cutting-edge lighting features to enhance the futuristic appeal of their interiors. Government incentives promoting energy-efficient technologies have encouraged the adoption of LED lighting systems, contributing to the growth of ambient lighting solutions that improve both aesthetics and driver safety.

Key players in the Automotive Interior Ambient Lighting System Market include Valeo, Stanley Electric, Innotec Group, Magneti Marelli, Koito Manufacturing, OSRAM, Lumileds Holding, Magna International, and HELLA. To strengthen their market presence, companies in the automotive interior ambient lighting system industry are focusing on product innovation, particularly in energy-efficient lighting technologies like LED and OLED. Manufacturers are expanding their portfolios to include customizable lighting solutions that enhance vehicle aesthetics and meet consumer demand for personalized in-cabin experiences. Additionally, these companies are investing in research and development to improve energy efficiency, prolong the lifespan of lighting systems, and create dynamic lighting effects that contribute to an enhanced driving experience. Strategic partnerships with automakers are also key, as these collaborations help integrate advanced lighting features into a wide range of vehicle models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators

- 3.2.4 Technology providers

- 3.2.5 OEM

- 3.2.6 Aftermarket suppliers and distributors

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 By Product

- 3.6.2 By Region

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for vehicle personalization

- 3.11.1.2 Technological advancements in lighting

- 3.11.1.3 Rapid growth of the automotive industry in emerging markets

- 3.11.1.4 Enhanced aesthetic appeal and comfort

- 3.11.1.5 Safety and driver assistance features

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial costs

- 3.11.2.2 Complex installation and maintenance

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 LED ambient lighting systems

- 5.3 OLED ambient lighting systems

- 5.4 Fiber optic ambient lighting systems

- 5.5 Laser ambient lighting systems

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

- 6.4 Electric vehicles (Evs)

Chapter 7 Market Estimates & Forecast, By Installation Area, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Dashboard lighting

- 7.3 Footwell lighting

- 7.4 Door panel lighting

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket installations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CML Innovative

- 10.2 HELLA

- 10.3 Innotec Group

- 10.4 Jiangsu Jingliang

- 10.5 Koito Electric

- 10.6 Koito Manufacturing

- 10.7 Lumenpulse

- 10.8 Lumileds Holding

- 10.9 Magna International

- 10.10 Magneti Marelli

- 10.11 Mitsubishi Electric

- 10.12 OSRAM

- 10.13 Stanley Electric

- 10.14 STANLEY Electric

- 10.15 TCL Automotive

- 10.16 Valeo

- 10.17 Varroc Lighting Systems

- 10.18 Wells Vehicle Electronics

- 10.19 Xenon Automotives

- 10.20 ZKW Group