PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755312

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755312

Defense Electronics Obsolescence Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

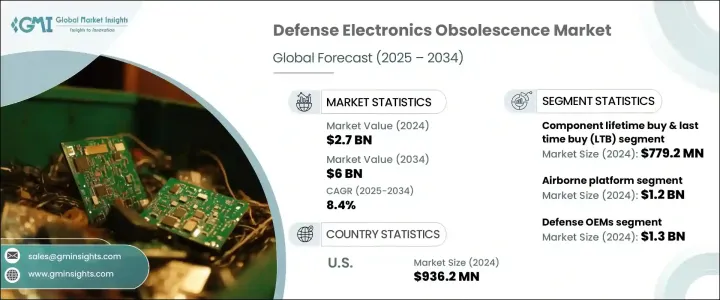

The Global Defense Electronics Obsolescence Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 6 billion by 2034, driven by a rising global defense budget and the increasing use of digital twin technology and predictive analytics. As military forces continue modernizing while relying heavily on long-serving platforms, the need to support aging systems with obsolete electronic components has become critical. Efforts toward sustainability, system upgrades, and component compatibility have intensified, prompting demand for lifecycle management and obsolescence mitigation solutions. In parallel, procurement reforms and strategies aimed at reinforcing industrial base resilience are encouraging domestic sourcing and digital transformation across the defense sector.

Over the years, structural modernization strategies and the continued use of legacy systems have prompted increased focus on maintaining and supporting older electronics. Policies promoting proactive lifecycle management have led to a more agile and technologically advanced approach to forecasting electronic component obsolescence. The emphasis on platform longevity has resulted in robust DMSMS (Diminishing Manufacturing Sources and Material Shortages) programs. As defense platforms remain active for decades, the mismatch between short component life cycles and long system lifespans has made obsolescence management essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.4% |

The component lifetime and last-time buy (LTB) segment was valued at USD 779.2 million in 2024. These strategies help address the growing need to secure legacy system support, especially as commercial off-the-shelf (COTS) parts are used across defense platforms. With electronic component lifecycles often limited to 5-10 years, lifetime and last-time buys help bridge the gap with platforms that may remain in service for over four decades. Geopolitical uncertainties, restricted exports, and semiconductor shortages accelerate reliance on LTB strategies to avoid supply disruptions.

The airborne platform segment was valued at USD 1.2 billion in 2024. Increased demand for extended service life of air platforms has fueled investments in avionics, radar systems, and electronic warfare (EW) upgrades. Compatibility challenges with integrating newer technologies into existing systems have amplified the need for form-fit-function replacements and legacy component emulation. Additionally, UAVs and support aircraft depend on COTS parts for affordability, making them vulnerable to early obsolescence and dependent on strong aftermarket sourcing.

United States Defense Electronics Obsolescence Market generated USD 936.2 million in 2024 driven by an aging military fleet that requires constant support for outdated electronic systems. Investments in sustainment programs and modernization initiatives, alongside the rapid implementation of predictive analytics and digital twin technologies by defense agencies, are pushing the market forward.

The prominent players in the market include Lynx, RTX, Thales Group, SMT Corp, Mercury Systems, Leonardo, Northrop Grumman, Boeing Defense, Teledyne Technologies, TT Electronics, Lockheed Martin, Saab RDS, L3Harris Technologies, Rheinmetall, AT Engine Controls, and Bae Systems. To strengthen its market foothold, the Defense Electronics Obsolescence Market is adopting several key strategies. These include securing long-term government contracts and emphasizing lifetime and last-time buys to ensure component availability. Many are investing heavily in digital tools like AI-powered forecasting and digital twins to improve obsolescence prediction. Collaborations across supply chains are being strengthened to reduce dependency on foreign sources.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 industry ecosystem analysis

- 3.2 trump administration tariffs

- 3.2.1 impact on trade

- 3.2.1.1 trade volume disruptions

- 3.2.1.2 retaliatory measures

- 3.2.2 impact on the industry

- 3.2.2.1 supply-side impact

- 3.2.2.1.1 price volatility in key components

- 3.2.2.1.2 supply chain restructuring

- 3.2.2.1.3 production cost implications

- 3.2.2.2 demand-side impact (selling price)

- 3.2.2.2.1 price transmission to end markets

- 3.2.2.2.2 market share dynamics

- 3.2.2.2.3 consumer response patterns

- 3.2.2.1 supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 supply chain reconfiguration

- 3.2.4.2 pricing and product strategies

- 3.2.4.3 policy engagement

- 3.2.5 outlook and future considerations

- 3.2.1 impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Aging military platforms

- 3.3.1.2 Increasing defense budgets

- 3.3.1.3 Technological advancement in electronics

- 3.3.1.4 Geopolitical tensions & threat modernization

- 3.3.1.5 Growing adoption of digital twin & predictive analytics

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited forecasting tools

- 3.3.2.2 Intellectual property (IP) restrictions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Solution Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Obsolescence monitoring & forecasting

- 5.3 Component lifetime buy & last-time buy (LTB)

- 5.4 Redesign & retrofit solutions

- 5.5 Emulation & simulation

- 5.6 Alternative sourcing (aftermarket, brokers)

- 5.7 Software & firmware updates

Chapter 6 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Airborne

- 6.3 Naval

- 6.4 Land

- 6.5 Space

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense OEMs

- 7.3 MRO providers

- 7.4 Government & defense agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AT Engine Controls

- 9.2 Bae Systems

- 9.3 Boeing Defense

- 9.4 L3Harris Technologies

- 9.5 Leonardo

- 9.6 Lockheed Martin

- 9.7 Lynx

- 9.8 Mercury Systems

- 9.9 Northrop Grumman

- 9.10 Rheinmetall

- 9.11 RTX

- 9.12 Saab RDS

- 9.13 SMT Corp

- 9.14 Teledyne Technologies

- 9.15 Thales Group

- 9.16 TT Electronics