PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755313

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755313

Modified Atmosphere Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

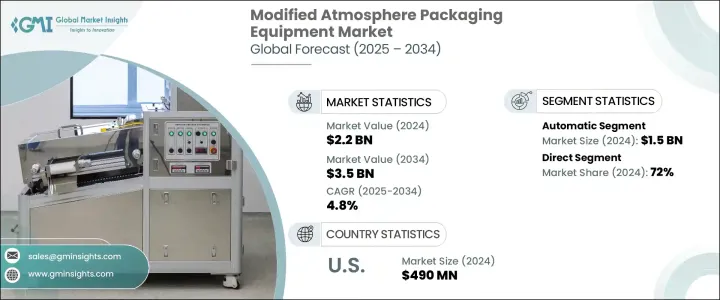

The Global Modified Atmosphere Packaging Equipment Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 3.5 billion by 2034. The growth is driven by the increasing demand for food products with extended shelf life, which plays a crucial role in minimizing food waste. These machines replace oxygen inside the packaging with inert gases like nitrogen and carbon dioxide, which slows down spoilage and keeps food fresh longer. This technology is rapidly being adopted in the food packaging industry, particularly in perishable product categories.

As consumer habits evolve with urban lifestyles, there is a rising preference for convenience foods and ready-to-eat meals. The growing consumption of pre-packed meals and precut produce is creating a strong demand for packaging solutions that are both sustainable and capable of maintaining freshness for extended durations. Modified atmosphere packaging equipment supports this need by offering compatibility with eco-friendly materials and helping reduce conventional single-use plastic packaging. With the dual benefit of extending product shelf life and reducing environmental impact, this equipment is becoming a preferred choice for food manufacturers and retailers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 4.8% |

In 2024, automatic modified atmosphere packaging systems generated USD 1.5 billion. Their popularity stems from their efficiency and ability to handle large-scale production essential for high-volume sectors like food processing. Advanced features such as predictive maintenance and real-time system monitoring have increased their appeal by reducing downtime and enhancing productivity. These smart technologies help manufacturers meet growing output demands while maintaining consistent product quality across batches.

Direct sales segment accounted for a 72% share in 2024 due to its ability to provide personalized solutions and facilitate one-on-one collaborations between manufacturers and end-users. Modified atmosphere packaging machines often require high degrees of customization, tailored for specific food products, and direct sales channels make this customization process more streamlined and effective. Such sales strategies also help forge long-term partnerships that benefit equipment providers and buyers.

United States Modified Atmosphere Packaging Equipment Market was valued at USD 490 million in 2024, holding a 76% share. The rising demand for quick meals, driven by busy lifestyles, continues to shape consumer preferences globally. As a result, the need for packaging that extends freshness while using sustainable materials is becoming more important. Technological innovations and automation in packaging equipment have further advanced the market in the U.S., where companies are increasingly adopting smart systems to improve performance and reduce operational costs.

Major companies leading the Global Modified Atmosphere Packaging Equipment Market include ULMA Packaging, Webomatic, Proseal, Ross Industries, Robert Reiser, MULTIVAC Group, Ishida, ORICS Industries, GEA Group, Ilapak, Reepack, Henkelman, PFM Group, G. Mondini, and Coesia Group. These key players compete on innovation, scale, and customization. To maintain a competitive edge in the market, leading manufacturers focus on integrating advanced automation and digital monitoring features into their equipment to improve reliability and reduce operational downtimes. They strengthen partnerships with food processing companies through customized machinery and flexible pricing models. Additionally, R&D investment in sustainable packaging materials is helping them align with environmental regulations and shifting consumer expectations. Expanding their geographic footprint through direct sales strategies and enhancing after-sales support is a common approach to boost long-term client retention and global presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Shelf-Life Extension & Food Waste Reduction

- 3.6.1.2 Rising Demand for Ready-to-Eat & Convenience Foods

- 3.6.1.3 Sustainability & Regulatory Compliance Pressures

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Initial Capital Investment

- 3.6.2.2 Complexity in Gas Mixture Calibration & Monitoring

- 3.6.2.3 Environmental Concerns Over Plastic Packaging Waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vacuum-Based MAP Equipment

- 5.3 Tray Sealing MAP Equipment

- 5.4 Horizontal flow pack MAP

- 5.5 Vertical flow pack MAP

- 5.6 Others (multi-lane machines, custom MAP systems, etc.)

Chapter 6 Market Estimates & Forecast, By Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automated

- 6.3 Semi-automated

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Tray sealing

- 7.3 Thermoforming

- 7.4 Pouch/Bag

- 7.5 Rigid container

Chapter 8 Market Estimates & Forecast, By End Use Application, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Meat, poultry, and seafood

- 8.3 Bakery & confectionery

- 8.4 Fresh produce (fruits and vegetables)

- 8.5 Dairy products

- 8.6 Ready-to-Eat (RTE) meals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Coesia Group

- 11.2 G. Mondini

- 11.3 GEA Group

- 11.4 Henkelman

- 11.5 Ilapak

- 11.6 Ishida

- 11.7 MULTIVAC Group

- 11.8 ORICS Industries

- 11.9 PFM Group

- 11.10 Proseal

- 11.11 Reepack

- 11.12 Robert Reiser

- 11.13 Ross Industries

- 11.14 ULMA Packaging

- 11.15 Webomatic