PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755316

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755316

Space Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

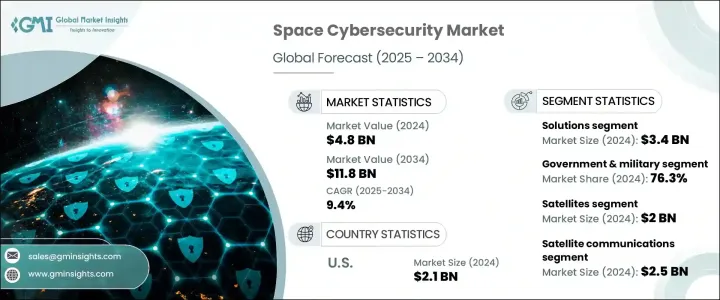

The Global Space Cybersecurity Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 11.8 billion by 2034, fueled by increased investments in space-focused cybersecurity initiatives from government and defense bodies, alongside the ongoing rise in commercial space operations. As space becomes an increasingly strategic domain, securing digital infrastructure in orbit has become a national and global priority. Public and private entities deploy cybersecurity solutions to protect sensitive satellite networks, communications systems, and mission-critical space assets. The demand for end-to-end protection in space operations continues to grow as orbital technologies evolve and the threat of cyber-attacks intensifies across both military and commercial platforms.

As strategic defense policies continue to modernize space systems, cyber protection of orbital assets is prioritized. The rising dependency on satellite communication and space surveillance has created a critical need to shield these systems from cyber vulnerabilities. The industry experienced significant cost pressures due to earlier tariff policies, which drove up prices for essential components like encryption systems and secure communications hardware. These tariffs affected sourcing from major international suppliers and increased operational costs for US-based companies, impacting their pricing structures and delivery timelines. Simultaneously, global supply chain instability led to prolonged deployment delays of key cybersecurity solutions for satellite and mission-critical infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 9.4% |

In 2024, the solutions segment was valued at USD 3.4 billion witnessing strong momentum as demand surges for sophisticated tools that can secure satellites, mission computers, and space communications systems from emerging cyber threats. Technologies such as encryption hardware, advanced cybersecurity platforms, and secure communication protocols are now critical to ensuring seamless and safe operations in orbit. With commercial and defense satellite launches increasing globally, the need for robust, scalable, and specialized security solutions is rapidly expanding.

When segmented by end-use, the government and military segment accounted for a 76.3% share in 2024, highlighting its dominance. The segment's lead is attributed to growing reliance on secure, encrypted satellite-based systems for communication, surveillance, and national security operations. Cyberattacks targeting defense infrastructure have pushed state agencies to allocate higher budgets toward cybersecurity. The increasing complexity of threats and geopolitical uncertainty has made it essential for defense organizations to adopt integrated and layered security architectures.

Germany Space Cybersecurity Market is expected to grow at a CAGR of 9.6% through 2034, backed by its leadership in aerospace manufacturing and continued emphasis on cyber protection within space infrastructure. Investments from national agencies in satellite communications, earth observation, and space research continue to drive demand. Germany's focus on integrating cybersecurity across both commercial and defense aerospace initiatives is creating steady and sustained market growth.

Key players shaping the competitive landscape include RTX Corporation, Thales Group, Lockheed Martin Corporation, and Northrop Grumman. These companies are advancing their market presence through several focused strategies. They invest in R&D to create next-generation cybersecurity systems tailored for space applications. Many are forming strategic alliances with defense agencies to secure long-term contracts, ensuring consistent revenue flow. Additionally, companies are enhancing their domestic production capabilities to reduce reliance on volatile global supply chains. Adopting AI-powered security platforms and predictive threat detection models, improve real-time response capabilities and long-term resilience for space missions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Government and military investments

- 3.3.1.2 Rising threats to space assets

- 3.3.1.3 Expansion of commercial space activities

- 3.3.1.4 Global space exploration efforts

- 3.3.1.5 Increased space traffic

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High costs of implementation

- 3.3.2.2 Shortage of skilled cybersecurity professionals

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offerings, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Network security

- 5.2.2 Endpoint and IoT security

- 5.2.3 Application security

- 5.2.4 Cloud security

- 5.2.5 Data protection

- 5.2.6 Identity and access management (IAM)

- 5.2.7 Others

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Satellites

- 6.3 Launch vehicles

- 6.4 Ground stations

- 6.5 Spaceports & launch facilities

- 6.6 Command & control centers

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Satellite communications

- 7.3 Earth observation

- 7.4 Navigation

- 7.5 Space exploration

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Government & military

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 BAE Systems

- 10.3 Boeing

- 10.4 Booz Allen Hamilton Inc.

- 10.5 CYSEC

- 10.6 General Dynamics

- 10.7 Kratos Defense & Security Solutions, Inc.

- 10.8 L3Harris Technologies, Inc.

- 10.9 Leidos

- 10.10 Leonardo S.p.A.

- 10.11 Lockheed Martin Corporation

- 10.12 Microsoft

- 10.13 Northrop Grumman

- 10.14 OHB Digital Connect GmbH

- 10.15 RTX Corporation

- 10.16 SpiderOak Inc.

- 10.17 Thales Group

- 10.18 Xage Security