PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755338

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755338

Electric Three-Wheeler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

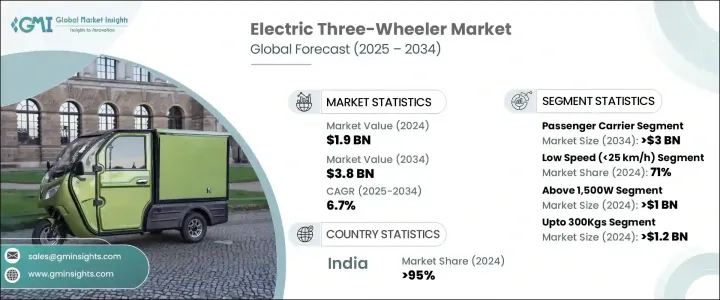

The Global Electric Three-Wheeler Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.8 billion by 2034. This rapid growth is driven by rising fuel prices, expanding EV adoption incentives, and an increasing focus on affordable urban transportation. Electric three-wheelers offer an ideal solution for short-distance and last-mile connectivity in densely populated urban settings. The expansion of EV charging infrastructure and advances in battery technology are also improving the range and performance of these vehicles. Coupled with supportive policies and investment in sustainable transport across regions, the market is witnessing significant traction among both private users and commercial fleet operators seeking cost-efficient, clean mobility solutions.

Electric three-wheelers offer compelling operational advantages over internal combustion engine alternatives. With minimal maintenance needs and significantly lower fuel costs, they present an attractive total cost of ownership. This makes them especially viable for daily-use commercial applications. Many governments across regions like Africa, Asia, and Europe are incentivizing EV purchases through schemes offering subsidies, tax exemptions, and fee waivers. These measures, along with country-specific programs to promote electric mobility, are helping bridge the price gap and accelerate the shift to electric fleets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.7% |

The passenger carrier segment generated USD 1.3 billion in 2024 and is expected to generate USD 3 billion by 2034. The widespread use of electric three-wheelers as public transport alternatives in urban and semi-urban areas is fueling this growth. For populations with limited access to conventional public transit, these vehicles offer a reliable and low-cost commuting solution. Their integration with ride-hailing and shared mobility platforms is further increasing utilization rates. Additionally, benefits such as low ownership costs, quick returns, and ease of driving are motivating entrepreneurs and fleet-based transport providers to adopt electric models at scale.

Electric three-wheelers with a top speed of 25 km/h segment captured a 71% share in 2024. These low-speed vehicles are increasingly being deployed for specialized utility tasks such as waste management, local delivery, and institutional transport, particularly in developing countries where short-distance, low-speed travel is the norm. Their popularity is bolstered by lenient licensing norms, lower costs, and eco-friendly operation. Government support aimed at rural electrification and clean mobility is further encouraging the use of light-duty EVs for local transport applications.

Asia Pacific Electric Three-Wheeler Market held a 95% share in 2024. India's strong reliance on three-wheeled vehicles for both passenger and cargo transport-especially in Tier II and Tier III cities-continues to drive adoption. The country's supportive EV ecosystem, including national and state-level policies, scrappage schemes, and awareness campaigns, is accelerating the transition to electric mobility in both urban centers and rural corridors. Demand for electric three-wheelers is strong in micro-mobility and last-mile logistics, reflecting the sector's adaptability and cost-effectiveness.

Major companies operating in the Electric Three-Wheeler Market include Hotage India, Mahindra Last Mile Mobility, Dilli Electric Auto, YC Electric, Energy Electric Vehicles, Piaggio Vehicles, Unique International, Saera Electric Auto, Bajaj Auto, and Mini Metro EV. To strengthen their position in the electric three-wheeler market, companies are focusing on expanding their product portfolios with models tailored to both cargo and passenger applications. Many players are investing in R&D to improve battery efficiency, enhance range, and reduce charging time. Strategic partnerships with battery suppliers, fleet operators, and charging infrastructure providers are helping them scale operations. Manufacturers are also prioritizing cost optimization through localized production and lean manufacturing to meet the needs of price-sensitive markets. Branding efforts, dealer expansion, and after-sales service improvements are further enabling deeper market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Battery

- 2.2.4 Power capacity

- 2.2.5 Battery capacity

- 2.2.6 Speed

- 2.2.7 Payload capacity

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Low operating and maintenance costs

- 3.2.1.2 Government incentives and subsidies

- 3.2.1.3 Advancements in battery technology and reducing battery prices

- 3.2.1.4 Stringent emission norms and environmental regulations

- 3.2.1.5 Integration of smart technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited charging infrastructure

- 3.2.2.2 High initial purchase cost

- 3.2.3 Market opportunities

- 3.2.3.1 Charging infrastructure development

- 3.2.3.2 Light commercial vehicle replacement

- 3.2.3.3 Last-mile delivery expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By country

- 3.8.2 By vehicle

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer behavior analysis

- 3.13.1 Usage trends: passenger commute vs. goods transport

- 3.13.2 Purchase decision factors (price, brand, range)

- 3.14 Analysis of insurance and aftermarket trends

- 3.14.1. Insurance adoption for commercial E3 Ws

- 3.14.2 Battery replacement & localized aftermarket services

- 3.14.3 Comparative maintenance costs: Electric vs. ICE 3-wheelers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product benchmarking

- 4.7.1 Range

- 4.7.2 Battery life

- 4.7.3 Build and design

- 4.7.4 Connectivity & tech features

- 4.7.5 Aftermarket service

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger carrier

- 5.3 Load carrier

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion

- 6.3 Lead acid

Chapter 7 Market Estimates & Forecast, By Power Capacity, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Below 1,000W

- 7.3 1,000W-1,500W

- 7.4 Above 1,500W

Chapter 8 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Below 3kWh

- 8.3 3-6kWh

- 8.4 Above 6kWh

Chapter 9 Market Estimates & Forecast, By Speed, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Low speed (<25 km/h)

- 9.3 High speed (≥25 km/h)

Chapter 10 Market Estimates & Forecast, By Payload Capacity, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Upto 300Kgs

- 10.3 Above 300Kgs

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.1.1 Jiangsu

- 11.4.1.2 Henan

- 11.4.1.3 Hebei

- 11.4.1.4 Shandong

- 11.4.1.5 Guangdong

- 11.4.1.6 Zhejiang

- 11.4.1.7 Others

- 11.4.2 India

- 11.4.2.1 Uttar Pradesh

- 11.4.2.2 Bihar

- 11.4.2.3 Assam

- 11.4.2.4 Rajasthan

- 11.4.2.5 Others

- 11.4.2.6 Others

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Southeast Asia

- 11.4.1 China

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Altigreen Propulsion Labs

- 12.2 Atul Auto

- 12.3 Avon EV

- 12.4 Bajaj Auto

- 12.5 Dilli Electric Auto

- 12.6 Energy Electric Vehicles

- 12.7 Euler Motors

- 12.8 Greaves Electric Mobility

- 12.9 Hotage India

- 12.10 J.S. Auto

- 12.11 Mahindra Last Mile Mobility

- 12.12 Mini Metro EV

- 12.13 Montra Electric

- 12.14 Omega Seiki Mobility

- 12.15 Piaggio Vehicles

- 12.16 Saera Electric Auto

- 12.17 TVS Motor Company

- 12.18 Unique International

- 12.19 VeeEss Eelectric

- 12.20 YC Electric