PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755340

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755340

North America Electric Zero Turn Mower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

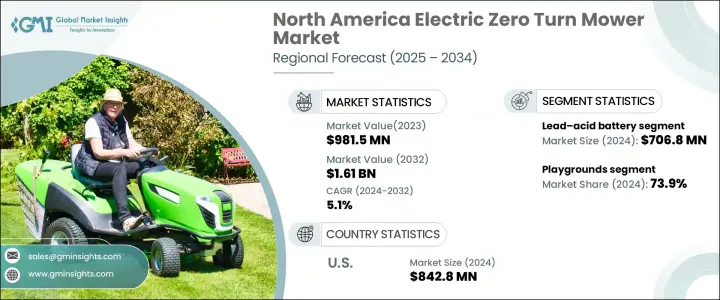

North America Electric Zero Turn Mower Market was valued at USD 981.5 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.61 billion by 2034. The growth is driven by the government's efforts to reduce emissions and tackle climate change, which has created a favorable regulatory climate. Noise and air pollution concerns have prompted several local governments to restrict gas-powered equipment use, increasing demand for quieter, low-emission electric models. While electric zero turn mowers currently come with a higher price tag, especially challenging for small landscaping businesses, advancements in battery efficiency and motor technology make them more affordable and cost-effective in the long term. This trend eliminates price barriers as manufacturers invest in efficient, budget-friendly solutions.

As environmental consciousness continues to influence consumer behavior, the U.S. market is set to expand significantly. Electric mowers are gaining popularity for their green attributes and integration with smart technologies like AI and GPS, improving navigation and safety. With intelligent systems that detect and avoid obstacles, these machines deliver enhanced performance in commercial and residential landscapes. Manufacturers are increasingly pivoting toward compact, efficient, and user-friendly designs to attract a broader customer base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $981.5 Million |

| Forecast Value | $1.61 Billion |

| CAGR | 5.1% |

By battery type, the lead acid batteries segment generated USD 706.8 million in 2024. These batteries are more economical to manufacture compared to lithium-ion versions and continue to attract cost-conscious buyers across commercial and residential sectors. Their ease of recycling adds an environmentally responsible dimension, especially appealing in jurisdictions with strict ecological mandates. Although they offer lower energy density, their durability and low upfront cost make them a practical choice for users prioritizing affordability over extended runtimes or rapid charging.

Based on applications, the playgrounds segment captured a 73.9% share in 2024, illustrating its vital role in driving overall demand. The segment's growth is fueled by the operational silence and zero-emission functionality of electric mowers critical in noise-sensitive areas like schools and parks. Their ability to maintain even, well-manicured turf helps prevent the spread of allergens and weeds, promoting a safer, cleaner play environment. These benefits make electric mowers a practical solution for institutions to maintain high-traffic public spaces.

United States Electric Zero Turn Mower Market generated USD 842.8 million in 2024, driven by a mix of regulatory support, increased environmental awareness, and rising demand from municipalities and landscaping contractors. Incentive programs and tax rebates have played a major role in encouraging adoption, while the country's broader push toward decarbonization has positioned electric landscaping equipment as a mainstream alternative. As infrastructure investments continue and electric mower technology becomes increasingly accessible, the U.S. is poised to remain the primary engine of growth for the regional market over the coming decade.

Key players in this sector include RYOBI, EcoTeq, SCAG Power Equipment, Bobcat Company, Briggs & Stratton Corporation, Greenworks Tools, EGO POWER+, Honda Power Equipment, Swisher Inc, The Toro Company, MTD Products, Hustler Turf Equipment, Ariens Company, Deere & Company, Husqvarna Group, CRAFTSMAN, Generac Power Systems, Inc., Cub Cadet, and Kubota Corporation.

To strengthen their market position, companies focus on battery innovation, cost optimization, and product differentiation through smart technology integration. Manufacturers are developing AI-powered features, improving energy efficiency, and expanding product lines tailored to residential, commercial, and municipal needs. Many collaborate with local retailers and leverage e-commerce platforms to widen their distribution network. Eco-centric branding, investment in R&D, and enhanced after-sales service offerings are central to building long-term customer loyalty in a rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Market 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Cost to customers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook & future considerations

- 3.2.1 Trade impact

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Increasing environmental awareness

- 3.4.1.2 Government regulations on diesel and gas-powered equipment

- 3.4.1.3 Advancements in battery technology

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High initial cost

- 3.4.2.2 Reoccurring maintenance cost

- 3.4.1 Growth drivers

- 3.5 Consumer buying behavior analysis

- 3.5.1 Demographic trends

- 3.5.2 Factors affecting buying decision

- 3.5.3 Consumer product adoption

- 3.5.4 Preferred distribution channel

- 3.5.5 Preferred price range

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share, 2024

- 4.3 Competitive analysis of major market players, 2024

- 4.4 Competitive positioning matrix, 2024

- 4.5 Strategic outlook matrix, 2024

Chapter 5 Estimates & Forecast, By Battery Type 2021-2034, (USD Million; Million Units)

- 5.1 Key trends

- 5.2 Lithium -Ion

- 5.3 Lead - Acid

Chapter 6 Estimates & Forecast, By Cutting Width 2021-2034, (USD Million; Million Units)

- 6.1 Key trends

- 6.2 Less than 50 inches

- 6.3 50 to 60 inches

- 6.4 More than 60 inches

Chapter 7 Estimates & Forecast, By Battery Capacity 2021-2034, (USD Million; Million Units)

- 7.1 Key trends

- 7.2 Upto 18 kWh

- 7.3 18 - 25 Kwh

- 7.4 26 -35 Kwh

- 7.5 More than 35 Kwh

Chapter 8 Estimates & Forecast, By Yard Space 2021-2034, (USD Million; Million Units)

- 8.1 Key trends

- 8.2 Small yard (less than 1 acre)

- 8.3 Medium yard (1 to 3 acres)

- 8.4 Large yard (More than 3 acres)

Chapter 9 Estimates & Forecast, By End Use 2021-2034, (USD Million; Million Units)

- 9.1 Key trends

- 9.2 Golf Course centers

- 9.3 Playgrounds

Chapter 10 Estimates & Forecast, By Distribution Channels 2021-2034, (USD Million; Million Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Estimates & Forecast, By Country 2021-2034, (USD Million; Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

Chapter 12 Company Profiles

- 12.1 Ariens Company

- 12.2 Bobcat Company

- 12.3 Briggs & Stratton Corporation

- 12.4 CRAFTSMAN

- 12.5 Cub Cadet

- 12.6 Deere & Company

- 12.7 EcoTeq

- 12.8 EGO POWER+

- 12.9 Generac Power Systems, Inc.

- 12.10 Greenworks Tools

- 12.11 Honda Power Equipment

- 12.12 Husqvarna Group

- 12.13 Hustler Turf Equipment

- 12.14 Kubota Corporation

- 12.15 Kubota Tractor Corporation

- 12.16 MTD Products

- 12.17 RYOBI

- 12.18 SCAG Power Equipment

- 12.19 Swisher Inc

- 12.20 The Toro Company