PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755341

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755341

India Gas Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

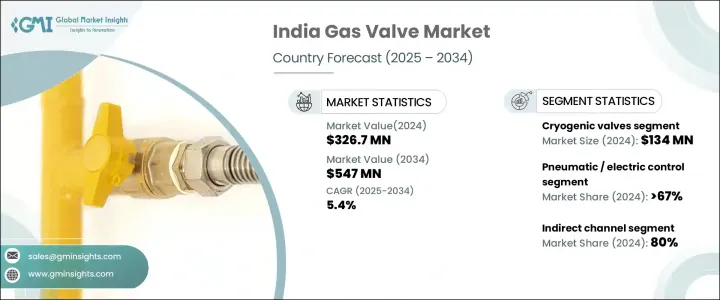

India Gas Valve Market was valued at USD 326.7 million in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 547 million by 2034. This growth is driven by the country's ongoing industrial expansion across oil and gas, petrochemicals, power generation, manufacturing, and pharmaceuticals. Gas valves play a crucial role in controlling gas flow, pressure, and direction within pipelines and processing plants. The rapid urbanization and major infrastructure initiatives, including metro projects, smart cities, and city gas distribution networks, have contributed to the rising demand for gas valves in India. Technological advancements and automation are transforming the gas valve market in India, improving the efficiency, safety, and reliability of these systems.

The integration of actuators, sensors, IoT, and remote-control technologies is gradually replacing traditional valves with smart, automated solutions. These systems allow for real-time monitoring of valve performance, gas flow, and pressure, enabling predictive maintenance and minimizing downtime. In industries like oil & gas, power, and chemicals, where safety and precision are paramount, automated valves can instantly adjust to system conditions, preventing accidents and equipment damage. For example, in the event of a pressure surge or gas leak, automated valves can immediately close or reduce the flow without waiting for manual intervention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $326.7 Million |

| Forecast Value | $547 Million |

| CAGR | 5.4% |

The cryogenic valve segment contributed USD 134 million in 2024 and is expected to grow at a CAGR of 5.2% during 2025-2034. India's increased focus on LNG imports, storage, and distribution is a major factor driving the need for cryogenic valves, which are essential for safely storing and transporting LNG at extremely low temperatures. Additionally, the demand for these valves is rising due to government policies encouraging the use of cleaner fuels and the expansion of city gas distribution networks and LNG terminals. Cryogenic valves are also in high demand across other sectors such as healthcare, pharmaceuticals, and industrial manufacturing, where gases like oxygen and nitrogen are needed in large quantities.

In 2024, the pneumatic/electric control segment represented a 67% share, and it is expected to grow at a rate of 5.8% until 2034. Pneumatic and electric control valves are increasingly being adopted due to their automation capabilities, precise flow control, and enhanced safety features. These valves are crucial in industries like manufacturing, petrochemicals, oil & gas, and power, where they help ensure safe and efficient operation. Pneumatic control valves, powered by compressed air, are particularly valuable in hazardous environments because they do not generate sparks. Electric control valves, on the other hand, are highly compatible with SCADA systems, offering digitization and compliance with Industry 4.0 standards.

The western region of India, particularly Maharashtra and Gujarat, holds a significant share of the gas valve market due to the presence of major petrochemical hubs, refineries, and natural gas production facilities. This area drives a large portion of the demand for industrial gas valves. Meanwhile, the eastern part of the country, especially Assam, is also emerging as an important area for industrial growth, thanks to ongoing infrastructure projects and the development of natural gas resources in the Brahmaputra Valley.

Leading players in the India Gas Valve Market include: L&T Valves, IMI Critical Engineering, Emerson Electric, Rotex Automation, Audco India, Uniklinger, Beekay Industries, Fluidline Valves, Hawa Engineers, Sampson Controls, Amtech, Sri Venkat Engineers, Unitech Combustion, Virgo Valves and Controls. To strengthen their position in the competitive gas valve market in India, companies are focusing on product innovation, enhancing automation and safety features, and expanding their presence across key industrial sectors. Many companies are investing in research and development to create advanced gas valve solutions that meet the growing demand for precision, reliability, and energy efficiency. Partnerships with local and global distributors help improve market reach and customer satisfaction. Companies are also incorporating IoT and remote monitoring technologies in their product offerings to provide real-time data and predictive maintenance capabilities, which improves overall performance and reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing industrialization and infrastructure development

- 3.3.1.2 Exploration in oil and gas sector

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Regulatory compliance

- 3.3.2.2 Price Sensitivity

- 3.3.2.3 Adoption of renewable energy sources

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Valve Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Liquefied petroleum gas valve

- 5.2.1 Ball valve

- 5.2.2 Check valve

- 5.2.3 Gate valve

- 5.2.4 Globe valve

- 5.2.5 Others

- 5.3 Cryogenic valve

- 5.3.1 Ball valve

- 5.3.2 Check valve

- 5.3.3 Gate valve

- 5.3.4 Globe valve

- 5.3.5 Butterfly valves

- 5.3.6 Others

- 5.4 Air separation valve

- 5.4.1 Ball valve

- 5.4.2 Check valve

- 5.4.3 Gate valve

- 5.4.4 Globe valve

- 5.4.5 Butterfly valves

- 5.4.6 Others

Chapter 6 Market Estimates & Forecast, By Gas Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Liquefied natural gas

- 6.3 Liquid nitrogen

- 6.4 Hydrogen

- 6.5 Oxygen

- 6.6 Other gases

Chapter 7 Market Estimates & Forecast, By Function, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Pneumatic/electric control

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Supplying line

- 8.3 Filling device

- 8.4 Bulk storage tank

- 8.5 Gas Transportation

- 8.6 Storage tank & piping

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Industry Sector, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Water & Wastewater

- 9.3 Food & Beverage

- 9.4 Chemicals

- 9.5 Pharma

- 9.6 Pulp & Paper

- 9.7 Oil & Gas

- 9.8 Power

- 9.9 Semiconductor

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Company Profiles

- 11.1 Amtech

- 11.2 Audco India

- 11.3 Beekay Industries

- 11.4 Emerson Electric

- 11.5 Flosteer Engineers

- 11.6 Fluidline Valves

- 11.7 Hawa Engineers

- 11.8 IMI Critical Engineering

- 11.9 L&T Valves

- 11.10 Rotex Automation

- 11.11 Samson Controls

- 11.12 Sri Venkat Engineers

- 11.13 Uniklinger

- 11.14 Unitech Combustion

- 11.15 Virgo Valves and Controls