PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755346

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755346

Industrial Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

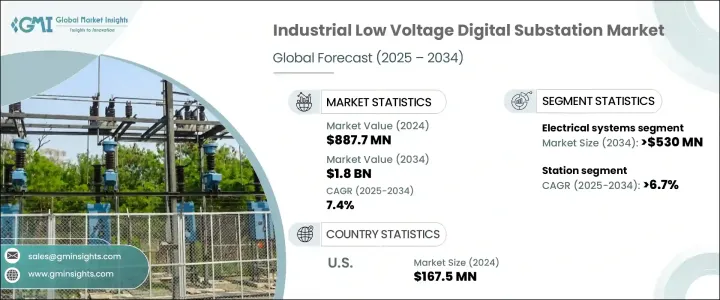

The Global Industrial Low Voltage Digital Substation Market was valued at USD 887.7 million in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 1.8 billion by 2034, driven by the increasing adoption of digital substations across various industries is enhancing operational efficiency and reliability. Incorporating IoT devices, artificial intelligence, and machine learning enables real-time monitoring and predictive maintenance, reducing equipment failures and optimizing energy consumption. Governments and industries are increasingly focused on developing smart grids, which act as the backbone of future energy systems, and this demand is accelerating the implementation of digital substations. These substations improve communication, automation, and control within the power distribution network enhancing grid stability and efficiency.

Unlike traditional electromechanical systems, digital substations use intelligent electronic devices (IEDs) that enable real-time data collection, swift decision-making, and preventive maintenance. Furthermore, the rise in renewable energy sources like wind and solar is pushing for digital substations to manage intermittent power, ensuring stable energy distribution. However, industry may face challenges due to government policies impacting the importation of electrical components, leading to potential price inflation of key parts like transformers and circuit breakers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $887.7 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 7.4% |

The electrical systems segment of the industrial low voltage digital substation market is expected to reach USD 530 million by 2034. This growth is driven by the rising demand for automation, robotics, and digitalization in power distribution networks. As these sectors evolve, there is a need for more precise and reliable equipment like transformers, circuit breakers, and busbars to effectively manage low voltage operations and ensure the safety of the system. These components are essential for maintaining smooth and efficient power distribution in increasingly complex and automated grids.

The bay segment, which held a 32.8% share in 2024, is crucial for operating digital substations. It plays an integral role in switching, protecting, and control at the feeder level, allowing for localized decision-making, enhancing overall system reliability, and ensuring fast fault isolation. This capability is vital for large-scale utility networks, where an uninterrupted power supply is paramount. Bay-level architecture contributes to the resilience of the system, making it an indispensable component in modern substations.

United States Industrial Low Voltage Digital Substation Market was valued at USD 167.5 million in 2024 fueled by supportive policy initiatives, as well as the increasing adoption of Environmental, Social, and Governance (ESG) principles, which encourage businesses to focus on energy efficiency and reducing emissions. These factors lead to a greater demand for digital substations that can help optimize energy consumption and support sustainability efforts.

Key players in the Global Industrial Low Voltage Digital Substation Market include Siemens, Schneider Electric, Hitachi Energy, Toshiba Energy Systems & Solutions Corporation, and WEG, among others. These companies focus on expanding their market presence through strategic partnerships, technological innovations, and product developments that cater to the increasing demand for efficient, automated solutions. By incorporating advanced digital solutions like IoT, machine learning, and AI-driven analytics, these players are enhancing the functionality of their products. In addition, many are investing in R&D to develop more reliable, cost-effective, and scalable solutions that meet the growing need for high-performance substations in renewable energy and large-scale industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco Systems, Inc.

- 9.3 Eaton Corporation

- 9.4 General Electric

- 9.5 Hitachi Energy

- 9.6 Hubbell

- 9.7 Larson & Toubro Limited

- 9.8 Locamation

- 9.9 Netcontrol Group

- 9.10 NR Electric Co. Ltd.

- 9.11 Ormazabal

- 9.12 Powell Industries

- 9.13 Schneider Electric

- 9.14 Siemens

- 9.15 Toshiba Energy Systems & Solutions Corporation

- 9.16 WEG

- 9.17 WAGO