PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755350

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755350

Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

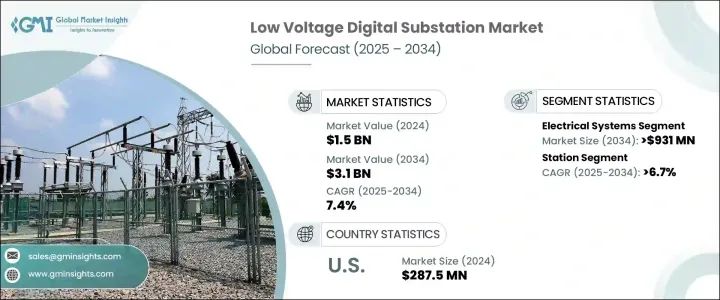

The Global Low Voltage Digital Substation Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 3.1 billion by 2034, driven by the widespread integration of IoT, artificial intelligence, and next-generation communication systems that are transforming traditional substations into intelligent, automated nodes. These digital systems offer real-time performance insights, proactive maintenance capabilities, and enhanced operational control. As the energy sector continues to shift toward renewables, the role of advanced grid infrastructure in managing variable energy inputs has become critical. Global investments in grid upgrades are increasing to support the reliable integration of alternative energy sources.

Additionally, technological innovations such as digital twin solutions, secure cloud-based monitoring, and advanced interfacing with SCADA and EMS platforms are elevating substation performance. These developments are reducing the lifecycle costs of equipment and improving asset utilization. Utilities are embracing this transformation to improve fault response, boost automation, and reduce unplanned outages. Predictive analytics and automated decision-making within these substations help streamline operations while lowering maintenance expenses and improving energy distribution efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.4% |

The electrical systems segment is projected to generate USD 931 million by 2034, driven by the rising demand for advanced protection, control, and monitoring technologies that ensure the seamless operation of modern power networks. As utilities face the growing complexity of managing distributed energy resources, especially from renewable sources, there is a pressing need for intelligent electrical components that offer real-time visibility and response. Enhanced relay systems, smart switchgear, and precision metering tools are increasingly being integrated to meet these evolving operational standards. These systems are critical for ensuring grid stability and performance in an environment of fluctuating energy input.

The bay segment held a 32.8% share in 2024, underscoring its fundamental role in digital substation architecture. Its contribution lies in offering highly modular configurations that can be adapted quickly to meet changing energy demands. Bay-level automation allows for faster fault localization, streamlined maintenance, and improved system availability. These functions reduce operational risks and enhance grid resilience. By digitizing the bay level, utilities expand or modify substation capacity without causing major disruptions, making it a core component in scalable and future-proof grid designs.

United States Low Voltage Digital Substation Market was valued at USD 287.5 million in 2024 fueled by extensive federal and state investments aimed at reinforcing energy infrastructure and improving grid intelligence. The country's continued leadership in renewable energy deployment, combined with aggressive targets for decarbonization and energy efficiency, is pushing utilities to adopt cutting-edge digital technologies. This environment creates a strong foundation for the widespread implementation of low-voltage digital substations across urban and rural grid networks.

Key players in the market include Schneider Electric, Powell Industries, Cisco Systems, Inc., Siemens, General Electric, Eaton Corporation, Hitachi Energy, ABB, Toshiba Energy Systems & Solutions Corporation, Larson & Toubro Limited, Hubbell, Netcontrol Group, WEG, and WAGO. To strengthen their market position, companies are deploying strategies such as investing in smart grid R&D, launching modular and interoperable digital substation solutions, and expanding digital service offerings. Partnerships with utilities and government bodies are helping to roll out pilot programs and secure large-scale deployments. Companies are also enhancing cybersecurity features in their products to address growing concerns over digital infrastructure safety. Further, expanding their presence in emerging markets and reinforcing after-sales service networks help players deliver complete digital substation solutions, ensuring long-term client retention and market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Industrial

Chapter 8 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 New

- 8.3 Refurbished

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cisco Systems, Inc.

- 10.3 Eaton Corporation

- 10.4 General Electric

- 10.5 Hitachi Energy

- 10.6 Hubbell

- 10.7 Larsen & Toubro Limited

- 10.8 Netcontrol Group

- 10.9 Powell Industries

- 10.10 Schneider Electric

- 10.11 Siemens

- 10.12 Toshiba Energy Systems & Solutions Corporation

- 10.13 WEG

- 10.14 WAGO