PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755354

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755354

Millets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

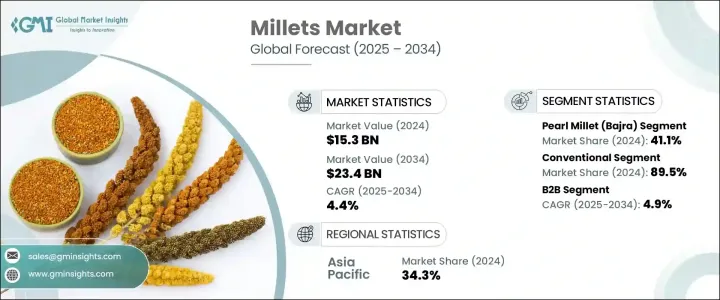

The Global Millets Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 23.4 billion by 2034. This growth is largely driven by rising consumer interest in healthy, gluten-free foods rich in fiber and protein. With increasing awareness about the nutritional benefits of millets, their inclusion in modern diets is becoming more common. Consumers are turning to millets not just for traditional consumption but also for their role in functional foods, wellness diets, and sustainable food practices. In recent years, millets have found a place in a wide range of new applications, especially in baked goods, snacks, and beverages, where they offer not just health benefits but also improved texture and taste.

Their ability to withstand harsh climatic conditions also makes them a reliable food source in regions with limited water availability, reinforcing their importance for food security. Innovations in processing and product development continue to drive millet consumption globally. As sustainability becomes a stronger focus across food systems, millets are being recognized as climate-smart grains, ideal for environmentally-conscious diets. Growing demand in urban markets for sustainable and plant-based food products further supports the market's long-term trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 4.4% |

Supportive policy frameworks and institutional incentives continue to fuel this market. Several global efforts to promote millet have significantly contributed to building awareness and driving investment in millet-based food industries. Governments and agricultural bodies are encouraging millet cultivation by offering financial support, creating value-chain infrastructure, and fostering entrepreneurship in millet product development. Such measures not only support farmers but also help streamline distribution and widen accessibility for both domestic and international markets.

By type, pearl millet led the market in 2024, holding a share of 41.1%, which equates to a market size of USD 6.3 billion. Each millet variety holds unique value based on its nutrient profile and suitability for different diets. While some are favored for their high protein or calcium content, others are gaining interest for their use in gluten-free and vegan diets. As global demand continues to shift towards clean-label and allergen-friendly foods, these grains are securing strong growth opportunities across regions.

Based on nature, in 2024, conventional millets dominated with an 89.5% share and are expected to grow at a higher CAGR of 5.8% during the forecast period. This segment continues to appeal to a broader consumer base due to affordability and easy availability. However, the organic millet segment is also witnessing increased interest, especially in urban markets where consumers are seeking chemical-free and eco-friendly food options. Government programs that promote sustainable agriculture are also enhancing the appeal of organically produced millets. Although organic millets currently occupy a smaller share, rising demand for clean nutrition is expected to boost their penetration, particularly in premium retail spaces and health-conscious demographics.

When segmented by form, the whole grain accounted for 39.7% of the total market share in 2024, maintaining strong relevance due to its nutritional richness and minimal processing. Millet flour continues to gain popularity globally as a versatile ingredient in gluten-free bakery products, including cookies, breads, and health snacks. Flakes are increasingly favored for breakfast cereals and snack bars, reflecting the market's alignment with modern, convenience-driven consumption patterns. With evolving dietary habits, the demand for millet-based ready-to-cook and ready-to-eat offerings is also rising, providing manufacturers the opportunity to introduce diverse product lines across retail shelves.

The B2B segment is expanding rapidly, with a projected CAGR of 4.9% through 2034. This growth is driven by increased demand from food manufacturers, institutional buyers, and animal feed producers who are integrating millet as a functional and sustainable ingredient in a wide variety of applications. The integration of millets into packaged foods, school meal programs, and private-label health foods is opening up large-scale procurement opportunities. As more industries tap into the health and sustainability benefits of millets, the B2B segment is expected to witness strong momentum.

Regionally, Asia Pacific held the largest revenue share in 2024 at 34.3%, fueled by high production and rising domestic consumption. The region continues to be a stronghold for millets due to historical cultivation patterns and increasing health awareness. Urbanization, rising incomes, and supportive agriculture policies are boosting millet usage not only in traditional diets but also in contemporary food innovations.

Key players in the millets market are actively implementing strategic initiatives to expand their market footprint and strengthen brand positioning. Leading companies are investing in product innovation by launching millet-based ready-to-eat meals, snacks, breakfast cereals, and gluten-free bakery items to cater to evolving consumer preferences. Many are collaborating with food tech startups and research institutions to develop nutrient-dense formulations that enhance shelf life and taste while retaining the grains' natural benefits. Strategic partnerships with retail chains and e-commerce platforms are also becoming common, allowing broader product visibility and consumer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pearl millet (Bajra)

- 5.3 Finger millet (Ragi)

- 5.4 Foxtail millet

- 5.5 Proso millet

- 5.6 Sorghum (Jowar)

- 5.7 Barnyard millet

- 5.8 Kodo millet

- 5.9 Little millet

- 5.10 Others

Chapter 6 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food

- 7.2.1 Bakery products

- 7.2.2 Breakfast cereals & porridges

- 7.2.3 Snacks & savory products

- 7.2.4 Infant food

- 7.2.5 Traditional foods

- 7.2.6 Others

- 7.3 Beverages

- 7.3.1 Alcoholic beverages

- 7.3.2 Non-alcoholic beverages

- 7.4 Animal feed

- 7.4.1 Poultry feed

- 7.4.2 Cattle feed

- 7.4.3 Others

- 7.5 Nutraceuticals & dietary supplements

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Whole grain

- 8.3 Flour

- 8.4 Flakes

- 8.5 Ready-to-cook

- 8.6 Ready-to-eat

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.2.1 Food manufacturers

- 9.2.2 Animal feed industry

- 9.2.3 HoReCa (Hotels, Restaurants, Cafes)

- 9.2.4 Others

- 9.3 B2C

- 9.3.1 Supermarkets & Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Convenience stores

- 9.3.4 Online retail

- 9.3.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Archer Daniels Midland Company

- 11.3 Cargill, Incorporated

- 11.4 Bunge Limited

- 11.5 Kellogg Company

- 11.6 PepsiCo, Inc. (Quaker Oats)

- 11.7 General Mills, Inc.

- 11.8 Britannia Industries Ltd.

- 11.9 ITC Limited

- 11.10 Patanjali Ayurved Limited

- 11.11 Organic India Pvt. Ltd.

- 11.12 24 Mantra Organic (Sresta Natural Bioproducts)

- 11.13 Nature's Path Foods

- 11.14 Bob's Red Mill Natural Foods

- 11.15 Arrowhead Mills (Hain Celestial Group)