PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755359

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755359

Industrial Vacuum Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

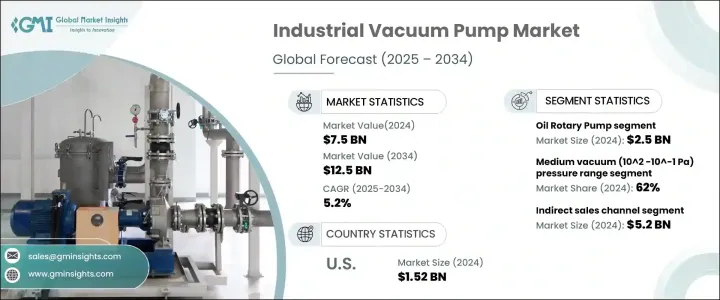

The Global Industrial Vacuum Pump Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 12.5 billion by 2034, driven by the increasing demand across multiple end-use sectors. These vacuum pumps are extensively used in industries requiring precision manufacturing and high-purity processing, contributing significantly to market expansion. Their widespread application across sectors dealing with sensitive operations requiring a controlled environment has solidified their relevance in industrial workflows.

As the semiconductor segment advances, it fuels demand in interconnected markets. With rising industrial automation and cleaner production standards, vacuum pump technology is increasingly being adopted across the globe. Nevertheless, the high upfront investment and the ongoing maintenance costs remain major deterrents, especially for smaller companies. In addition, the operational complexity and the need for technical expertise make adoption more challenging in less advanced setups, creating growth limitations in emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 5.2% |

Many of these regions face a shortage of skilled technicians and lack access to specialized training programs, essential for managing and maintaining modern vacuum systems. Even routine troubleshooting or maintenance can become a significant hurdle, leading to increased downtime and reduced equipment lifespan. Moreover, the high cost associated with technical staffing, coupled with limited infrastructure to support complex machinery, further deters smaller industries from upgrading to advanced vacuum pump technologies.

The oil rotary pump segment generated USD 2.5 billion in 2024 and is projected to maintain strong momentum with a CAGR of 5% through 2034. These pumps are particularly valued for their stable vacuum output and ability to withstand continuous, demanding operations under variable pressure conditions. Their robust construction and high performance make them a go-to solution in industrial environments where precision and consistency are mission-critical. Their adaptability to harsh process environments and minimal downtime further boost their utility across various sectors, from material processing to vacuum coating.

From a distribution standpoint, the indirect sales segment generated USD 5.2 billion in 2024 and is anticipated to grow at a CAGR of 4.7% through 2034. The success of indirect sales is driven by a well-established network of distributors, resellers, and digital marketplaces that offer a broad selection of vacuum pump products. These channels simplify procurement for end-users but provide value-added services like system customization, technical training, post-purchase support, and faster delivery through regional inventories.

United States Industrial Vacuum Pump Market was valued at USD 1.52 billion in 2024, projected to grow at a CAGR of 5.2% by 2034. This leadership is fueled by the country's advanced infrastructure in sectors requiring high-purity manufacturing processes, such as electronics, pharmaceuticals, and specialty chemicals. Government support for modernizing manufacturing and the widespread integration of automation technologies further strengthens the market outlook.

Prominent companies contributing to the Global Industrial Vacuum Pump Market include Gardner Denver, Ebara Corporation, Pfeiffer Vacuum GmbH, Atlas Copco AB (Edwards), ULVAC Inc., Flowserve Corporation, Global Vac, Wintek Corporation, Ingersoll Rand Inc., Busch Vacuum Solutions, Becker Pumps Corporation, Tsurumi Manufacturing Co. Ltd, Graham Corporation, and Agilent Technologies. Key strategies adopted by leading players in the industrial vacuum pump market include a strong focus on product innovation, capacity expansion, and strategic mergers or partnerships. Companies are investing in R&D to introduce energy-efficient and smart vacuum technologies, targeting increased automation and digital integration. Collaborations with industry-specific OEMs help broaden their application reach. Geographic expansion through distribution networks ensures stronger regional footprints, while after-sales services and customized offerings help boost customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Cost to customers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook & future considerations

- 3.2.1 Trade impact

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand in semiconductor and electronics industry

- 3.3.1.2 Expansion in chemical and pharmaceutical industries

- 3.3.1.3 Rising adoption in food and beverage industry

- 3.3.1.4 Growth in manufacturing and industrial processes

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High initial investment and maintenance costs

- 3.3.2.2 Complexity and technical challenges

- 3.3.1 Growth drivers

- 3.4 Technology & innovation landscape

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Liquid ring vacuum pump

- 5.3 Oil rotary pump

- 5.4 Roots pump

- 5.5 Dry vacuum pump

- 5.6 Multi-stage roots vacuum pump

- 5.6.1 Dry screw vacuum pump

- 5.6.2 Dry scroll vacuum pump

- 5.6.3 Dry diaphragm vacuum pump

- 5.6.4 Dry rotary vane vacuum pump

- 5.6.5 Dry rocking piston vacuum pump

- 5.6.6 Dry rotary crow vacuum pump

- 5.6.7 Dry turbo vacuum pump

Chapter 6 Market Estimates & Forecast, By Pressure Range, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low vacuum (10^5-10^2 Pa)

- 6.3 Medium vacuum (10^2 -10^-1 Pa)

Chapter 7 Market Estimates & Forecast, By Size, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Small (< 10 m3/h)

- 7.3 Medium (10-100 m3/h)

- 7.4 Large (> 100 m3/h)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Semiconductor

- 8.3 Water & wastewater treatment

- 8.4 Chemicals and petrochemicals

- 8.5 Mining

- 8.6 Food and beverages

- 8.7 Construction

- 8.8 Oil & gas

- 8.9 Pharmaceutical

- 8.10 Others (Agricultural, textile, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Agilent Technologies

- 11.2 Atlas Copco AB (Edwards)

- 11.3 Becker Pumps Corporation

- 11.4 Busch Vacuum Solutions

- 11.5 Ebara Corporation

- 11.6 Flowserve Corporation

- 11.7 Gardner Denver

- 11.8 Global Vac

- 11.9 Graham Corporation

- 11.10 Ingersoll Rand Inc.

- 11.11 Pfeiffer Vacuum GmbH

- 11.12 Tsurumi Manufacturing Co. Ltd

- 11.13 ULVAC Inc.

- 11.14 Wintek Corporation