PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755362

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755362

Utility-Scale Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

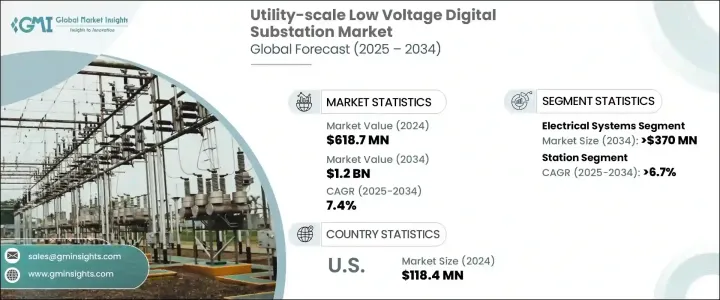

The Global Utility Scale Low Voltage Digital Substation Market was valued at USD 618.7 million in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 1.2 billion by 2034, driven by the increasing demand for more intelligent substations that can adapt to fluctuating energy outputs. These advanced substations help stabilize the grid by seamlessly integrating variable power sources and improving overall operational efficiency. The rise of smart grids is further accelerating the need for real-time monitoring, automated control systems, and high-accuracy fault detection, which are all effectively supported by digital substations that utilize intelligent electronic devices and standardized communication frameworks. This evolution supports a more responsive and efficient grid infrastructure.

Real-time data from IoT-enabled sensors in digital substations allows operators to track equipment conditions continuously, generating insights that were previously inaccessible through conventional means. Leveraging advanced AI and data analytics, these systems can identify potential issues early and trigger timely interventions before failures occur. Predictive maintenance reduces unplanned downtime and helps utilities focus resources where needed, enhancing workforce efficiency and system performance. In parallel, robust cybersecurity frameworks have become essential to ensure the secure operation of digital substations in an increasingly connected energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $618.7 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 7.4% |

The station-level architecture is forecasted to grow at a CAGR of 6.7% through 2034, driven by a strong push toward grid modernization. These station systems play a central role by aggregating critical data from various substation levels, allowing for real-time control and enhanced system protection. As digital infrastructure becomes more vital, global investment flows emphasize station-level upgrades, positioning these hubs as key enablers of smart, automated, and agile power distribution networks across metropolitan and industrial regions. With utilities focused on resilience and responsiveness, digitization at this level is gaining strong traction.

In the utility-scale low voltage digital substation market, the electrical systems segment is projected to reach USD 370 million by 2034, driven by several critical technological, operational, and strategic factors influencing global utility operations. These systems-including switchgear, circuit breakers, transformers, busbars, and protection relays-serve as the core functional components enabling the transmission and control of power within digital substations. As utility providers modernize grid infrastructure to enhance efficiency, reliability, and automation, the demand for advanced electrical systems is surging.

United States Utility-Scale Low Voltage Digital Substation Market reached USD 118.4 million in 2024. This steady growth trajectory reflects the nation's commitment to grid modernization and its well-established energy infrastructure. Backed by substantial federal and state-level funding, the U.S. continues to lead in deploying intelligent substation technologies that improve grid visibility, resilience, and performance across utility-scale operations.

Leading industry players include Eaton Corporation, General Electric, WAGO, Netcontrol Group, WEG, Cisco Systems, Inc., Powell Industries, Toshiba Energy Systems & Solutions Corporation, Hitachi Energy, Larson & Toubro Limited, Siemens, Hubbell, ABB, and Schneider Electric. To strengthen their market presence, companies in this sector are deploying multiple strategic initiatives. They are investing heavily in R&D to introduce interoperable, cyber-secure digital substation solutions that align with evolving grid standards. Collaborations and joint ventures are being formed to leverage complementary technologies and broaden market outreach. Key players are also entering new geographic markets and scaling manufacturing capabilities to meet rising global demand. Through customer-centric innovations and integrated service models, these companies reinforce long-term partnerships with utilities and government entities to sustain competitive advantage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco Systems, Inc.

- 9.3 Eaton Corporation

- 9.4 General Electric

- 9.5 Hitachi Energy

- 9.6 Hubbell

- 9.7 Larson & Toubro Limited

- 9.8 Netcontrol Group

- 9.9 Powell Industries

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 Toshiba Energy Systems & Solutions Corporation

- 9.13 WEG

- 9.14 WAGO