PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755363

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755363

North America Soy Protein Concentrate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

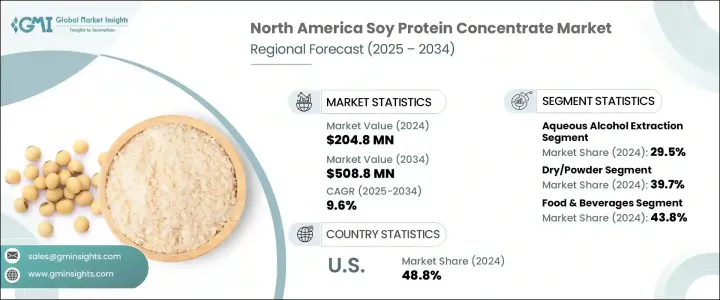

North America Soy Protein Concentrate Market was valued at USD 204.8 million in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 508.8 million by 2034. The growth is fueled by rising consumer interest in plant-based proteins, driven by health-conscious lifestyles and rising adoption of vegan and flexitarian diets. Soy protein concentrate has become a popular ingredient due to its high protein content and versatility in applications such as nutraceuticals, dairy alternatives, and meat substitute products. Technological progress in food processing is also making soy-based offerings more appealing by enhancing taste, texture, and nutritional value. Consumers are increasingly aware of the environmental benefits of plant-based diets, which further supports market adoption.

Increased government support and innovation in sustainable food production are accelerating growth. Manufacturers respond to clean label demands by developing minimally processed products that align with natural ingredient preferences. The use of soy protein concentrate is also growing in the animal feed industry, where it improves feed quality and supports sustainable livestock farming. Improved extraction methods have product purity and sensory appeal, reinforcing market performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $204.8 Million |

| Forecast Value | $508.8 Million |

| CAGR | 9.6% |

The aqueous alcohol extraction process accounted for a 29.5% share in 2024, generating USD 60.5 million. This traditional method uses food-safe alcohols to extract soluble sugars while preserving protein integrity, making it suitable for human consumption. Other methods like acid leaching offer higher protein yields with reduced carbohydrate content, ideal for use in plant-based dairy and meat alternatives. These evolving techniques are helping manufacturers enhance the functional properties and sustainability profile of their products.

The dry or powdered segment held a 39.7% share in 2024 and is projected to grow at a CAGR of 9.4%. Dry forms of soy protein concentrate are widely favored for their longer shelf life, flexibility in food formulations, and ease of transport. These are extensively used in snacks, baked items, and meat substitutes. Liquid concentrates are gaining ground in beverage and infant nutrition sectors due to their ease of blending and convenience, despite having a shorter shelf life. Textured soy protein, also known as TVP, continues to gain attention as a meat substitute with a texture that mimics real meat, offering a protein-rich, eco-friendly alternative for consumers.

United States Soy Protein Concentrate Market held 48.8% share in 2024 supported by strong consumer demand for plant-based protein products, government backing for sustainable agriculture, and the large-scale use of soy protein in both food products and animal feed. The region's dynamic poultry sector also contributes to soy protein concentrate usage in livestock nutrition, supporting the dual expansion across both food and agriculture sectors.

Key players in the North America Soy Protein Concentrate Market include Lactalis International, Cargill, Incorporated, DuPont de Nemours, Inc., Wilmar International Ltd, and Kerry Group plc. To strengthen their market position, companies in the North America soy protein concentrate industry are adopting a combination of strategic actions. These include investment in R&D to enhance processing methods, improve taste profiles, and reduce anti-nutritional factors. Businesses are forming partnerships with food manufacturers to create custom formulations and expand their presence across new application areas such as dairy alternatives and performance nutrition. Expanding production capacity and establishing local sourcing agreements are also helping reduce costs and secure supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Methodology and Scope

- 1.2 Research methodology

- 1.3 Research scope & assumptions

- 1.4 List of data sources

- 1.5 Market estimation technique

- 1.6 Research limitations

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Manufacturers

- 3.1.4 Distributors

- 3.1.5 Impact on trade

- 3.1.6 Trade volume disruptions

- 3.2 Retaliatory Measures

- 3.3 Impact on the Industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side Impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Growing demand for plant-based proteins

- 3.11.1.2 Increasing health consciousness among consumers

- 3.11.1.3 Rising adoption in food processing industry

- 3.11.1.4 Cost-effectiveness compared to animal proteins

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Competition from other plant protein sources

- 3.11.2.2 Allergen concerns

- 3.11.3 Market Opportunities

- 3.11.1 Growth drivers

- 3.12 Production process analysis

- 3.12.1 Aqueous alcohol extraction

- 3.12.2 Acid leaching process

- 3.12.3 Heat denaturation process

- 3.12.4 Membrane filtration technologies

- 3.12.5 Electroacidification process

- 3.13 Raw material analysis and sourcing strategies

- 3.13.1 Soybean varieties and their impact on concentrate quality

- 3.13.2 GMO vs. non-GMO soybeans

- 3.13.3 Sustainable sourcing practices

- 3.13.4 Supply chain sustainability

- 3.14 Nutritional profile analysis

- 3.14.1 Protein content and quality

- 3.14.2 Amino acid profile

- 3.14.3 Fiber content

- 3.14.4 Micronutrient composition

- 3.14.5 Comparison with other protein sources

- 3.15 Regulatory framework and government initiatives

- 3.15.1 FDA regulations and health claims

- 3.15.2 USDA guidelines

- 3.15.3 Canadian food inspection agency regulations

- 3.15.4 Mexican regulatory framework

- 3.15.5 Labeling requirements

- 3.15.6 GMO regulations

- 3.16 Consumer trends and acceptance analysis

- 3.16.1 Consumer perception of soy protein concentrate

- 3.16.2 Demographic analysis of soy protein consumers

- 3.16.3 Purchasing behavior and decision factors

- 3.16.4 Awareness and knowledge of health benefits

- 3.16.5 Barriers to adoption

- 3.16.6 Comparison with other protein sources

- 3.16.7 Regional variations in consumer preferences

- 3.16.8 Future consumer trends

- 3.17 Sustainability and Environmental Impact

- 3.17.1 Environmental footprint of soy protein concentrate production

- 3.17.2 Comparison with animal protein production

- 3.17.3 Water and land use efficiency

- 3.17.4 Carbon footprint analysis

- 3.17.5 Sustainable farming practices

- 3.17.6 Waste management and by-product utilization

- 3.17.7 Industry initiatives for sustainability

- 3.17.8 Future sustainability challenges and opportunities

- 3.18 Future outlook and emerging trends

- 3.18.1 Technological innovations in processing

- 3.18.2 Emerging applications

- 3.18.3 Product development trends

- 3.18.4 Market growth projections (2035-2040)

- 3.18.5 Impact of alternative proteins on market dynamics

- 3.18.6 Changing regulatory landscape

- 3.18.7 Future of sustainable protein production

- 3.18.8 Strategic recommendations for stakeholders

- 3.19 Growth potential analysis

- 3.20 Porter's analysis

- 3.21 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Market share analysis

- 4.3 Strategic framework

- 4.3.1 Mergers & acquisitions

- 4.3.2 Joint ventures & collaborations

- 4.3.3 New product developments

- 4.3.4 Expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Vendor landscape

- 4.6 Competitive positioning matrix

- 4.7 Strategic dashboard

- 4.8 Brand positioning & consumer perception analysis

- 4.9 Market entry strategies for new players

- 4.10 Private label analysis & strategies

Chapter 5 Market Estimates and Forecast, By Production Process, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Aqueous alcohol extraction

- 5.3 Acid leaching process

- 5.4 Heat denaturation process

- 5.5 Membrane filtration technologies

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry/Powder

- 6.3 Liquid

- 6.4 Textured

- 6.5 Others

Chapter 7 -Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverages

- 7.2.1 Meat products & alternatives

- 7.2.2 Bakery & confectionery

- 7.2.3 Dairy alternatives

- 7.2.4 Beverages

- 7.2.5 Infant nutrition

- 7.2.6 Others

- 7.3 Animal feed

- 7.3.1 Aquaculture feed

- 7.3.2 Poultry feed

- 7.3.3 Swine feed

- 7.3.4 Ruminant feed

- 7.3.5 Pet food

- 7.3.6 Others

- 7.4 Sports nutrition

- 7.4.1 Protein powders

- 7.4.2 Protein bars

- 7.4.3 Ready-to-drink beverages

- 7.4.4 Others

- 7.5 Pharmaceuticals & nutraceuticals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Organic

- 8.4 Non-GMOs

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.2.1 Food & beverage manufacturers

- 9.2.2 Animal feed manufacturers

- 9.2.3 Nutraceutical companies

- 9.2.4 Others

- 9.3 B2C

- 9.3.1 Hypermarkets/supermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Others

Chapter 10 Market Estimates and Forecast, By Country, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

Chapter 11 Company Profiles

- 11.1 Archer Daniels Midland Company

- 11.2 Cargill, Incorporated

- 11.3 DuPont de Nemours, Inc.

- 11.4 Wilmar International Ltd.

- 11.5 CHS Inc.

- 11.6 Kerry Group plc

- 11.7 Bunge Limited

- 11.8 Foodchem International Corporation

- 11.9 Devansoy Inc.

- 11.10 Gushen Biological Technology Group Co., Ltd.

- 11.11 Solae LLC (DuPont)

- 11.12 Ingredion Incorporated

- 11.13 AGT Food and Ingredients

- 11.14 Sojaprotein

- 11.15 The Scoular Company

- 11.16 Fuji Oil Holdings Inc.

- 11.17 Crown Soya Protein Group

- 11.18 Nutra Food Ingredients

- 11.19 Farbest Brands

- 11.20 Shandong Yuxin Bio-Tech Co., Ltd. (Saputo)