PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755364

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755364

Automotive Weigh in Motion Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

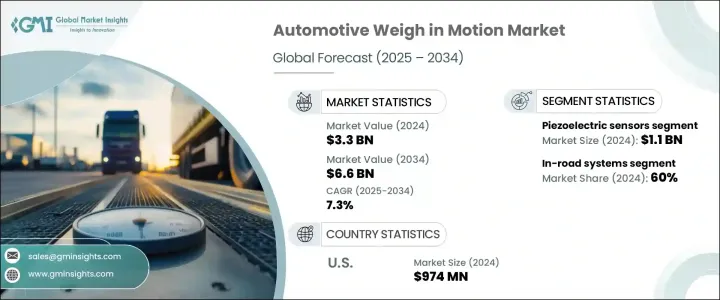

The Global Automotive Weigh in Motion Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 6.6 billion by 2034. This upward trend is fueled by rising demand for intelligent traffic solutions and real-time vehicle weight tracking across freight corridors, toll booths, highways, and logistics hubs. The expanding need for accurate, dynamic vehicle weighing without halting traffic is leading to the widespread adoption of WIM technologies. Governments and transportation authorities are increasingly turning to WIM systems to boost road safety, extend road lifespans, and ensure compliance with axle-load regulations. With the integration of artificial intelligence, advanced sensors, and real-time data analytics, WIM systems are becoming more reliable, efficient, and intelligent across transportation infrastructures worldwide.

These systems now include cloud integration, embedded cameras, high-speed data transfer, and remote diagnostics to streamline traffic management. The use of IoT-powered sensors, predictive maintenance features, and digital twin simulations has also reshaped infrastructure planning. Built-in tamper resistance, cybersecurity protocols, and compliance features further support safe and efficient road monitoring. These innovations empower authorities and commercial operators to cut costs, enhance operational efficiency, and reduce traffic disruptions while improving environmental sustainability across both urban and long-haul transport routes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 billion |

| Forecast Value | $6.6 billion |

| CAGR | 7.3% |

The piezoelectric sensors segment generated USD 1.1 billion in 2024, making it the leading sensor type in the global WIM market. Their widespread use stems from their high signal sensitivity, compact size, and ability to measure weights at highway speeds. These sensors are a preferred choice for transportation authorities due to their straightforward installation process and minimal upkeep needs. They are particularly effective in large-scale deployments, where scalable and cost-efficient systems are essential. Their compatibility with existing road infrastructure, as well as their ability to support traffic data applications, toll operations, and freight analytics, makes them highly attractive in smart mobility projects.

In 2024, in-road systems led the market with a 60% share. These systems are directly embedded into roadways and provide continuous, accurate weight data without causing traffic delays. They are ideally suited for high-traffic corridors, freight transport routes, and toll stations. Their seamless integration into intelligent transportation networks enables automation, improves enforcement accuracy, and increases operational throughput. Authorities rely on in-road WIM systems to carry out high-speed vehicle classification, real-time compliance checks, and dynamic vehicle assessments, all without manual intervention. Their low visibility and high performance make them vital tools in road infrastructure optimization and regulatory enforcement.

U.S. Automotive Weigh in Motion Market generated USD 974 million in 2024 and is estimated to grow at a CAGR of 7.6% through 2034. The country's strong push toward infrastructure modernization and digital transformation in transportation has positioned it as a key leader in WIM adoption. The focus on preserving road quality, managing freight volumes, and adhering to axle-load compliance rules has driven nationwide deployments of advanced weight monitoring systems. With one of the most extensive highway systems globally, the U.S. continues to invest in high-precision WIM technology for both urban and rural freight corridors. Backed by federal and state-level funding, robust ITS ecosystems, and increasing data-driven transport policy initiatives, the U.S. market remains a key hub for innovation and deployment of next-gen weigh-in-motion platforms.

Key industry participants in the Automotive Weigh in Motion Market include Intercomp, SWARCO AG, Kistler, Q-Free ASA, Kapsch TrafficCom, Siemens Mobility, TE Connectivity, TDC Systems Ltd., Econolite, and International Road Dynamics. To enhance their position in the automotive weigh-in-motion market, companies are focusing on continuous innovation, particularly in AI-powered weight analytics, sensor integration, and smart infrastructure compatibility. Investments in cloud connectivity, machine learning, and edge computing help deliver real-time diagnostics and automated vehicle classification. Firms are also offering scalable modular systems to meet varying roadway conditions and traffic densities. Collaborations with transportation authorities and smart city planners have become central to expanding application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Installation

- 2.2.3 Sensor

- 2.2.4 Axle configuration

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 In-road systems

- 5.3 Weight bridge systems

- 5.4 Onboard systems

Chapter 6 Market Estimates & Forecast, By Sensor, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Piezoelectric sensors

- 6.3 Bending plate

- 6.4 Single load cell

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Axle Configuration, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Single axle

- 7.3 Tandem axle

- 7.4 Triple axle

- 7.5 Quad axle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Weight enforcement

- 8.3 Traffic data collection

- 8.4 Weight based tolling

- 8.5 Bridge protection

- 8.6 Industrial truck weighing

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Government

- 9.3 Transportation

- 9.4 Private sector

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adient

- 11.2 Applus

- 11.3 Axis Communications

- 11.4 Cestel

- 11.5 Continental

- 11.6 Econolite

- 11.7 Efftronics Systems

- 11.8 Golden River

- 11.9 IAC Group

- 11.10 Intercomp

- 11.11 International Road Dynamics

- 11.12 Kapsch TrafficCom

- 11.13 Kasai Kogyo

- 11.14 Q-Free ASA

- 11.15 Siemens Mobility

- 11.16 SWARCO AG

- 11.17 TDC Systems

- 11.18 TE Connectivity

- 11.19 Wavetronix

- 11.20 WIM Systems