PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755370

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755370

Hygienic Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

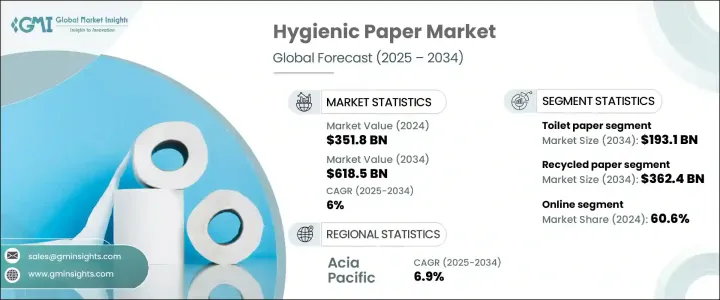

The Global Hygienic Paper Market was valued at USD 351.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 618.5 billion by 2034. The market's strong growth trajectory is largely driven by rising consumer preference for eco-friendly products, heightened hygiene standards, and growing environmental consciousness. Shoppers today are increasingly aware of their ecological impact and actively seek sustainable alternatives that align with green values. This shift in behavior has fueled a surge in demand for recycled hygienic paper, especially as consumers place a premium on safety and environmental protection. Public concern over global health issues has also contributed to the widespread adoption of tissues, wipes, and other hygiene-related products as both individual and community hygiene practices continue to evolve.

This behavioral transition is being reinforced by a broader cultural movement toward sustainability, heavily influenced by environmental education and widespread media coverage. Businesses are responding by redesigning products and supply chains to reflect these values, ensuring they stay relevant in a rapidly changing market. Sustainable innovation and corporate responsibility are now central to competitive strategies. Governments are also playing a role by enacting stricter environmental policies while offering incentives to encourage sustainable manufacturing. These regulations, coupled with consumer expectations and technological improvements, are leading to the development of eco-conscious products that meet hygiene standards without compromising environmental integrity. The use of advanced materials and sustainable processes has made it feasible to produce hygienic paper that is both effective and environmentally responsible, creating long-term growth potential for the global market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $351.8 Billion |

| Forecast Value | $618.5 Billion |

| CAGR | 6% |

The hygienic paper market is segmented by type into toilet paper, facial tissues, paper towels, napkins, wet wipes, and others, which include kitchen and medicinal paper. Among these, toilet paper held the dominant share in 2024, generating USD 104 billion in revenue, and is projected to reach USD 193.1 billion by 2034. Its widespread usage in homes, businesses, and public restrooms ensures steady demand. Unlike other hygienic paper products, toilet paper is non-substitutable and consumed consistently across demographics and geographies. In many developing nations, growing urban populations and access to modern sanitation have further fueled usage. Bulk purchasing habits also contribute to the product's reliability as a staple in the hygiene paper segment.

In terms of sources, the market is categorized into virgin pulp and recycled paper. In 2024, recycled paper dominated with a market value of USD 203.1 billion and is expected to climb to USD 362.4 billion by 2034. This segment continues to lead due to the increasing consumer and business preference for environmentally safe options. Recycled hygienic paper not only minimizes waste but also offers cost advantages, making it attractive for both manufacturers and buyers. Improvements in recycling processes have significantly enhanced product quality, bridging the gap between performance and sustainability. In contrast, virgin pulp, while offering high-end quality for premium products, involves resource-intensive extraction methods that negatively impact the environment. These factors make recycled paper the more viable option as sustainability gains traction globally.

Distribution channels in the hygienic paper market include online and offline platforms. In 2024, online sales accounted for approximately 60.6% of the market and are expected to grow at a CAGR of 6.5% through 2034. Digital platforms have gained dominance due to shifting consumer preferences for convenient, fast, and contactless shopping. E-commerce enables easy price comparison, access to a wide product range, and subscription-based purchasing, which suits both individuals and corporate buyers. Moreover, many manufacturers are strengthening their direct-to-consumer strategies through enhanced online experiences, making digital channels even more appealing.

Regionally, Asia Pacific captured a significant share of the global hygienic paper market in 2024 and is projected to grow at the highest CAGR of 6.9% during the forecast period. Within this region, China alone contributed over USD 78 billion in 2024 and is on track to reach USD 158.7 billion by 2034. Rising urbanization, improved living standards, and increasing disposable income are key factors boosting demand. With heightened awareness around hygiene and eco-friendly practices, consumers in the region are embracing high-quality and branded paper products. Manufacturers are also responding with investments in regional production and distribution infrastructure to support this growing demand.

Leading companies in the hygienic paper industry are focusing on sustainability, product innovation, and efficient supply chain management to remain competitive. Key players are aligning their business strategies with global environmental trends and evolving consumer expectations to maintain market share and achieve long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Supplier Landscape

- 3.1.3 Profit margin analysis

- 3.1.4 Disruptions

- 3.1.5 Future outlook

- 3.1.6 Manufacturers

- 3.1.7 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer preference for eco-friendly products

- 3.2.1.2 Increased Hygiene Standard

- 3.2.1.3 Growing awareness of environmental issues and a shift towards sustainable practices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Energy-intensive processes required for paper production

- 3.2.2.2 Raw material costs and supply chain issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.4.5 Preferred price range

- 3.5 Regulatory landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.1.3 Company market share analysis

- 4.1.4 Competitive positioning matrix

- 4.1.4.1 Product positioning

- 4.1.4.2 Price-performance positioning

- 4.1.4.3 Geographic presence

- 4.1.4.4 Innovation capabilities

- 4.1.5 Strategic dashboard

- 4.1.5.1 Competitive benchmarking

- 4.1.5.1.1 Manufacturing capabilities

- 4.1.5.1.2 Product portfolio strength

- 4.1.5.1.3 Distribution network

- 4.1.5.1.4 R&D investments

- 4.1.5.2 Strategic initiatives assessment

- 4.1.5.3 SWOT analysis of key players

- 4.1.5.4 Future competitive outlook

- 4.1.5.1 Competitive benchmarking

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (Triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (Center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

- 8.3.1 HoReCa

- 8.3.2 Corporate

- 8.3.3 Healthcare

- 8.3.4 Others (Spa, Institutional, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Supermarket/hypermarket

- 9.3.2 Specialty stores

- 9.3.3 Others (Individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 APP

- 11.2 Cascades

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Hengan

- 11.6 Kimberly-Clark

- 11.7 Mondi

- 11.8 Nine Dragons Paper

- 11.9 Oji

- 11.10 Paperlinx

- 11.11 Procter & Gamble

- 11.12 Sofidel

- 11.13 Suzano

- 11.14 Vinda

- 11.15 Wausau Paper