PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755374

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755374

Low Voltage Industrial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

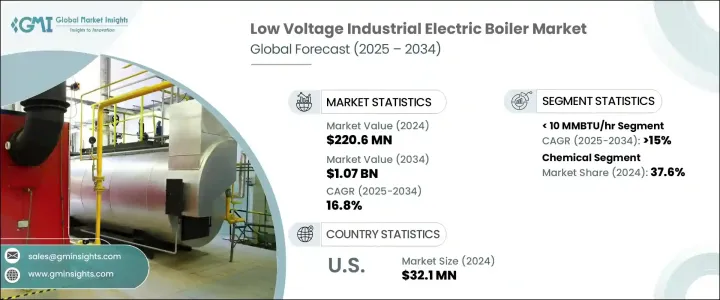

The Global Low Voltage Industrial Electric Boiler Market was valued at USD 220.6 million in 2024 and is estimated to grow at a CAGR of 16.8% to reach USD 1.07 billion by 2034. The increasing demand for energy-efficient heating solutions, backed by supportive government incentives for cleaner energy systems, is reshaping the industrial landscape. This shift is further amplified by the growing emphasis on decarbonization and the push to meet strict emission standards, particularly concerning sulfur oxides (SOx) and nitrogen oxides (NOx) in industrial zones. With rising energy costs and increasing environmental regulations, industries are prioritizing cleaner, more efficient heating systems to stay compliant and reduce operational costs.

Another factor driving this momentum is the integration of artificial intelligence into industrial heating applications. AI-driven optimization is enhancing the performance and energy efficiency of electric boilers, making them a preferred choice for modern industrial operations. In tandem with this, heightened investments in sustainable infrastructure and energy modernization across key regions are adding further fuel to market expansion. Industrial users are also channeling resources into research and development to enhance electric boiler performance, safety, and automation, creating additional growth opportunities. The rising importance of sustainability in manufacturing and processing environments is compelling firms to explore systems that offer low emissions, compatibility with renewable sources, and simplified integration into existing operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $220.6 Million |

| Forecast Value | $1.07 Billion |

| CAGR | 16.8% |

Low voltage industrial electric boilers are specifically engineered to generate steam or hot water using electric energy, delivering minimal emissions and high energy efficiency. Their compatibility with renewable energy grids and compliance with emerging automation and safety standards make them well-suited for modern industrial operations. Advanced industrial design requirements continue to evolve, and the need for precision-engineered, scalable systems is contributing to higher adoption rates. These boilers are not only cost-effective in the long term but also align with broader sustainability goals, allowing industries to reduce their carbon footprint without sacrificing performance or reliability.

In terms of capacity segmentation, the market is categorized into 10 MMBTU/hr, 10-50 MMBTU/hr, 50-100 MMBTU/hr, and above 100 MMBTU/hr. The rapid pace of innovation in heating technology, alongside increasing energy prices, is encouraging industries to adopt more efficient and adaptable boiler systems. The 10 MMBTU/hr capacity segment is anticipated to expand at a CAGR of over 15% through 2034. These systems are particularly favored by small and mid-sized manufacturers due to their modularity, low installation costs, compact footprint, and silent operation. Moreover, the rising focus on energy optimization and changing environmental regulations is contributing to the growing preference for these lower-capacity units across various industries.

From an application standpoint, the market includes segments such as paper, refinery, food and beverages, chemical, and others. The chemical sector is projected to hold a significant market share of 37.6% in 2024. A growing emphasis on operational efficiency and increased capital spending on chemical infrastructure in leading economies is driving demand for high-performance electric boiler systems. These units support the stringent temperature and pressure requirements typical in chemical processing while meeting emission compliance standards.

In regional terms, the market in the United States has demonstrated consistent growth, with values estimated at USD 24.8 million in 2022, USD 27.9 million in 2023, and USD 32.1 million in 2024. Federal tax credits promoting clean energy transition, especially in industrial sectors, combined with adherence to global emission reduction frameworks, are encouraging the adoption of electric industrial heating systems. These efforts are playing a pivotal role in shaping the industry outlook in the U.S., with more industries upgrading their existing systems to meet modern energy and environmental benchmarks.

North America, as a whole, is expected to witness strong market expansion with a projected CAGR of over 20% through 2034. The region's booming industrial sector, coupled with continuous technological advancements and favorable public-private initiatives, is fostering a dynamic growth environment. Strategic collaborations between government bodies and private enterprises for the development and expansion of industrial infrastructure are creating fertile ground for the increased deployment of electric boilers.

Leading players in the low voltage industrial electric boiler market include major manufacturers and technology firms, each contributing to the advancement of boiler technologies and system integration. Their collective focus remains on innovation, energy efficiency, and environmental compliance, which are all central to the industry's long-term growth strategy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 50 MMBTU/hr

- 5.4 50 - 100 MMBTU/hr

- 5.5 > 100 MMBTU/hr

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.3 Paper

- 6.4 Chemical

- 6.5 Refinery

- 6.6 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Hot water

- 7.3 Steam

Chapter 8 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Dealer

- 8.4 Retail

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 ALFA LAVAL

- 10.2 Acme Engineering Products

- 10.3 ACV

- 10.4 Babcock Wanson

- 10.5 Bosch Industriekessel

- 10.6 Cerney

- 10.7 Chromalox

- 10.8 Cleaver-Brooks

- 10.9 Danstoker A/S

- 10.10 Ecotherm Austria

- 10.11 FERROLI

- 10.12 Klopper-Therm

- 10.13 LACAZE ENERGIES

- 10.14 PARAT Halvorsen AS

- 10.15 Precision Boilers

- 10.16 Reimers Electra Steam

- 10.17 Ross Boilers

- 10.18 Thermodyne Boilers

- 10.19 Thermon

- 10.20 Thermona

- 10.21 Vapor Power