PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755379

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755379

Utility Scale High Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

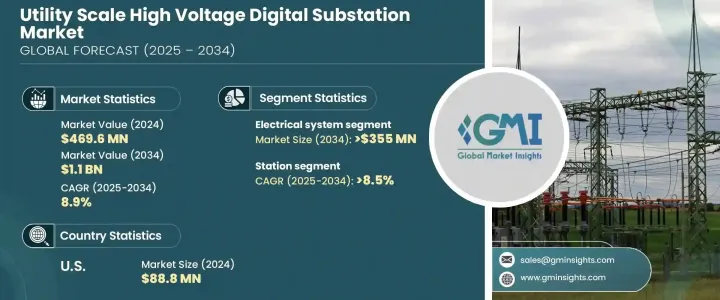

The Global Utility Scale High Voltage Digital Substation Market was valued at USD 469.6 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 1.1 billion by 2034, fueled by rapid advancements in digital technology and an increasing emphasis on grid modernization. Utilities are increasingly adopting automation and remote monitoring solutions to cut operational costs and minimize downtime.

The rise of renewable energy sources, particularly solar and wind, has highlighted the need for more efficient and reliable energy distribution systems further driving the adoption of high-voltage digital substations. These substations integrate renewable power into existing grids while maintaining stability and reliability. Advanced smart grid technologies enable real-time monitoring, automated control, and improved data analytics, ensuring that energy distribution can be adjusted based on demand and supply fluctuations, particularly from intermittent renewable sources. Moreover, digital substations help utilities optimize grid performance by detecting faults and outages quicker, reducing downtime, and enhancing overall operational efficiency. This is especially vital as the global push for sustainability and decarbonization intensifies, encouraging the adoption of cleaner energy solutions while maintaining a stable and resilient power grid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $469.6 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 8.9% |

The electrical systems segment is expected to reach USD 355 million by 2034, spurred by technological innovations and a growing focus on efficiency. Integrating high-performance sensors and Internet of Things (IoT) devices enables real-time monitoring and data analysis, which are crucial for effective grid management and predictive maintenance. This heightened emphasis on minimizing downtime and reducing operational expenses has increased investments in durable, high-quality components that ensure long-term reliability and lower maintenance requirements. Such trends underscore the shift towards more sophisticated and interconnected systems within digital substations, aligning with the objectives of modernizing and optimizing power infrastructure.

The station architecture segment is projected to achieve a CAGR of 8.5% through 2034, reflecting a movement toward modular and decentralized designs. These architectures provide utilities with enhanced flexibility and scalability, enabling them to adapt to changing demands and incorporate emerging technologies. As digital substations become increasingly interconnected, they are also more vulnerable to cyber threats, which has resulted in a stronger focus on cybersecurity measures within their architecture. This shift indicates a trend towards more adaptable, efficient, and secure substation designs that support contemporary grid management and operational goals.

U.S. Utility Scale High Voltage Digital Substation Market was valued at USD 88.8 million in 2024, driven by the private and public sectors upgrading their electrical infrastructure. Government incentives, coupled with the need for energy-efficient solutions, are accelerating the adoption of digital substations across the U.S. Utility companies are being pressured not only by strict environmental policies but also by mounting pressure for more reliable and sustainable energy systems. As the demand for grid resilience and flexibility grows, digital substations are essential for real-time data analysis, predictive maintenance, and seamless integration of diverse energy sources.

Key players involved in the industry include Schneider Electric, Siemens, Powell Industries, Toshiba Energy Systems & Solutions Corporation, Larsen & Toubro Limited, WEG, Hitachi Energy, WAGO, Eaton Corporation, General Electric, Hubbell, NR Electric Co. Ltd., ABB, and Netcontrol Group. In the utility-scale high voltage digital substation industry, companies are adopting a range of strategies to enhance their market presence and meet the increasing demand for reliable, sustainable energy solutions. Major players are investing heavily in research and development to drive technological innovation, particularly by integrating advanced digital control systems, automation, and predictive maintenance. Additionally, sustainability is a key focus, with companies pushing forward green energy solutions and low-carbon technologies to meet global environmental standards. Strategic partnerships and acquisitions allow for expanded technological capabilities and access to new markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Eaton Corporation

- 9.3 General Electric

- 9.4 Hitachi Energy

- 9.5 Hubbell

- 9.6 Larson & Toubro Limited

- 9.7 NR Electric Co. Ltd.

- 9.8 Netcontrol Group

- 9.9 Powell Industries

- 9.10 Siemens

- 9.11 Schneider Electric

- 9.12 Toshiba Energy Systems & Solutions Corporation

- 9.13 WAGO

- 9.14 WEG