PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755399

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755399

Breast Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

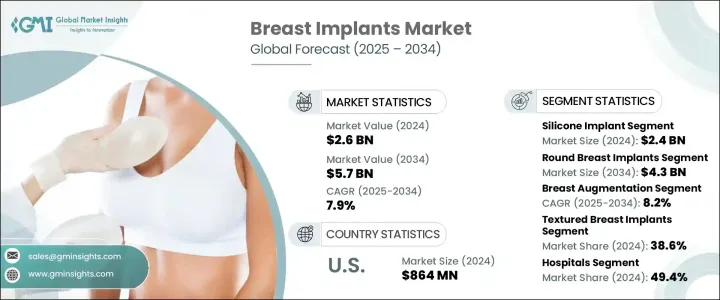

The Global Breast Implants Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.7 billion by 2034, driven by the rise in breast augmentation surgeries, technological innovations in implant designs, and an increasing focus on physical appearance. Breast augmentation has become a widely sought-after cosmetic procedure, particularly in developed regions, due to its high satisfaction rate, personalized results, and relatively safe, minimally invasive procedures. Advances in surgical techniques, including quicker recovery times and reduced complication risks, have also contributed to the procedure's appeal.

Additionally, the increasing societal acceptance of body-enhancing procedures, particularly those focused on aesthetics and self-confidence, has contributed to the growing popularity of breast implants. Women are increasingly opting for breast augmentation not just for cosmetic reasons but also to address functional issues like asymmetry and the need for breast reconstruction following mastectomies or other medical conditions. The ability of breast implants to offer customized solutions tailored to everyone's body shape and aesthetic goals has significantly driven demand. Moreover, advances in surgical techniques, including minimally invasive methods, have made these procedures safer and more effective, with faster recovery times and reduced risk of complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 7.9% |

The silicone implant segment generated USD 2.4 billion in 2024. The increasing preference for silicone implants for breast augmentation and reconstruction, especially after mastectomy, is largely due to their natural look and feel, as well as their durability. Silicone implants are highly favored by plastic surgeons because they are less prone to wrinkles or rippling and provide a smoother, more natural aesthetic. These implants are approved by both the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for both augmentation and reconstruction procedures. The growing variety of implant sizes and profiles has also contributed to their popularity, making them suitable for a broad range of patients. Moreover, silicone implants are increasingly used for revision surgeries, further supporting market growth.

The round breast implants segment accounted for a substantial share in 2024 and is expected to grow to USD 4.3 billion by 2034. Round implants are particularly popular due to their ability to provide a more lifted, rounder appearance and flexibility in placement. They can be inserted through any type of incision, including underarm incisions, which reduces visible scarring, making them a preferred choice for many patients. Furthermore, round implants offer flexibility based on cost-effectiveness, surgical ease, and a wider range of size options, contributing to their increasing usage. The growth of this segment is expected to be bolstered by the availability of diverse options, including both saline and silicone versions, and the continued development of improved implant technologies.

United States Breast Implants Market generated USD 864 million in 2024, with an increase in breast augmentation procedures and advancements in healthcare facilities driving market growth. The presence of major players and the development of new, advanced implant products support this market expansion. The growing acceptance of aesthetic surgery, as well as the increasing affordability of breast implants, has made them more accessible to a broader demographic, resulting in higher adoption rates.

Key players in the Global Breast Implants Industry include AbbVie, Euromi, Guangzhou Wanhe Plastic Material, Sientra, POLYTECH Health & Aesthetics, and Mentor Worldwide LLC, among others. These companies focus on product innovation and expanding their market reach through strategic partnerships and collaborations. They are also increasingly investing in research and development to improve implant quality, enhance patient satisfaction, and reduce surgical risks. Furthermore, many of these companies are actively working to develop a wider range of implant sizes, shapes, and materials to cater to diverse patient needs, which helps strengthen their competitive position in the market. Additionally, adopting more advanced manufacturing processes has enabled these companies to offer more customized, higher-quality implants, further boosting their market share.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.1.3 Base year calculation

- 1.1.4 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.1.5 Primary sources

- 1.1.6 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of breast augmentation procedures

- 3.2.1.2 Growing breast cancer incidence

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing number of plastic surgeons

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of implantation procedure

- 3.2.2.2 Risk of complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 GAP analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Saline implant

- 5.3 Silicone implant

Chapter 6 Market Estimates and Forecast, By Shape, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Round

- 6.3 Anatomical

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Breast augmentation

- 7.3 Breast reconstruction

Chapter 8 Market Estimates and Forecast, By Implant Texture, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Smooth

- 8.3 Textured

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Clinics

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Sweden

- 10.3.7 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Columbia

- 10.5.5 Chile

- 10.5.6 Peru

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Israel

- 10.6.5 Turkey

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Establishment Labs

- 11.3 Euromi

- 11.4 GC Aesthetics

- 11.5 Groupe Sebbin

- 11.6 Guangzhou Wanhe Plastic Material

- 11.7 Hansbiomed

- 11.8 IDEAL Implant

- 11.9 Laboratoires Arion

- 11.10 Mentor Worldwide LLC (Johnson & Johnson)

- 11.11 POLYTECH Health & Aesthetics

- 11.12 Prayasta 3D Inventions

- 11.13 Shanghai Kangning Medical Device

- 11.14 Sientra